Plunges for 7-straight days, despite BoC’s rate hike

- CAD/JPY extends losses for the seventh consecutive day, with minimal decline of 0.07%, trading near weekly low of 104.79.

- Despite BoC raising rates to 5%, the pair fails to gain momentum, losing 0.99% or 100 pips.

- Downward trend aims for support at June 7 high of 104.88, potentially leading to 104.00 and June 8 low of 103.70.

- Bullish continuation requires breaking above resistance at 105.00, with further hurdles at 105.45, 106.11, Kijun-Sen at 106.60, and Tenkan-Sen at 107.09.

As the Asian session begins, the CAD/JPY extends its losses to seven straight days, registering minimal losses of 0.07%. Despite the Bank of Canada (BoC) raising rates by 25 bps to 5% on Wednesday, the CAD/JPY pair failed to gain traction and lost 0.99% or 100 pips. As of writing, the CAD/JPY trades at 104.96, nearby the weekly low of 104.79.

CAD/JPY Price Analysis: Technical outlook

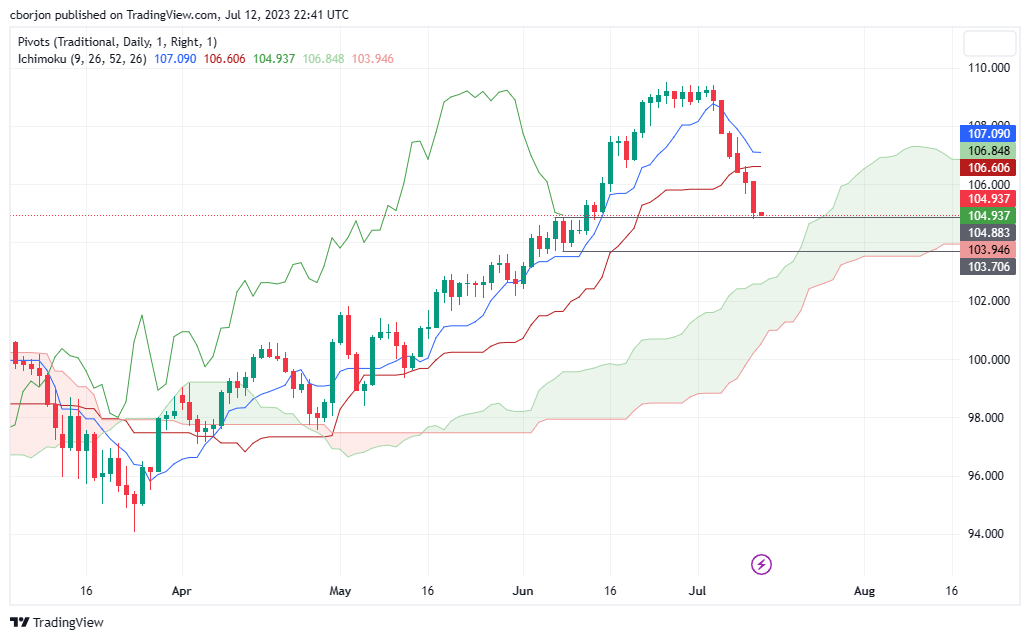

The CAD/JPY daily chart portrays the pair as upward biased, similar to the AUD/JPY pair case published here. Even though the CAD/JPY edged lower, as long as it remains above the Ichimoku Cloudthe uptrend remains in place. But some mixed signals suggest caution is warranted, like prices sliding below the Tenkan-Sen and Kijun-Sen lines and the Chikou Span about to turn bearish can pave the way for further losses.

If CAD/JPY continues to drop, the June 7 daily high of 104.88 will be the first support level to challenge. A breach of the latter will expose the 104.00 mark, followed by the June 8 daily low of 103.70.

Conversely, the CAD/JPY first resistance would be 105.00 for a bullish continuation. Once cleared, the next resistance emerges at the June 13 daily high of 105.45, followed by the July 12 daily high of 106.11. the next resistance level would be the Kijun-Sen line at 106.60 before the Tenkan-Sen at 107.09.

CAD/JPY Price Action – Daily chart

Comments are closed.