Gold, US Dollar, Nasdaq 100, Crude Oil, Fed, Labor Markets

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

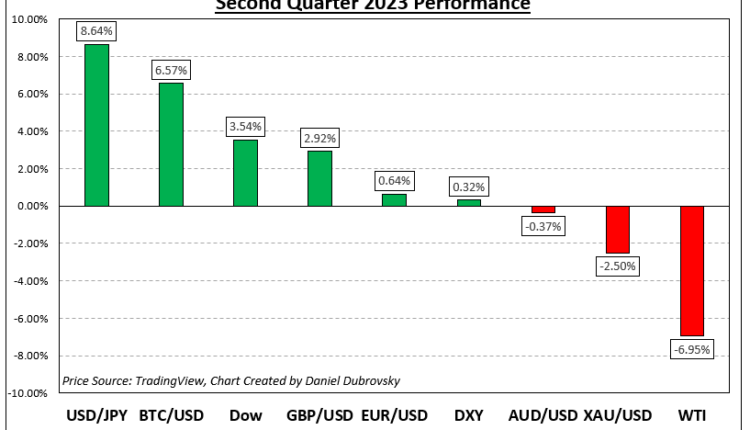

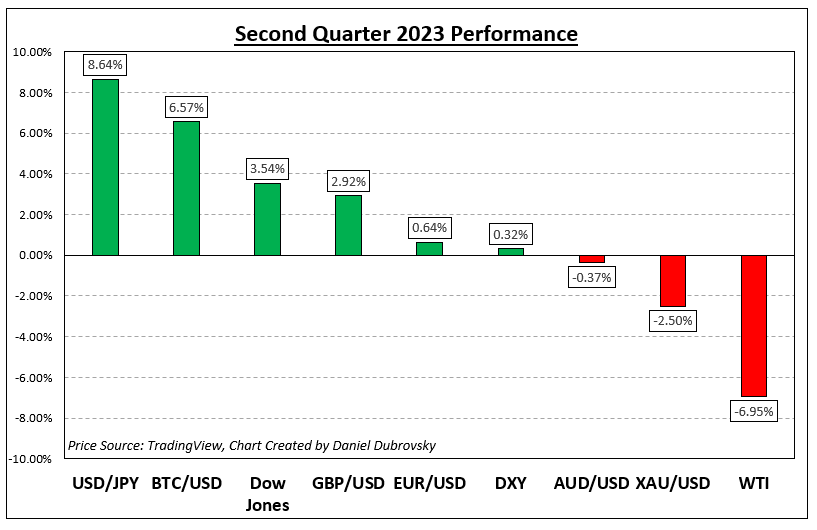

The second quarter brought with it a solid performance from the US Dollar as it outperformed most of its major counterparts. Notable gains were seen against the Japanese Yen and Australian Dollar. Meanwhile, the British Pound held its ground as the Euro was able to fend off pressure from the world’s most liquid currency.

Financial markets began to focus back on hawkish expectations from the Federal Reserve. By the beginning of July, any hopes of a rate cut from the central bank this year were priced out. In fact, from June 1st until July 7th, traders added almost 4 rate hikes to the outlook. However, markets have not fully priced back in hawkishness since the collapse of Silicon Valley Bank.

Compared to the beginning of March and before SVB’s demise, financial markets are still more dovish on the Fed outlook for the one-year horizon as of July 7th. But, near-term bets have become more hawkish. As such, there is potentially more room to go for markets to recover long-term hawkish bets since SVB’s fall.

All this tightening and surge in Treasury yields have done little to deter stock market bulls. At nearly +40%, the first 6 months of 2023 have been the best for the tech-heavy Nasdaq 100 since the late 1990s. This is as the S&P 500 rallied almost 16%. That said, the breadth of the stock market recovery has been lackluster, with a handful of mega-cap firms driving the push higher.

The US labor market remains resilient and underlying inflation is struggling to nudge meaningfully lower. June’s non-farm payrolls report showed that wage growth surprised higher. This will likely be to the displeasure of Fed Chair Jerome Powell and company, opening the door to further weakness in gold. XAU/USD declined 2.5 percent in the second quarter.

Elsewhere, crude oil prices suffered in Q2 despite a few attempts from OPEC+ to cut production. At the end of the day, major central banks around the world are practically working in unison to slow their economic engines, which is an attempt to hurt domestic consumption. Chinese exports are slowing, alongside global growth expectations, taking crude oil lower with it.

All eyes remain on how central banks will continue in the face of sticky price pressures and just how much damage could be done to domestic demand and labor markets. Treasury yields continued surging, but yield curve inversion remains present, potentially signaling economic pain ahead. What is in store for the third quarter?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

How Markets Performed – Second Quarter

Fundamental Forecasts:

Q3 Euro Fundamental Forecast: Deteriorating Data to Test ECB’s Resolve

Worsening economic data in Germany and wider Europe sets up an interesting third quarter as the ECB maintains hawkish resolve.

Japanese Yen Q3 Forecast: Weakness Unlikely to Abate Soon but FX Intervention Risks Grow

The Japanese yen could remain biased to the downside early in the third quarter in response to monetary policy divergence between the Bank of Japan and other developed market central banks.

Australian Dollar Outlook: Central Banks Continue to Grapple with CPI

The Australian Dollar finished the second quarter not far from where it started after breaking both sides of an established range. Although some domestic factors have played a role in AUD/USD direction, the US Dollar remains a dominant factor for the currency.

Oil Fundamental Forecast: Q3 the Catalyst for Crude Oil?

Crude oil prices could be in for a positive Q3 with OPEC+ maintaining production cuts through to August.

Technical Forecasts:

Bitcoin Q3 Technical Forecast: Candlestick Patterns Hint at Potential Bullish Continuation

Bitcoin Prices may see a short-term pullback in the early part of Q3 but remains poised for further gains.

Gold Q3 Technical Forecast: Recent Breakdown Signals More Losses

The recent breakdown in gold prices could portend further losses for the yellow metal early in the third quarter.

British Pound Q3 Technical Forecast – GBP/USD, EUR/GBP, and GBP/JPY

As we enter the third quarter of the year, the outlook for the British Pound looks mixed.

US Dollar Q3 Technical Forecast – External Catalysts Will Weigh on the US Dollar

The US dollar has been trapped in a five-point range for the first half of the year and this is unlikely to change as we head into Q3.

Dow, S&P 500, Nasdaq Technical Outlook: No Sign of a Reversal

The S&P 500 and the Nasdaq 100 index’s break above key resistance confirms that the 2022-2023 downtrend has ended, raising the odds of a resumption of the long-term uptrend. While Nasdaq looks a bit tired, DJIA is on the verge of a bullish break.

Q3 Top Trade Opportunities:

S&P 500 Vulnerable to Pullback on Weak Fundamentals and Frothy Markets

The S&P 500 has rallied significantly in recent months, but could face serious challenges in the third quarter, especially if fundamentals worsen on hawkish monetary policy.

US Dollar May Extend its Rally Against the Chinese Yuan in the Third Quarter

The US Dollar may continue pressuring the Chinese Yuan in the third quarter with global growth still vulnerable to central banks that are keeping monetary policy tight.

Short USD/ZAR: Top Trade Opportunities

Rand strength could be the top trade for Q3 2023 as USD/ZAR hit all time highs in Q2.

Short EUR/GBP as A Hawkish BoE and Price Action Support Further Downside

EURGBP looks well on its way to print fresh lows in Q3 as the Bank of England faces the toughest challenge out of all the major Central Banks. 0.8200 incoming?

Short DAX as German Fundamentals Turn Sour

Worsening EU and German Fundamental data weighs on the DAX at a time when Germany attempts to recover from a technical recession and manufacturing downturn.

Canadian Dollar Could Rise Further Against the US Dollar in the Third Quarter

The Canadian dollar's rise against the US dollar above key resistance points to further gains on improving risk appetite amid resilient global growth, signs of a turnaround in commodity prices, and hopes of more stimulus from China.

Bitcoin Looking to Shrug Off Regulatory Concerns and Push Even Higher

Bitcoin is entering the third quarter of the year on the front foot and is looking to print a new yearly high after rallying sharply in the last weeks of June.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.