Why You Should Use Wide Stop Losses » Learn To Trade The Market

Stop loss placement is perhaps the most overlooked and misunderstood piece of the trading ‘puzzle’…

Stop loss placement is perhaps the most overlooked and misunderstood piece of the trading ‘puzzle’…

Aside from the particular trading strategy you use to navigate and trade the markets, ‘where you place your stop loss’ is arguably the most important aspect of every trade you take.

One of the core tenets of my trading approach that I hammer-home to my members is the importance of using wide stop losses. Many traders are naturally drawn to and tempted to place as tight (small) of a stop loss on their trades as possible. There are multiple reasons why traders do this, but they all are the result of not understanding key aspects of trading such as position sizing, risk reward ratios, proper stop loss placement and the use of wider stops.

This lesson will dispel some of the most common myths and misconceptions around placing stop losses and will help you understand just how critically important it is that you plan your stop loss placement correctly and do not act emotionally when placing your stops, e.g. avoiding placing them too tight and in a price area where they are likely to be hit.

First, a note on position sizing…

It surprises me how many people still email me each day believing that they must use tighter stop losses because they have a small account and too wide of a stop will cost them too much to trade. This notion comes from the (mis)belief that a tighter stop loss somehow reduces one’s risk on a trade or (equally as wrong) will increase their chances of making money since they can increase their position size.

90% of new traders I speak to still think that a smaller stop loss distance means a smaller risk, and that wider stop losses distance means they are risking more. However, these beliefs are simply not true and for any experienced trader who understands trade position sizing, it is obvious that it is the contract size (number of lots) traded that determines the risk per trade, not the stop loss distance by itself. The stop loss distance is nowhere near as important as the position size you are trading. It is the position size (lot size) that determines how much MONEY is risked per trade!

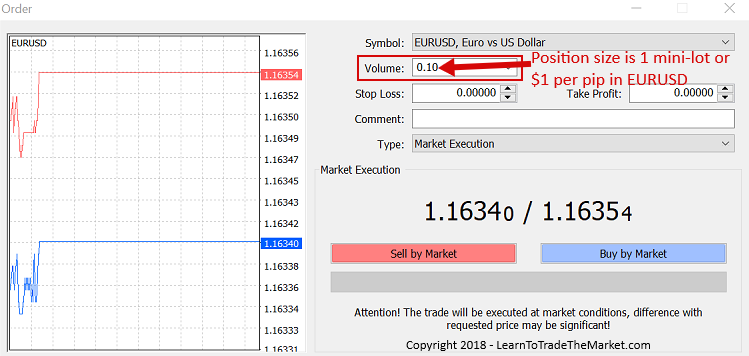

The money you are risking on any given trade is increased or decreased when you adjust the number of lots traded. For example, in the Metatrader platform I use, the position size is labelled as “volume” and the bigger the volume the more lots and hence more money you are risking per trade. If you want to dial-down your risk you reduce the number of lots you trade. Stop loss distance is only half of what determines how much you might lose (your risk) on any given trade. If you are adjusting your stop loss distance but not your position size, you are making a grave mistake!

To put this into perspective, a trader can have a 60 pip stop loss or a 120 pip stop loss and still risk the exact same amount of money, all they do is adjust the number of contracts they are trading.

Example:

Trade 1 – EURUSD trade. 120 pip stop loss and 1 mini lot traded, is $120 usd risked.

Trade 2 – EURUSD trade. 60 pip stop loss and 2 mini lots traded is $120 usd risked.

So you see, we have 2 different stop loss distances, and 2 different lot sizes, but the SAME Dollar risk.

It’s also important to note that wider stops do not decrease our risk reward, as risk reward is relative. If you have a wider stop you will need a wider target / reward. We can still yield great trades around 2 to 1 and 3 to 1 or higher with daily charts and wider stops. We can also use pyramiding to increase that risk reward yield.

Why Wider Stops?

So, now that we know that we can use wider stop losses on any size account, the question becomes why do I use wider stops and how can you implement the same in your own trading?

Give the market room to move…

How many times have you been right about a market’s direction, your trade signal was right, but you still lost money somehow? Very, very frustrating. So, here’s why this keeps happening to you; your stop loss is too tight!

Markets move, sometimes erratically, sometimes with high volatility without any notice. As a trader, it’s part of your duty to factor this into your decision making process when deciding where to place your stop losses. You cannot just place your stop loss at a set distance on every trade and “hope for the best”, that isn’t going to work and it’s not a strategy.

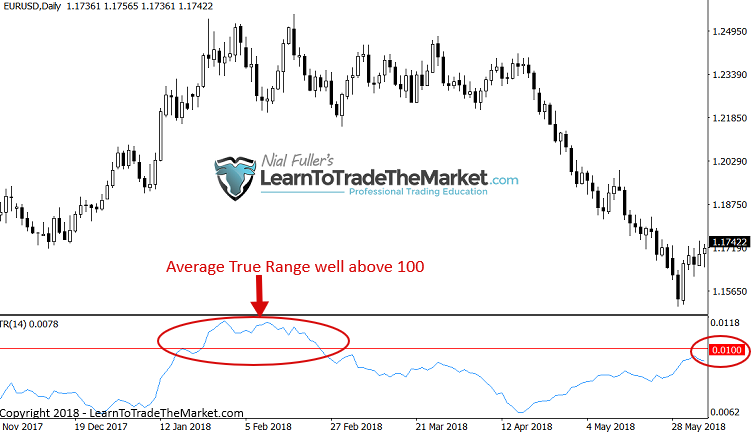

You need to allow space for the normal “vibrations” of the market each day. There is something called the Average True Range (ATR) of a market that will show you the average daily range over any given time period. This can help you see the market’s recent and probably current volatility, which is something you need to know when trying to figure out where to put your stop losses.

If the EURUSD moves 1% or more some days (over 100 pips) why would you place a 50 pip stop loss? It makes no sense does it? Yet, everyday, traders do exactly that. Of course, there are other factors to consider, such as time frame traded and the particular price action setup you’re trading as well as surrounding market structure, which I expand upon in great detail in my pro trading course.

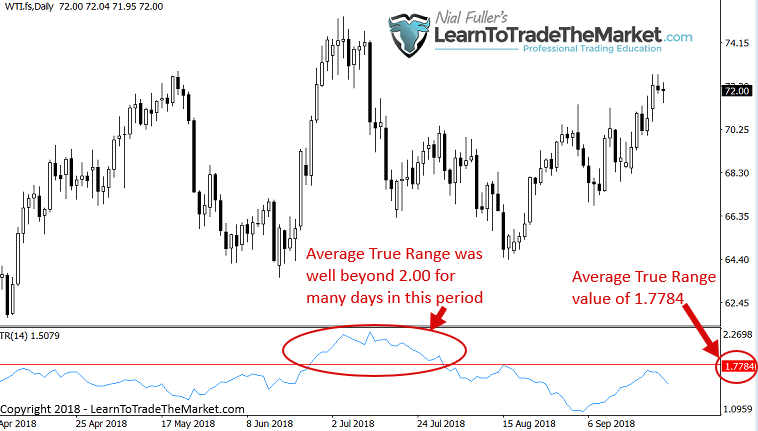

Below, we see two images, the first is the EURUSD daily chart showing an ATR of above 100 and near 100 for many days. The second is Crude Oil showing a large daily ATR as well (above $2 for many days). Traders who aren’t even aware of the ATR of the market they’re trading are at a huge disadvantage when it comes to placing their stop losses. At a bare minimum, you want your stop loss bigger than the 14 day moving ATR value:

Crude Oil ATR: Crude Oil is measured in dollars and cents but an ATR above $2 a day or even $1.75 is relatively large. Rest assured, if you aren’t placing your stops outside of this ATR, you’re going to get burned.

Wider stops give trades longer to play out

As we know, when trading price action based on the end-of-day approach that I use, big trades can take days or weeks to unfold. You’re just not going to catch a 200 to 300 point move on EURUSD with a 30 to 50 pip stop, most of the time you will have been stopped out well before the market goes the correct way.

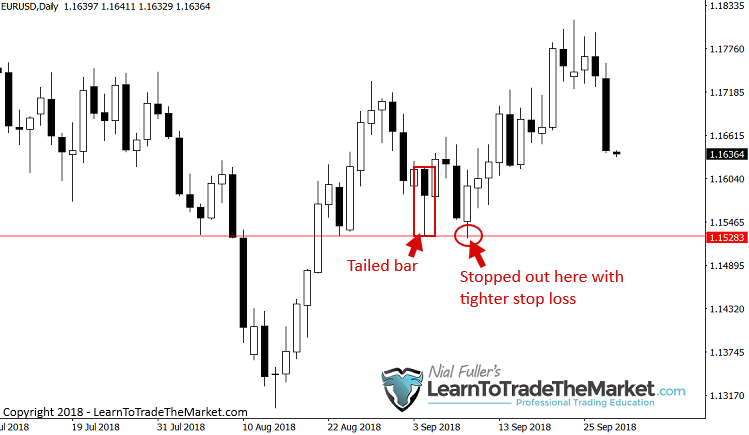

Case and point: The two images below show the same EURUSD tailed bar signal but with different stop loss placements.

The first image below shows a tighter stop loss and the second image below shows a wider stop loss, from looking at this example, it’s pretty clear why you need wider stops.

Note, the stop loss in the wider scenario seen below, was placed 20-30 pips below the support level at 1.1528 area, this is often a good technique to use:

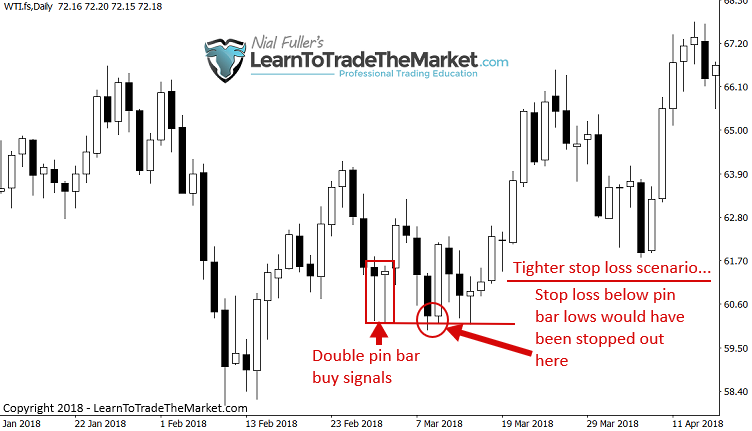

Next, let’s look at an example on the daily Crude Oil chart below. This time we have a very obvious double pin bar buy signal that formed on the daily chart time frame recently. Notice, if you placed your stop just under the pin bar low, as many traders like to do, you would have been stopped out for a loss just before the market pushed higher, without you on board.

Now, if you placed your stop loss 50 points or so below the lows of those pins, not only does that keep you in the trade but you would have been a fool to not make a nice profit after price began pushing higher again.

Note: No matter which entry you are using, a market entry or a 50% tweak entry, a wider stop loss will still dramatically change the outcome of the trade, even for the more conservative 50% tweak entries. The goal is to stay in the market until it clearly proves you wrong, not to get shaken out simply by the natural daily fluctuations of price. Give the market the room it needs to breathe!

I don’t day trade, so wider stops are essential

If you’ve followed me for any length of time, you know I don’t day trade. My view on day trading is that it’s just gambling on the natural market ‘noise’ that occurs each day, and I am a trader, not a gambler. Therefore, it’s essential I use wider stop loss that won’t result in my getting chopped up in the short-term intraday noise of the market.

It’s an interesting ‘coincidence’ (not really a coincidence), day traders naturally use very tight / small stops (some don’t use any!) and the stats show that day traders typically lose money and do worse than longer-term position traders. Is it just a coincidence that people who use tight stop losses tend to lose more money than those who use wider stops and hold traders for longer? I think not.

Longer-term trades require larger stop losses. If we know the EURUSD moves a few percentage points a week (say 200-300 pips) and we are looking at a price action setup that could yield us a 200 to 300 pip profit target, then it stands to reason you’re going to need wider stop loss to stay in that trade.

Keep in mind, the power of higher time frame charts is immense. Yes, you have to wait longer for trades to play out on higher time frames, but the trade off is that you get more accurate signals and it’s much easier to call a market the higher in time frame you go. Thus, trading becomes less like gambling and more of a skill set the higher up in time frame you go. For many reasons, the daily chart time frame is my favourite, it’s a happy medium.

Lifestyle and less stress

Perhaps the greatest benefit to YOU is that using wider time frames reduces stress and improves your lifestyle. You can set and forget trades with wider stop losses. Wider stops are what my end of day trading approach encourages and it means you don’t have to sit there agonising over each tick of the market.

This style of trading also allows you more time to learn and focus on finding good trades and identify trends and price action patterns, reading the footprint on the chart; the stuff that matters!

If you want to walk away from your trades and relax whilst the market does the ‘heavy lifting’, then all you have to do is: Use wider stop losses and adjust your position size to maintain your desired dollar risk per trade. That’s it!

Conclusion

Let me ask you something…

Do you know why most traders fail over the long-run? Well, yes, because they lose too much money. But, WHY do they lose too much money?

The two main reasons why so many traders lose money and blow out their accounts are: Trading too much (over trading) and using stop losses that are too tight (not letting the trade have room).

A funny thing happens when you start placing tight stops, you get stopped out more often! Seems obvious, right? Yet, each day, thousands, probably millions of otherwise very intelligent traders do something really unintelligent; they place a tiny little stop loss on a perfectly good trade setup. They do this because they don’t understand position sizing or they do this because they’re being greedy, either way, they are doomed to fail and be just another statistic.

Don’t be like them.

Be patient. Be willing to place a wider stop even if that means letting a trade go for a few weeks. Ask yourself, what’s better: Placing 20 trades with tight stops and losing on most of them or placing 2 trades with wide stops, winning big on one and taking a predefined 1R loss on the other? I promise you, it’s the latter, not the former.

Read this lesson again closely. It may be the most important trading lesson you ever learn. Combine the concepts taught here today with trading techniques and price action strategies I teach in my trading courses and the daily guidance from my members trade setups newsletter and you have yourself a pretty potent long-term trading strategy that, if followed, stands a very good chance at bringing you closer to consistent success in the markets.

What did you think of this lesson? Please leave your comments & feedback below!

If You Have Any Questions, Please Email Me Here.

Comments are closed.