RSI: King of Indicators – Analytics & Forecasts – 3 March 2023

Although it may sound counter-intuitive, typical use of Forex indicators can actually cause an inexperienced trader to lose money, rather than make money. However, if you are going to use one, the best Forex indicator is the RSI (Relative Strength Indicator) because it reflects momentum, and it is well established that following Forex momentum can give you a winning edge. The RSI is a Forex momentum indicator, and it is the best momentum indicator. If you are going to use the RSI, the best way to use it is to trade long when it is showing above 50 on all time frames, or short if below 50 on all time frames. It is best to always trade with the trend of the last 10 weeks or so.

What is the RSI (Relative Strength Index)?

The Relative Strength Index formula was developed in the 1970s, like so many other technical analysis concepts. The Relative Strength Index calculation is made by calculating the ratio of upward changes per unit of time to downward changes per unit of time over the look-back period. The actual indicator calculation is more complex than we need to worry about here. What is important to understand is that if the look back period for example is 10 units of time and every single one of those 10 candles closed up, the RSI will show a number very close to 100. If every single one of those 10 candles closed down, the number will be very close to 0. If the action is completely balanced between ups and downs, the RSI indicator will show 50.

The Relative Strength Index definition is as a momentum oscillator. It shows whether the bulls or bears are winning over the look-back period, which can be adjusted by the user.

Relative Strength Index Technical Analysis

The RSI indicator is typically used in forecasting and trading strategies in the following ways:

- When the RSI is over 70, it should be expected to fall. A fall below 70 from above 70 is taken as confirmation that the price is beginning a move down.

- When the RSI is under 30, it should be expected to rise. A rise above 30 from below 30 is taken as confirmation that the price is beginning a move up.

- When the RSI crosses above 50 from below 50, it is taken as a signal that the price is beginning a move up.

- When the RSI crosses below 50 from above 50, it is taken as a signal that the price is beginning a move down.

What is the Best Way to Use the RSI?

The third and fourth methods described above regarding the cross of the 50 level, are generally superior to the first and second methods concerning 30 and 70. That is because better long-term profits can be made in Forex by following trends than by expecting prices to always bounce back to where they were: just be careful not to move stop losses to break even too quickly.

This is a point worth expanding – whether to follow trends, or “fade” them by trading against them. There is a lot of old-fashioned trading advice on the subject, most of which was developed in the pre-1971 era when currency exchange rates were not floating, but fixed by pegs to gold or other currencies. In this era, trading was conducted mostly in stocks or, to a lesser extent, in commodities. It is a fact that stocks and commodities tend to show a markedly different price behavior from the exchange rates of Forex currency pairs – stocks and commodities trend more often, are more volatile, and have longer and stronger trends than Forex currency pairs, which have a stronger tendency to revert to a mean. This means that when trading Forex, most of the time, using the RSI to trade against directional moves by using the methods 1. and 2. described above, will work more often but will make less profit overall than using methods 3. and 4. to follow trends by trading in the direction of the prevailing strong trend, when such a trend exists. Although it might seem attractive to try to win smaller amounts more often and use money management to compound winnings quickly, it is much harder to build a profitable mean reversion model than it is to build a profitable trend-following model, even when trading Forex currency pairs.

The best way to trade crosses of the 50 level is by using the indicator on multiple time frames of the same currency pair.

Multiple Time Frame Cross of the 50 Level

Open multiple charts of the same currency pair on several time frames: weekly, daily, H4, all the way down. Open the RSI indicator on all the charts and make sure the 50 level is marked. Practically all charting programs or software includes the RSI so it should not be difficult. A good look back period to use in this indicator is 10. It is also important that the look back period is the same on all the different time frame charts.

If you can find a currency pair where all the higher time frames are either above or below 50, and the lower time frame is the other side of 50, then you can wait for the lower time frame to cross back over the 50 and open a trade in the direction of the long-term trend.

The higher or lower the RSI value is, the better the trade is likely to be. It is an iron law of the markets that strong trends are more likely than not to keep going, and that a retracement that then turns back around tends to move nicely in the direction of the trend. This method is an intelligent way to use an indicator: it identifies retracements within strong trends, and tells you when the retracement is likely to be ending.

Short Trade Example

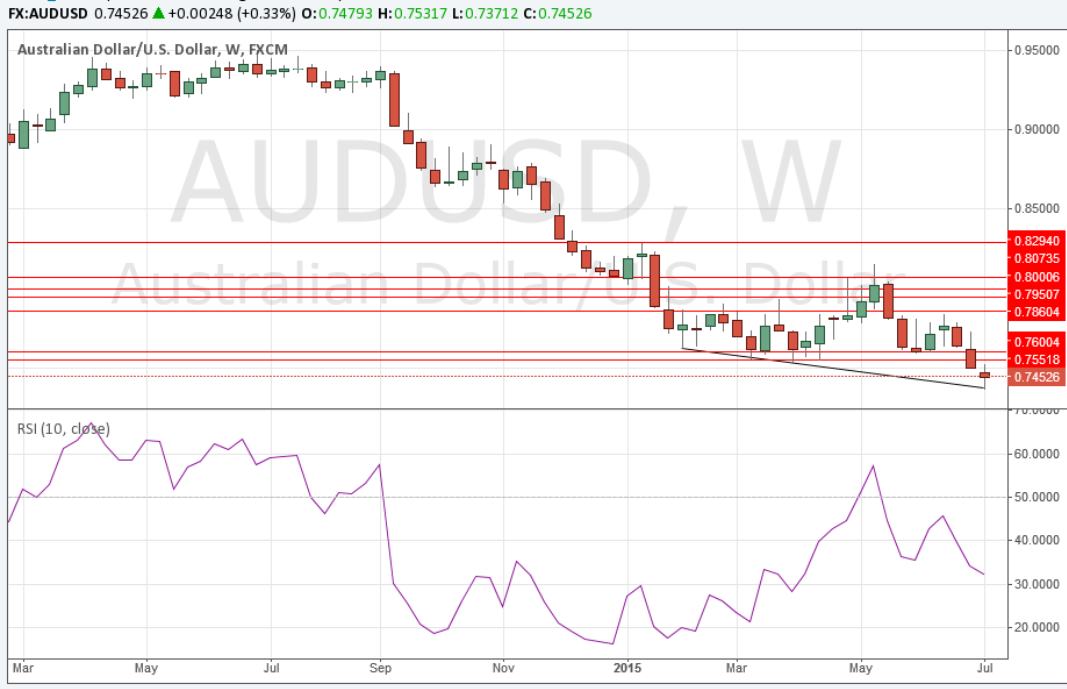

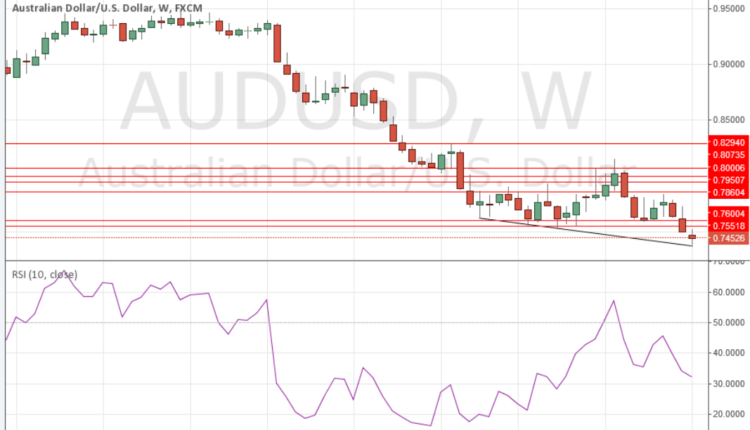

An example is shown below using the AUD/USD currency pair in several time frames, with the RSI indicator set to a look back period of 10. It is below 50 on the weekly, daily, and 4-hour time frames, and is just crossing from above 50 to below 50 on the 5 minute time frame. This could be interpreted as a signal for a short trade.

There is no reason why this cannot be combined with other strategies such as support and resistance, moving average crossovers, time of day etc.

It can also be used as a day trading strategy when you are prepared to drop down to low enough time frames.

Weekly:

Daily:

4 Hours:

5 Minutes:

Note: this is not a perfect example, as it would have been better if the Hourly time frame also showed the RSI below 50. Best results are obtained when there is no big gap between the time frames that are used.

Three New Ways to Use RSI in Forex

J. Welles Wilder’s Relative Strength Index (RSI) measures the strength of the currency pair against its history of price change by comparing the number of days the pair is up in price to the number of days it is down. Values range from 0 to 100. A common use is as a warning of market tops and bottoms, based on Wilder’s idea that overbought and oversold conditions occur after disproportionate moves. If it’s over 70, one might short; if it’s below 30, one might buy. In an earlier article, I described how you can use RSI for divergence trades.

Here are three other ways to use RSI:

First is what Wilder called a failure swing. This happens when RSI exceeds a previous extreme (overbought above 70 or oversold below 20), corrects, and then heads for that extreme but fails to achieve it. You would place a trade on the close of the candle that corresponds to the second peak or dip.

Here’s an example from the hourly EURJPY chart. Price and RSI are rising in tandem. RSI becomes overbought, above 70. Both correct. They again rise but the second peak of RSI is lower than the first. You’d sell on the close of the candle that accompanied the lower peak.

If price and RSI were falling the situation is reversed. When the indicator becomes oversold below 30, corrects, and then fails to reach the prior low, you’d buy on the candle close. Confirming the trade with other evidence—for example, support or resistance or candlesticks—is advisable.

A second use of RSI involves support and resistance, not with price, but on the indicator itself. It can help you gauge if a trend is changing.

Here you would watch the indicator to ascertain that it never rises above (in a down trend) or falls below (in an up trend) key levels. Studying past RSI behavior helps you find these levels.

The 15-minute chart of GBP/USD provides an example. Price and RSI are rising. Price then becomes congested and RSI starts to drop. Is this a simple correction or is the trend changing? Examining RSI provides a clue. RSI never drops below 43. This is above the last dip in RSI and far above an oversold reading of 30. On the second dip in price, with the RSI holding above 43, the trader can feel confident this is a correction and buy on the candle close of the second dip. A safer trade would involve waiting until price broke and closed above the congestion top. As always, it’s best to find other evidence to support the trade decision such as price support and resistance levels, candlesticks, or a comparison with other indicators.

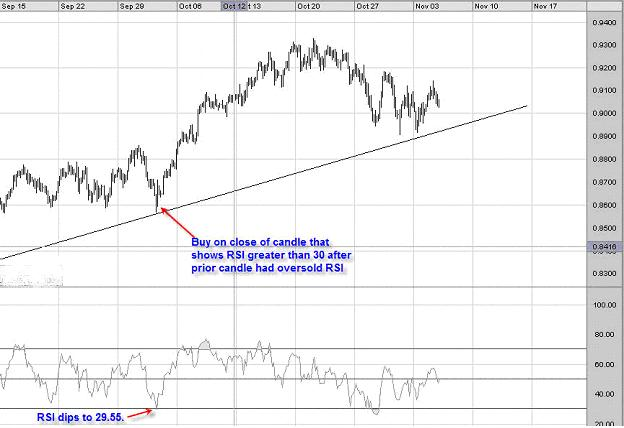

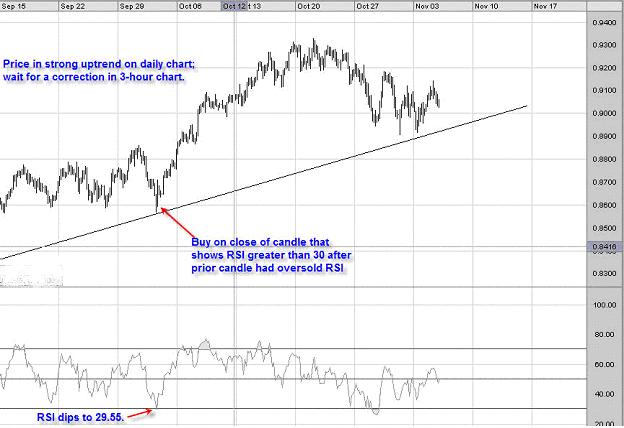

A third way to use RSI is when both price and indicator are in an overall trend in a larger time frame, for example, daily. You then watch the 3-hour or 1-hour chart to find an overbought or oversold reading in RSI accompanying a price rally or reaction. When the RSI overbought or oversold condition corrects, you’d place a trade.

Here’s an example with the AUD/USD three-hour chart. Its uptrend began March, 2009. Where’s a good entry point if you want to go long? In the chart below you see a price correction to .8569. RSI drops to 29.55, oversold. On the next candle close of .8655, RSI is 40.56. This is the buy signal. Had you bought you would have made hundreds of pips as prices climbed to .9328 in late October.

The key to this technique is finding a strong trend on a larger time frame and then trading corrections on the smaller time frame. Best results seem to be when you use daily and one-or –three hour charts. As always, look for other evidence to support your decision—staying above a trend line or candle behavior.

A selection of material from the Daily Foreks information source

Automate your trading with our Robots and Utilities

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

EA Long Term MT4 https://www.mql5.com/en/market/product/92865

EA Long Term Mt5 https://www.mql5.com/en/market/product/92877

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256

EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Risk manager MT4 – https://www.mql5.com/en/market/product/72214

Risk manager MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

3 in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/72257

3 in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Power Reserve MT4- https://www.mql5.com/en/market/product/72392

Power Reserve MT5 – https://www.mql5.com/en/market/product/72410

Comments are closed.