Crude Oil Holds Gains On Hopes For China Demand Rebound

Crude Oil Price, Analysis, and Chart

- US Crude prices continued their run of gains

- Hopes for economic revival in China and, perhaps the US, keep tight supply in focus

- The $82 region looks key now

Recommended by David Cottle

Get Your Free Oil Forecast

Crude oil prices continued to find robust support in hopes for rising Chinese demand on Friday even as the economic picture across western economies remains decidedly patchy.

January has seen consistent gains for energy benchmarks, mostly triggered by signs of renewed vigor in the world’s number two economy. China was hit hard by draconian Covid-lockdown rules, and also by a broad, post-pandemic rethink of the globalization model which has underpinned its astonishing economic rise.

However, those rules have been relaxed and latest data are more encouraging. November’s crude demand in China was at its highest level since last February, according to the Joint Organizations Data Initiative which released its numbers this week. Optimism over China enabled the market to shrug off Thursday’s news of a large oil-inventory rebuild in the US, with the prospect of weaker inflation and a pause in interest rate rises enough to convince some traders that US oil demand is likely to grow too.

The market is looking for two more quarter percentage point rate rises from the US Federal Reserve, possibly followed by a long hiatus.

Supply Looks Set To Remain Tight

The global oil market seems likely to remain pretty tightly supplied if both the US and China see a demand revival, especially given that major producer Russia remains hamstrung by sanctions.

However, there remain serious worries about recession in Western economies. The latest US retail sales numbers were dismal and hardly represented an economy crying out for still-higher borrowing costs.

These worries are likely to contain crude bulls’ enthusiasm, at least until inflation levels show durable declines.

Recommended by David Cottle

How to Trade Oil

US Crude Oil Technical Analysis

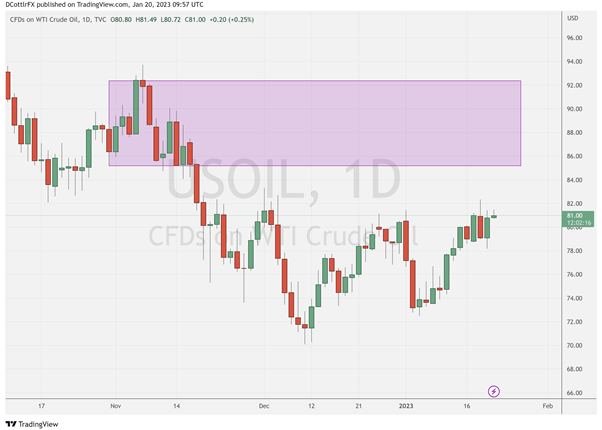

The $82/barrel psychological resistance level is proving quite the hurdle for US crude oil bulls.

Attempts to top this level have been rebuffed twice in the recent past, with failure presaging sharp falls at both the start and end of December.

US Crude Oil Futures, Daily Chart

Chart Compiled By David Cottle Using TradingView

Clearly the bulls are girding themselves for another try, and, given the strong run of gains seen since the market-based in the $73 area back on January 5, this might be the time they can make a challenge stick. However the uncommitted may be wise to wait and see where this week’s close takes the action, just in case some profit-taking kicks in.

However, even if the market can consolidate above $82, the bulls will have plenty of work to do to erase the memory of the sharp falls seen at the end of 2022. They’ll be faced with a broad band of resistance which will come in between November 14’s close of $85.15 and the previous peak, November 4’s $92.28 closing high.

Immediate support is likely to come in at the $79.02 region which has held the market on a daily closing basis for the past five sessions. A fall below that would put the lows of early December in the $71 region back in focus.

–By David Cottle For DailyFX

Comments are closed.