Forex and Cryptocurrencies Forecast for September 04 – 08, 2023 – Analytics & Forecasts – 2 September 2023

EUR/USD: No to Rate Hike, Yes to Dollar Appreciation!

● Market participants continue to scrutinize the macroeconomic backdrop in the United States, attempting to discern (or speculate) whether the Federal Reserve will proceed with further increases to the federal funds rate. Following disappointing consumer confidence reports, weak ADP labour market data, and a slowdown in economic growth in Q2, market chatter has shifted towards the spectre of recession and the potential for a dovish pivot by the American regulator. U.S. economic growth currently remains above expectations. However, the revised GDP assessment still disappointed markets, as it fell short of initial projections.

On the other hand, household expenditures increased by 0.8% month-over-month, the highest rate since January. The Personal Consumption Expenditures (PCE) Index, the inflation indicator most closely watched by the Federal Reserve, added 0.2% month-over-month for the second consecutive month. While the growth is modest, it is growth, nonetheless. The core PCE rose by 4.2% year-over-year, aligning with forecasts but exceeding the previous month's figure of 4.1%.

The labour market situation has transitioned from “consistently strong” to “potentially challenging.” The number of open job vacancies, as measured by the JOLTS report, dipped to 8.827 million in July for the first time in a long while. For over a year, it had mostly stayed above 10 million, a threshold figure for the Federal Reserve in assessing the strength of the labour market. Additionally, the number of initial unemployment claims increased by 228,000 last week.

● The data released on Friday, September 1st, further muddled market forecasts. On Thursday, all signs pointed to a cooling labor market. However, contrary to expectations of 170K, the number of new jobs created in the non-farm sector (NFP) rose significantly from 157K to 187K. In other words, the news is good. On the flip side, the unemployment rate also increased, from 3.5% to 3.8% (with a forecast of 3.5%). So, the news is bad. Additionally, the U.S. Manufacturing Purchasing Managers' Index (PMI) also increased, from a previous level of 46.4 and expectations of 47.0, to an actual figure of 47.6. Once again, the news is good. However, it's worth noting that a PMI above 50.0 indicates an improving economic situation, while below 50.0 suggests deterioration. So, is the news bad again?

Overall, these mixed indicators led to a divergent market reaction. On one hand, the U.S. Dollar Index (DXY) began gradually improving its position from Wednesday, August 30th, sharply accelerating its gains on Friday. On the other hand, the likelihood of a rate hike at the upcoming Federal Reserve meeting on September 19-20 dropped to 12%. Contributing to the reduced rate hike expectations were the somewhat divergent statements from Federal Reserve officials. We have already covered what Federal Reserve Bank of Boston President Susan Collins, Federal Reserve Bank of Philadelphia President Patrick Harker, and Federal Reserve Chairman Jerome Powell said at the global central banks symposium in Jackson Hole in our previous review. Now, we add that Federal Reserve Bank of Atlanta President Raphael Bostic believes that rates are already at a restrictive level and that further hikes could inflict additional pain on the U.S. economy.

● As for the Eurozone economy, the latest statistics indicate that inflation has ceased to decline, while the money supply contracted due to falling lending volumes. Contrary to Bloomberg experts' forecast of 5.1%, the year-over-year Consumer Price Index (CPI) remained stable at 5.3%. In Germany, the region's largest economy, the monthly CPI also remained static at 0.3%.

In such a situation, one would expect the European Central Bank (ECB) to continue tightening monetary policy. However, the threat of stagflation appears to concern the regulator more than rising prices. Even such a hawkish figure as ECB Executive Board Member Isabel Schnabel confirmed that the economic outlook for the Eurozone is more dire than initially thought, suggesting that the region could be on the brink of a deep or prolonged recession.

Her comments are supported by the state of the labour market. The overall unemployment rate in the Eurozone remains stubbornly high, holding steady at 6.4%. In Germany, the rate has been gradually increasing on a quarterly basis, slowly reverting to levels seen during the COVID-19 pandemic.

● It appears that both regulators, the Federal Reserve and the European Central Bank, are losing their appetite for further monetary tightening and are prepared to end their cycles of monetary restriction (or at least put rate hikes on hold). In such a scenario, it is logical that weaker economies stand to lose. Strategists at JP Morgan and Bank of America anticipate the euro to reach $1.0500 by the end of the current year, while BNP Paribas projects an even lower level of $1.0200.

● Starting the five-day trading period at 1.0794, EUR/USD closed nearly where it began, settling at 1.0774. As of the time of writing this review, the evening of September 1, 50% of experts are bullish on the pair in the near term, 20% are bearish, and 30% have taken a neutral stance. Regarding technical analysis, nothing has changed over the past week. All trend indicators and oscillators on the D1 timeframe remain 100% in favour of the U.S. currency and are coloured red. Additionally, 15% still indicate that the pair is oversold. The nearest support levels for the pair are situated around 1.0765, followed by 1.0665-1.0680, 1.0620-1.0635, and 1.0515-1.0525. Bulls will encounter resistance at 1.0800, followed by 1.0835-1.0865, 1.0895-1.0925, 1.0985, 1.1045, 1.1090-1.1110, 1.1150-1.1170, 1.1230, and 1.1275-1.1290.

● Among the events to watch for the upcoming week, attention should be paid to the speech by ECB President Christine Lagarde on Monday, September 4. On Wednesday, September 6, retail sales data for the Eurozone will be released, along with the U.S. Services PMI figures. On Thursday, September 7, revised Q2 GDP figures for the Eurozone will be published, as will the customary U.S. initial jobless claims numbers. And rounding out the workweek, on Friday, September 8, we will learn about the state of inflation (CPI) in Germany, the main engine of the European economy.

GBP/USD: Will the Rate Not Increase After All?

● Earlier in the EUR/USD overview, we highlighted the central banks' main question: what's more important – defeating inflation or preventing the economy from sliding into a recession? Although the annual inflation rate in the United Kingdom has dropped from 7.9% to 6.8% (the lowest since February 2022), inflation remains the highest among the G7 countries. Moreover, the core CPI indicator remained at 6.9% YoY, just as it was a month earlier. This is only 0.2% below the peak set two months prior. Additionally, rising energy prices pose a threat for new inflationary surges.

● Such data and outlooks, according to several analysts, should have compelled the Bank of England (BoE) to continue raising interest rates. However, there's another factor tipping the scales in the opposite direction. August marked a further deepening of the downturn in the UK's manufacturing sector. Manufacturers in the country reported a weakening economic backdrop, as demand suffers due to rising interest rates, a cost-of-living crisis, export sector losses, and market outlook concerns. According to S&P Global, intermediate goods producers are particularly hard-hit — the B2B sector is facing the steepest decline in production volumes. This affects both new orders and staffing levels, which are being cut back.

The final Purchasing Managers' Index (PMI) for August stood at just 43.0. The main PMI figure plummeted to a 39-month low, as production volumes and new orders contracted at rates rarely seen, except during major periods of economic stress, such as the global financial crisis of 2008-2009 and pandemic-related lockdown measures.

● Against this bleak backdrop, survey results indicate that the country's policymakers will increasingly focus on concerns about the state of the economy rather than on the issue of raising interest rates. The Bank of England's Chief Economist, Huw Pill, stated that while there's no room for complacency regarding inflation, he himself would prefer to keep the rate steady for a more extended period. He announced that at the upcoming BoE meeting on September 21, he will vote to maintain the current rate at 5.25%. Following such a statement, the previously described rule comes into effect – if both regulators lose their appetite for further rate hikes, the weaker economy loses. In the case of the UK/US pair, the former turns out to be the weaker link.

● We have previously mentioned that experts at Scotiabank do not rule out the possibility of GBP/USD falling further to 1.2400. Analysts at ING, the largest banking group in the Netherlands, believe that should the dollar strengthen, the pair may find support around 1.2500. Their colleagues at Singapore's United Overseas Bank anticipate that “as long as the pound remains below the strong resistance level of 1.2720, it is likely to weaken to 1.2530, and possibly even to 1.2480.”

● The pair closed last week at 1.2585. Looking at the near future, 40% of experts anticipate an upward correction, 20% foresee further dollar strengthening, and the remaining 40% expect sideways movement. Among the oscillators on the D1 timeframe, 90% are coloured red and 10% green. As for the trend indicators, the ratio between red and green is 85% to 15%, favouring red. If the pair moves south, it will encounter support levels and zones at 1.2560-1.2575, 1.2545, 1.2500-1.2510, 1.2435-1.2450, 1.2300-1.2330, 1.2190-1.2210, 1.2085, 1.1960, and 1.1800. In the event of an upward movement, the pair will face resistance at 1.2620-1.2635, 1.2690-1.2710, 1.2760, 1.2800-1.2815, 1.2880, 1.2940, 1.2980-1.3000, 1.3050-1.3060, 1.3125-1.3140, and 1.3185-1.3210.

● As for significant events concerning the state of the United Kingdom's economy, particular attention should be paid to the Inflation Report hearings scheduled for Thursday, September 7.

USD/JPY: Awaiting Currency Interventions

● generally speaking, if we review the week's outcomes, it can be stated that the Dollar Index (DXY) reclaimed all three pairs, EUR/USD, GBP/USD, and USD/JPY, on Friday, September 01, nearly returning them to where they began the five-day period. This occurred despite significant volatility. For instance, starting at the 146.40 yen mark per dollar, the Japanese currency reached a peak of 147.36, then declined to 144.44, with the final note being played at the 146.21 level.

● Fresh statistics indicate that industrial activity in Japan is experiencing a downturn. This is evident from the Purchasing Managers' Index (PMI) data for the manufacturing sector, which fell from 49.7 to 49.6 in a month, remaining below the threshold of 50 for the third consecutive month. The 50 mark separates expansion from contraction. Against this backdrop, USD/JPY maintains a bullish sentiment, although this could be disrupted by currency interventions from the Japanese authorities. Officials assure that they remain vigilant. For instance, Japan's Finance Minister, Sunaiti Suzuki, recently conducted another verbal (non-financial) intervention. On September 01, he stated that markets should determine currency exchange rates themselves, while emphasizing that sharp fluctuations are undesirable. He also mentioned closely monitoring currency movements. Whether such “incantations” will calm investors concerning the yen remains uncertain. It is plausible that concrete currency interventions, rather than verbal ones, might be required to provide evidence, much like what occurred last November.

● In terms of the near-term outlook, much like the previous pairs, the majority of analysts believe that the DXY has gained sufficiently and that it might be time for it to retrace southward, at least temporarily. Regarding USD/JPY, 80% of analysts have voted in favour of such a trend reversal. The remaining 20% continue to hold faith in the dollar's potential for further pair growth. On the D1 timeframe, all 100% of trend indicators are painted in green. Among oscillators, 65% are in this state, while 10% are in red, and the remaining 25% have assumed a neutral position.

The nearest support level is situated in the range of 146.10, followed by 145.50-145.70, 144.90, 144.50, 143.75-144.05, 142.90-143.05, 142.20, 141.40-141.75, 140.60-140.75, 139.85, 138.95-139.05, 138.05-138.30, 137.25-137.50. The closest resistance lies at 146.50-146.60, followed by 146.90, 147.25-147.35, 148.45-148.85, 150.00, and finally, the October 2022 high of 151.90.

● Friday, September 08, stands out in the economic calendar for the upcoming week as the day when the GDP figures for Japan's Q2 2023 will be released. There are no other significant statistical releases planned concerning the state of the Japanese economy for the upcoming week.

CRYPTOCURRENCIES: Why Bitcoin Soared and Why It Fell Again

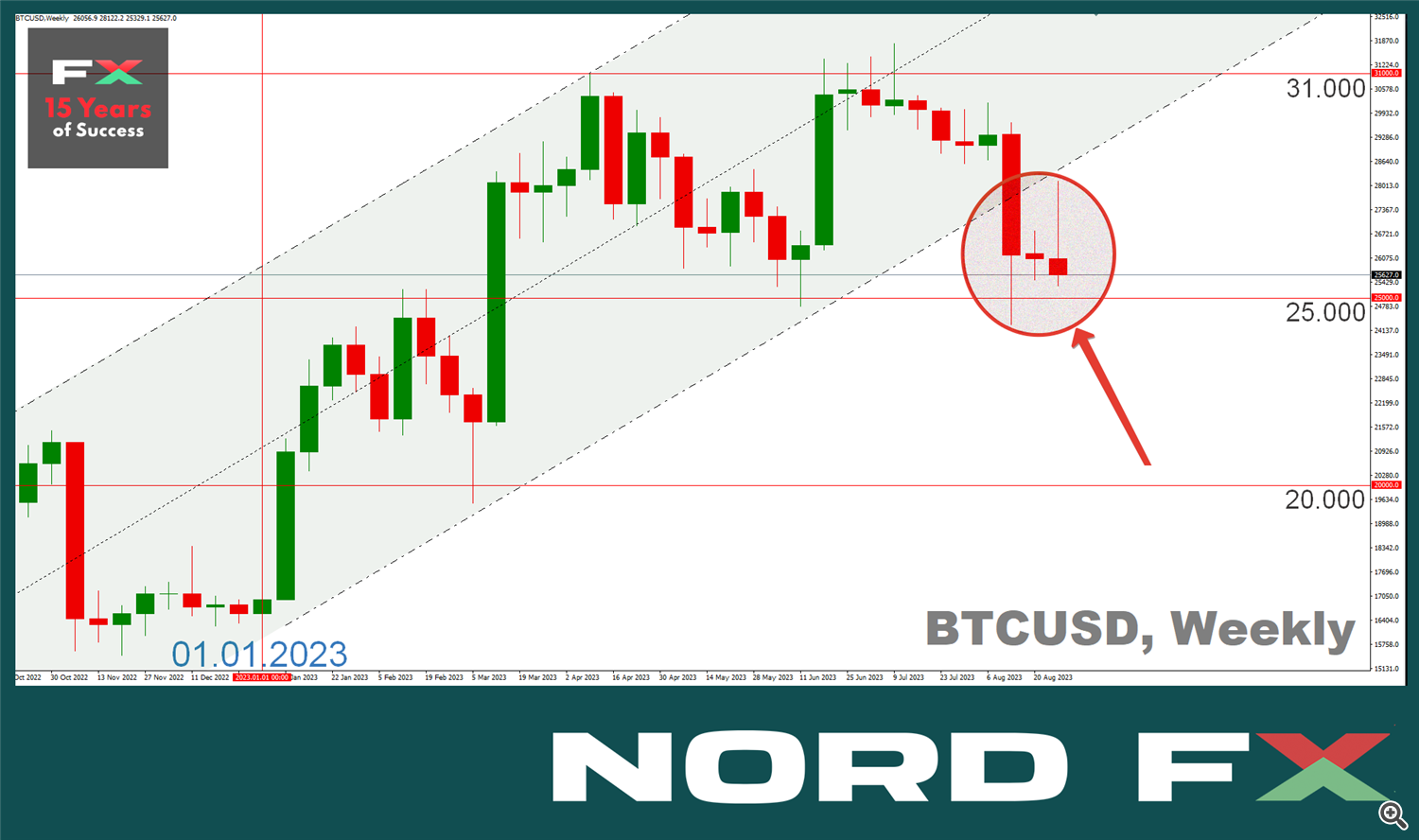

● The beginning of the past week was exceptionally dull. Its continuation could have been just as uneventful if not for Grayscale. Currently, Grayscale is the world's largest investment firm managing cryptocurrency assets. And now, it has won an appeal against the U.S. Securities and Exchange Commission (SEC). The judges unanimously deemed the regulator's denial of converting the Bitcoin trust fund into a spot ETF “arbitrary and capricious.” The legal battle lasted over a year, and unexpectedly on Tuesday, August 29, the court delivered such a definitive verdict. As a result, within three hours, Bitcoin surged from $26,060 to $28,122, a 7.9% increase, demonstrating the best growth rate in the last 12 months.

Perhaps, the explosive effect could have been even more impressive if not for the insiders. It turned out that someone did know about the court's decision in advance. Just before the court's announcement, this individual placed 30,000 Bitcoins, worth around $780 million, on the exchange. Selling such a volume of coins at the price peak is rather challenging due to low liquidity, thus causing a decline in their selling value. Consequently, the gains of BTC/USD gradually faded away, and it returned to where it started on August 29.

● However, despite this decline, many analysts are confident that the current court decision will still have a positive impact on the market. Recall that this summer, eight major financial institutions have already filed applications with the SEC to enter the cryptocurrency market through spot Bitcoin ETFs. Among them are global asset managers like BlackRock, Invesco, and Fidelity. Earlier, the fact that the SEC had previously rejected all similar applications raised concerns. However, everything has changed now following the Grayscale case verdict.

Senior Bloomberg strategist, Eric Balchunas, has already raised his prediction to 95% for ETF approvals within 2024 and to 75% for the possibility of it happening in this year, 2023. According to various estimates, these new funds could attract between $5 billion to $10 billion of institutional investments within the first six months alone, undoubtedly pushing the quotations higher.

● Co-founder of Fundstrat, Tom Lee, believes that if a spot Bitcoin ETF is approved, the price could rise to $185,000. On the other hand, Cathy Wood, the CEO of ARK Invest, forecasts a surge in the total cryptocurrency market capitalization to $25 trillion by 2030, representing an increase of over 2100%. Within this projection, ARK Invest's baseline scenario envisions BTC's price rising to $650,000 during this period, while the more optimistic scenario suggests roughly twice that.

The Artificial Intelligence ChatGPT, developed by OpenAI, has proposed its optimistic scenario. It envisions the primary cryptocurrency growing to $150,000 by 2024, $500,000 by 2028, $1 million by 2032, and $5 million by 2050. ChatGPT, however, outlined certain conditions. This growth could only materialize if: the cryptocurrency becomes widely adopted, bitcoin becomes a popular store of value, and the coin is integrated into various financial systems. If these conditions are not met, according to the AI's calculations, by 2050, the coin could be valued anywhere from $20,000 to $500,000.

● In general, even the latest figure sounds promising for long-term holders of BTC, whose numbers continue to grow. Research from Glassnode reveals that this figure recently reached a record high, indicating the popularity of the hodling concept, a presence of certain optimism, and potential resistance to market fluctuations.

On the flip side, short-term speculators are exiting the market. According to CryptoQuant, the trading volume of bitcoins has hit its lowest level in five years. “Trading volumes are decreasing amidst a bearish trend, as retail investors depart,” explains Julio Moreno, Head of Research at CryptoQuant. “Overall, the market remains lacklustre,” asserts Gautam Chhugani, an analyst at Bernstein. “This trend isn't necessarily bearish, but participants are still uninterested in trading, as the market awaits catalysts.”

Raoul Pal, CEO of Real Vision Group, one of the world's leading financial media platforms, noted that btc's 30-day volatility has decreased to 20 points. However, based on his observations, historically, such low volatility within two to four months led to a robust surge in the first cryptocurrency. According to the analyst known as Credible Crypto, for a truly potent surge, the bulls need to push the first cryptocurrency's price above the key zone of $29,000-$30,000. For now, a significant portion of traders anticipates a decrease in BTC to more favourable buying levels. Yet, when the price surpasses $30,000, according to Credible Crypto, the Fear of Missing Out (FOMO) phenomenon will come into play, propelling quotations upwards.

● To what extent can the price of the flagship cryptocurrency fall in the current situation? September historically has not been favourable for bitcoin. From 2011 to 2022, BTC on average lost about 4.67% of its value during this period.

Analyst Justin Bennett believes that the bitcoin price could potentially drop to $14,000. This level acted as strong support from 2018 to 2020. Bennett supports his forecasts with a chart showing that the flagship crypto asset has exited an ascending channel that it had been in for about ten months. Bitcoin failed to overcome resistance in the range of $29,000-$33,000, which led to this breakout. Furthermore, a global economic recession could exacerbate the decline. According to Bennett, since the S&P 500 stock index couldn't replicate the 2022 record of 4,750 points, it could now potentially lose a substantial percentage of its value.

However, despite the aforementioned viewpoints, September could still prove favourable for long-term investments within the “buy on dips” strategy. Bloomberg's Senior Analyst, Mike McGlone, compared metrics of the first cryptocurrency to the stock market and concluded that even a drop to $10,000 wouldn't significantly shake the coin's positions. As an example, the expert cited corporate giant Amazon's stocks, which yielded over 7,000% returns in the last 20 years. Yet, BTC far surpasses this figure having grown around 26,000% since 2011. “Even a return to the $10,000 mark would maintain an unprecedented asset performance,” notes McGlone. He emphasizes that bitcoin's trajectory of “mainstream migration” is also crucial, as exchange-traded funds and other instruments characteristic of the traditional market emerge.

● In addition to the potential approval of spot bitcoin ETFs, the upcoming halving could also influence the coin's growth. Thanks to these factors, according to TradingShot analysts, BTC/USD could rise to the $50,000 mark by the end of this year. However, at the time of writing this review on the evening of Friday, September 1st, it's trading around $25,750. The overall cryptocurrency market capitalization stands at $1.048 trillion ($1.047 trillion a week ago). The Crypto Fear & Greed Index remains in the Fear zone at a reading of 40 (39 points a week ago)

NordFX Analytical Group

https://nordfx.com/

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

#eurusd #gbpusd #usdjpy #Forex #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx

Comments are closed.