UK Economy Expands in January, US Jobs Data Key for GBP/USD

GBP/USD – Prices, Charts, and Analysis

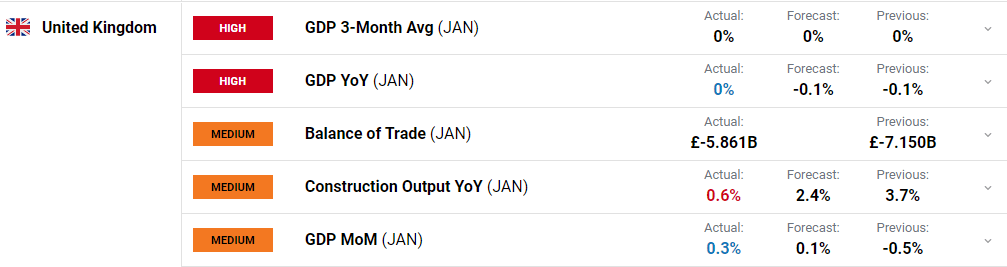

- The UK economy grew by 0.3% in January, beating expectations.

- The latest US Jobs Report is released at 13:30 GMT.

Recommended by Nick Cawley

How to Trade GBP/USD

The UK economy expanded by 0.3% in January, beating forecasts of 0.1% and December’s negative 0.5%. For the three months to January 2023, growth was flat. According to the Office for National Statistics (ONS),

‘The services sector grew by 0.5% in January 2023, after falling by 0.8% in December 2022, with the largest contributions to growth in January 2023 coming from education, transport and storage, human health activities, and arts, entertainment and recreation activities, all of which have rebounded after falls in December 2022.’

ONS GDP Monthly Estimate – January 2023

For all market-moving data releases and events, see the DailyFX Economic Calendar

GBP/USD pushed higher post-release, touching a high of 1.2020, but bigger tests for cable lie ahead with this afternoon’s release of the latest US Jobs Report (NFPs). The monthly look at data on employment, working hours, and earnings of workers on nonfarm payrolls is expected to show 205k new jobs created, although this number should be treated with caution. The last ten NFP readings have all beaten market expectations, some by a large margin, and today’s release may follow suit.

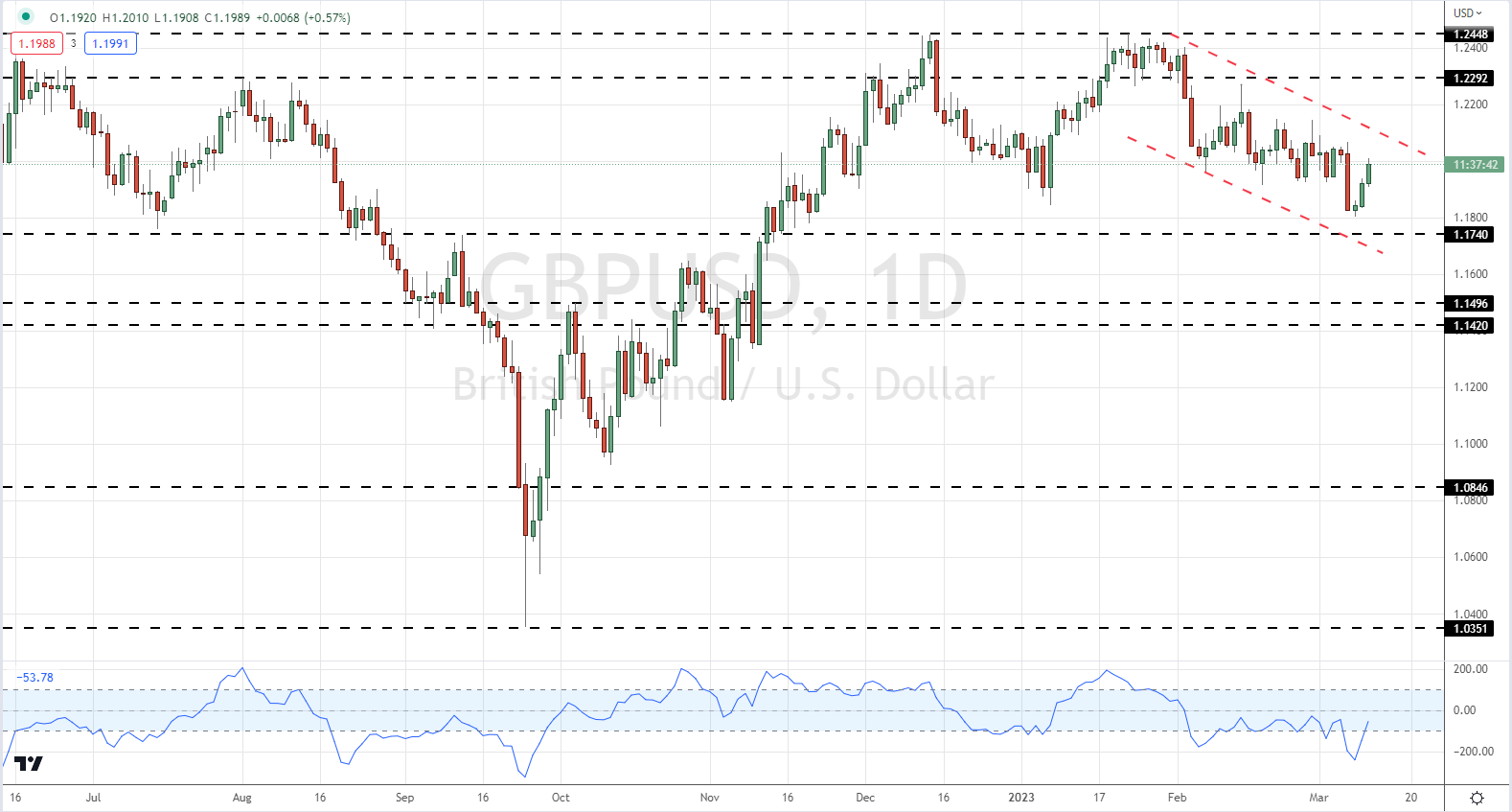

Cable is now likely to settle in a tight range ahead of the NFP release. While the rebound from the 1.1800 level over the last few days is welcomed by Sterling bulls, the short-term chart pattern shows a bearish sequence of lower highs and lower lows holding firm. The first level of support is at 1.1800/04 before 1.1740 comes into play. If the NFPs break their recent pattern and come in below expectations, prior highs at 1.2065 and then 1.2143 will act as the first two levels of resistance. All eyes are on the US.

GBP/USD Daily Price Chart – March 10, 2023

All Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -30% | 7% | -15% |

| Weekly | -27% | 16% | -10% |

Retail Trader Data Shows a Bullish Contrarian Bias

Retail trader data show 57.33% of traders are net-long with the ratio of traders long to short at 1.34 to 1.The number of traders net-long is 20.42% lower than yesterday and 13.50% lower from last week, while the number of traders net-short is 33.04% higher than yesterday and 20.19% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.