Crude Oil Price Climbs on Russia News and EIA Data as it Eyes New Highs

Crude Oil, WTI, Brent, Russia, OPEC+, China, India, EIA, API, OVX, NFP – Talking Points

- Crude oil jumped over hurdles overnight on possible Russian output cuts

- Stockpiles in the US continue to paint a picture of solid demand there

- The oil market structure might be supportive of it. Will WTI make a new high?

Recommended by Daniel McCarthy

Understanding the Core Fundamentals of Oil Trading

The crude oil price climbed higher going into Friday’s trading session after reports emerged that Russia would extend cuts to production and inventory data revealed another drop in stockpiles.

It is being reported overnight that Russia will announce new parameters of a deal with its OPEC+ partners next week according to Deputy Prime Minister Alexander Novak.

On the flipside, the latest data also shows that China and India imported less oil in July.

Thursday’s US Energy Information Agency (EIA) weekly petroleum status report revealed a massive drop of -10.584 million barrels for the week ended August 25th, much lower than the -3.267 million anticipated and -6.135 prior.

Recommended by Daniel McCarthy

Traits of Successful Traders

It comes hot on the heel of the American Petroleum Institute (API) inventory report the day before that showed -11.486 million fewer barrels in stock for the same week. Again, that was well below the -2.9 million forecast.

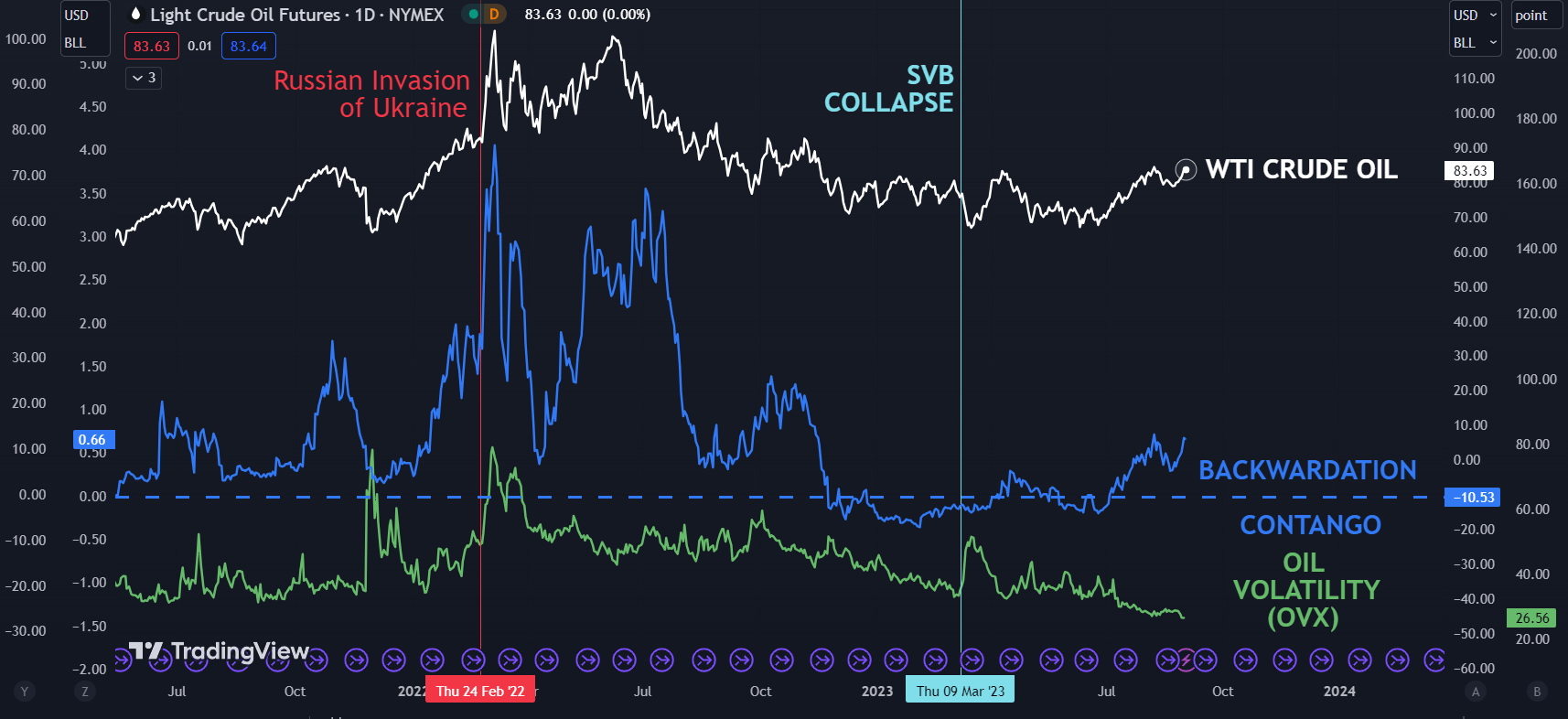

Backwardation between the front 2 WTI futures contracts had been moving in a bullish direction for crude and might support the case that demand in the US is robust for now.

At the same time, the OVX index continues to languish at its lowest level since 2019 which may indicate that the market is non-plussed about the run-up in prices.

The OVX index measures volatility in the WTI oil price in a similar way that the VIX index gauges volatility on the S&P 500.

At the start of trading on Friday, the WTI futures contract is a touch above US$ 83.50 bbl while the Brent contract is trading near US$ 86.80 bbl at the time of going to print.

The August peak was US$ 84.89 for WTI and US$ 87.37 for Brent. Live prices can be found here.

The markets appear to be somewhat at a crossroads after soft US data earlier in the week led to speculation that the Fed might not need to be as aggressive in its tight monetary policy stance.

Later today US non-farm payrolls (NFP) will be released could provide a catalyst for oil price volatility. A Bloomberg survey of economists is forecasting that 170k jobs were added in August and that the unemployment rate will remain steady at 3.5%.

The weekly Baker Hughes rig-count report is also likely to get some attention.

For more information on how to trade oil, click on the banner below.

Recommended by Daniel McCarthy

How to Trade Oil

WTI CRUDE OIL, RBOB CRACK SPREAD, BACKWARDATION AND VOLATILITY (OVX)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

Comments are closed.