Gold Consolidates as US Dollar Takes A Breather Ahead of Key Data. Where to for XAU/USD?

Gold, XAU/USD, US Dollar, Treasury Yields, Meta, NZD, Deutsche – Talking Points

- Gold reflects the general market malaise as US data looms later today

- Treasury and real yields persist at lower levels but USD appears directionless

- All eyes will be on US GDP and PCE data. Will XAU/USD gain momentum?

Recommended by Daniel McCarthy

Get Your Free Gold Forecast

Gold price volatility remains somewhat moribund with the precious metal bouncing around either side US$ 2,000 an ounce so far today. Markets appear poised ahead of US GDP and Core PCE data due out later with the US Dollar steady so far today

Treasury yields have also steadied after sliding lower earlier in the week. The benchmark 10-year bond remains below 3.50%.

Real yields continue to languish with the same part of the curve near 1.20%, notably below the peak 1.36% seen last week.

G-10 currencies have had a subdued start to Thursday although the Kiwi Dollar managed to climb a touch higher, reclaiming territory above 0.6140.

After the North American close, Meta revised their revenue outlook for the second quarter to USD 32 billion, above the forecasts of 29.48 billion. Futures are pointing toward a modestly positive start for Wall Street later today.

APAC equities have also had a quiet session today. Deutsche Bank announced that they missed estimates for the first quarter. They have reported that revenue was € 2.36 for the period against € 2.53 billion anticipated.

The WTI futures contract is near US$ 77.50 bbl while the Brent contract is a touch below US$ 78 bbl at the time of going to print.

A full economic calendar can be viewed here.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GOLD TECHNICAL ANALYSIS

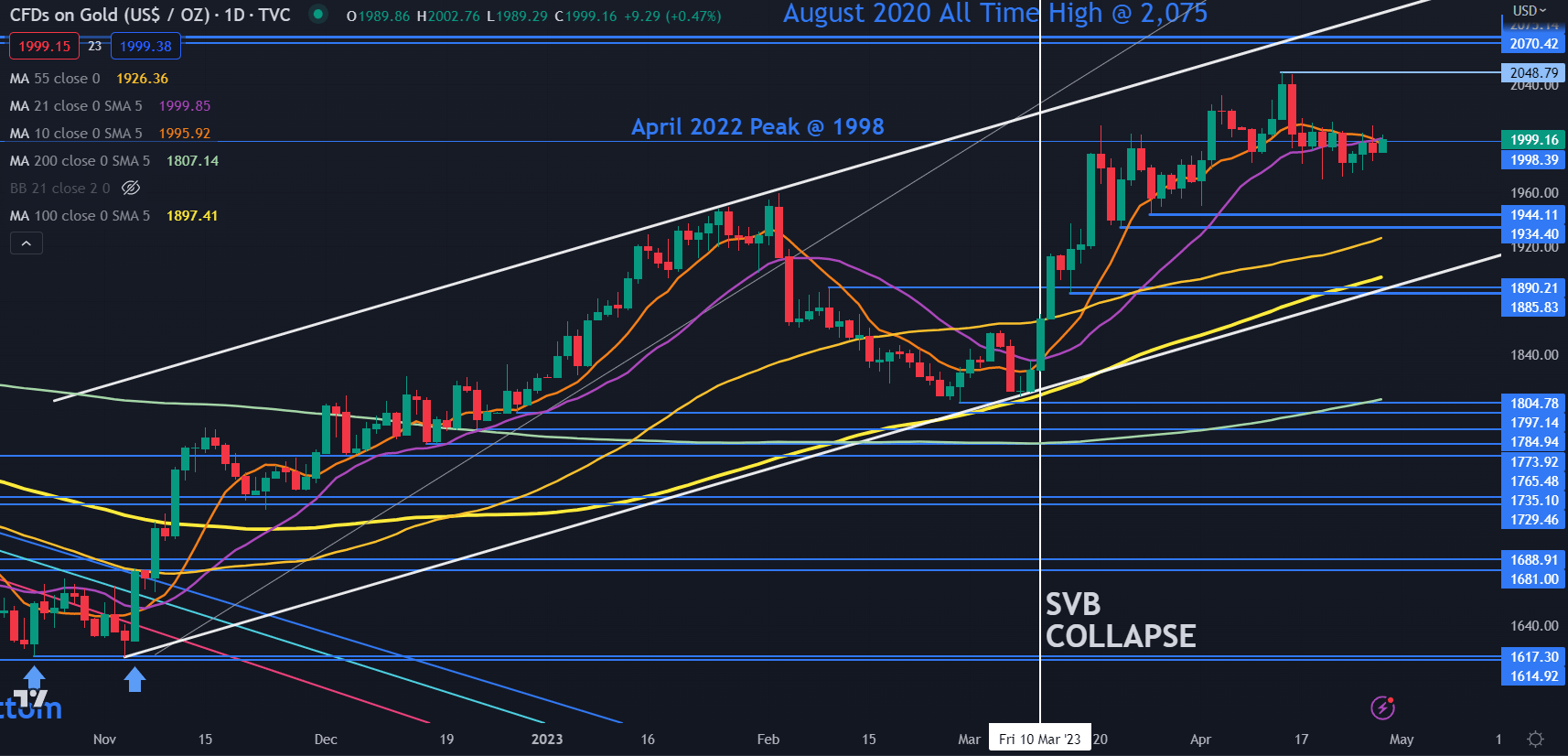

Gold has been caught in a 1934 – 2049 range for around six weeks and it remains within an ascending trend channel.

The lack of short-term direction is characterised by the price clustering near the 10- and 21-day Simple Moving Averages (SMA).

A breakout of the range might see momentum build for that direction but notable support and resistance levels lie on both sides.

To the topside, there is a Double Top created by the all-time high of 2075 in April 2020 and the failed attempt to break above it in March 2022 when a peak of 2070 was made.

On the downside, the 1885 – 1895 area appears to be a key support zone. Within it lies the 100-day SMA, a previos low, a breakpoint and an ascending tend line.

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.