WTI Oil Continues to Weaken as COP28 Deal Fails to Find Consensus

WTI Oil News and Analysis

- Phasing out fossil fuels proves a tricky topic to agree on

- WTI prices threaten to extend the bearish trend after short period of consolidation

- WTI sentiment suggests further selling ahead as trader positioning is massively long

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Phasing out Fossil Fuels Proves a Tricky Topic to Agree on

The COP28 climate summit extended on Monday into the early hours of Tuesday, as participating nations attempt to agree on a global plan of action to limit climate change in a timely manner to avoid severe weather events.

On Monday a draft text was released and sparked a thorough debate, sending the discussions into overtime on Monday. The initial guidance was presented in order to gauge potential stumbling blocks and ‘deal breakers’ regarding the phasing out of fossil fuels.

There is yet to be general agreement on the phasing out of fossil fuels and there would need to be consensus in this regard. Tuesday also marked the day when US CPI was due for release and the data showed CPI printing in line with estimates for both headline and core measures but month on month inflation surprised slightly to the upside. The dollar regained some lost ground in the aftermath but the month on month print is unlikely to outweigh the longer-term trend of falling inflation. Next up is the FOMC meeting on Wednesday.

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

Oil Prices Threaten to Extend Bearish Trend after Short Period of Consolidation

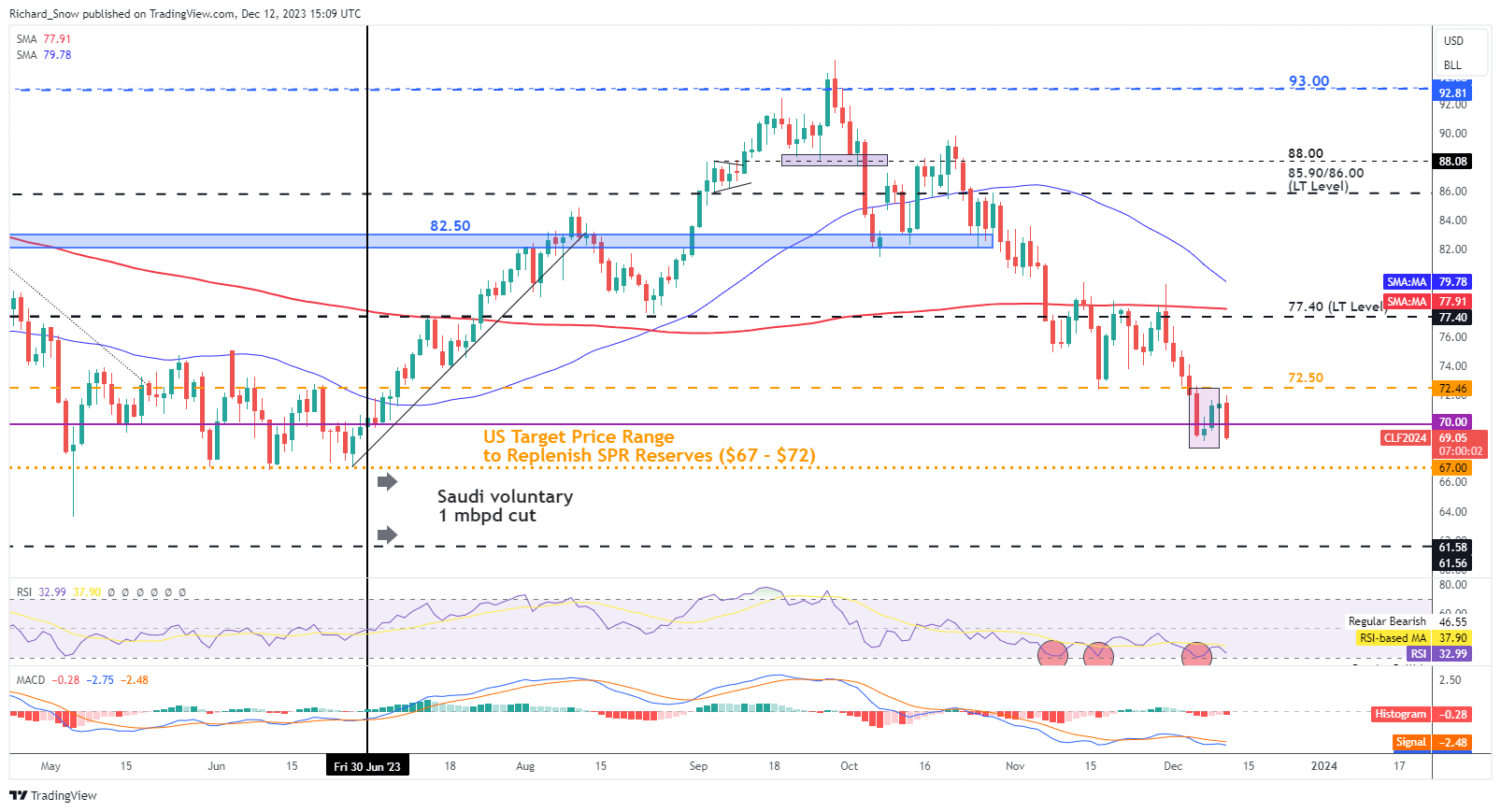

Oil continues to trade well below the 200-day simple moving average (SMA) and now threatens to invalidate the morning star pattern that had formed since Wednesday last week. The low of the pattern is currently being tested with the RSI heading quickly towards oversold conditions again.

The next level of support appears at $67, which was previously the underside of the price range identified by the Biden administration to refill depleted SPR storage. This coincides with the price level just before Saudi Arabia instituted its voluntary supply cuts. Resistance is at $72.50, followed by $77.40.

FOMC is the next major event and markets will scrutinize the Feds growth projections. The global growth slowdown continues to see oil prices trend lower and confirmation of slowing growth could see even more WTI selling.

WTI Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade Oil

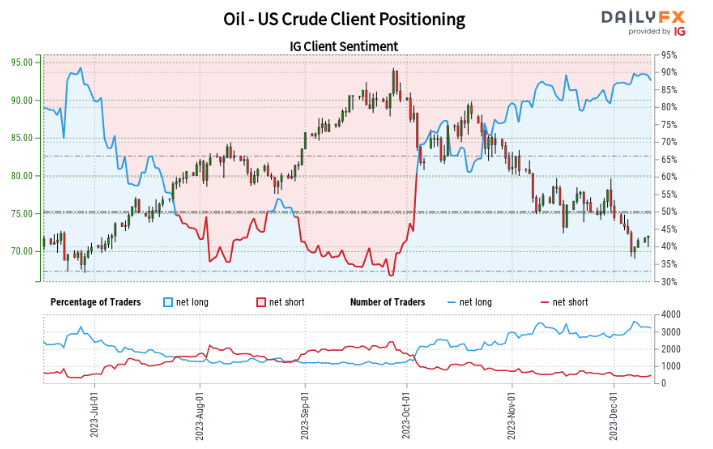

IG Client Sentiment Points to Bearish Continuation as Traders Remain Massively Long

Source: TradingView, prepared by Richard Snow

Oil– US Crude:Retail trader data shows 86.55% of traders are net-long with the ratio of traders long to short at 6.44 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsOil– US Crude prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil – US Crude-bearish contrarian trading bias.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.