Gold Prices Pause Ahead of US Jobs Data but Fresh Record Highs Remain in Sight

GOLD FORECAST:

- Gold prices struggle for direction as traders look for fresh market catalysts

- Despite Wednesday’s price action, the precious metal retains a bullish outlook

- The March U.S. jobs report will help set the trading tone for XAU/USD in the near term

Recommended by Diego Colman

Get Your Free Gold Forecast

Most Read: Canadian Dollar Outlook: USD/CAD Bounces Off Trendline Support as Haven Flows Pick Up

Gold prices (XAU/USD) wavered and lacked directional conviction on Wednesday, fluctuating between small gains and losses around the $2,035 level, as traders paused to wait for new drivers that could set the near-term trading bias for precious metals. Despite today’s uninspiring moves, gold retains a bullish profile, with fresh all-time highs firmly in sight following its strong performance over the past four weeks.

In terms of catalysts, the slump in bond yields triggered by a dovish repricing of the Fed’s monetary policy trajectory will continue to act as a strong tailwind for the yellow metal. By way of context, the U.S. Treasury curve has shifted sharply downwards since mid-March after the U.S. banking sector turmoil clouded the growth outlook substantially, raising the risk of a downturn.

Recent macro data has reinforced the view that the U.S. economy is headed for trouble. For instance, both ISM manufacturing and services PMI for March have disappointed expectations, pointing to a pronounced decline in demand conditions. If business activity fails to rebound soon, layoffs could accelerate in the coming months, plunging the country into a painful recession.

A recession in the world’s largest economy should theoretically be bullish for gold prices, insofar as it could lead the U.S. central bank to reverse course and to begin slashing interest rates to prevent economic carnage. This environment could also favor defensive assets if it causes a dramatic deterioration in sentiment and boosts safe-haven demand in financial markets.

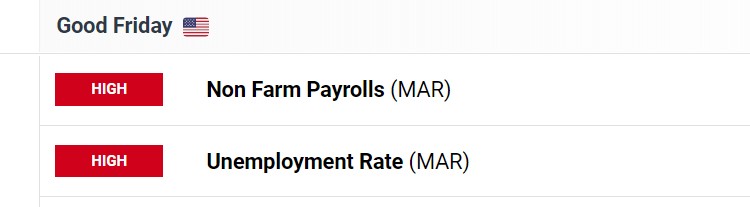

Looking ahead, traders should carefully monitor incoming data to better assess the economic outlook and the Fed’s future steps/measures. That said, one major release worth watching on Friday is the March U.S. labor market report. Consensus estimates predict U.S. employers added 240,000 jobs last month, but a negative surprise should not be ruled out following soft macro numbers earlier this week.

Recommended by Diego Colman

How to Trade Gold

GOLD TECHNICAL ANALYSIS

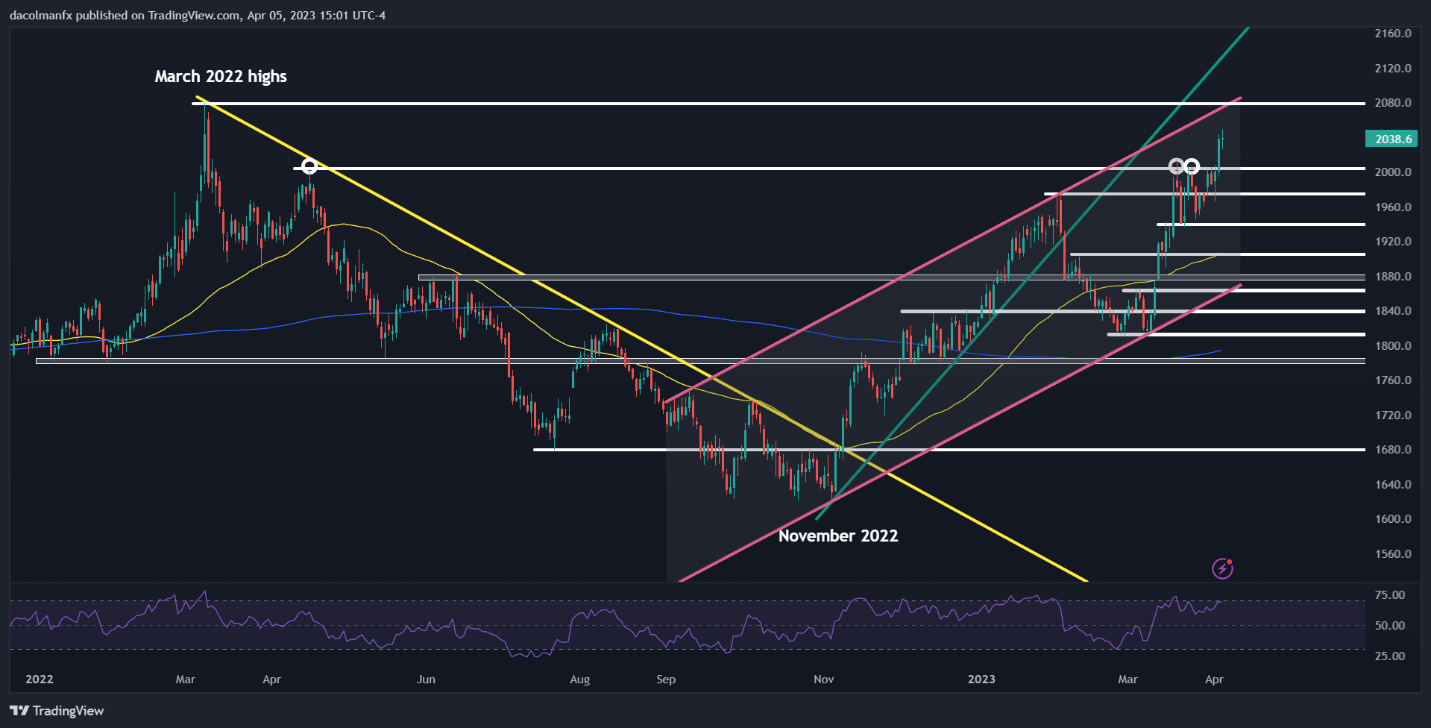

After breaking above the psychological $2,000 level decisively, gold has risen to its best level since 2022, with traders chasing the bullish trend and bidding prices higher steadily. With upward momentum on its side, XAU/USD could soon recapture its all-time highs near $2,075, which currently aligns with the upper boundary of a medium-term ascending channel. A clean break here could pave the way for a move towards $2,130.

On the flip side, if sellers regain control of the market and spark a pullback, initial support comes in at $2,000, followed by $1975. On further weakness, the focus shifts downwards to $1,940.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 3% |

| Weekly | -12% | 32% | 5% |

GOLD PRICES TECHNICAL CHART (XAU/USD)

Gold Futures Technical Chart Prepared Using Trading View

Comments are closed.