CB Consumer Confidence Declines Ahead of FOMC

CB Consumer Confidence Key Points:

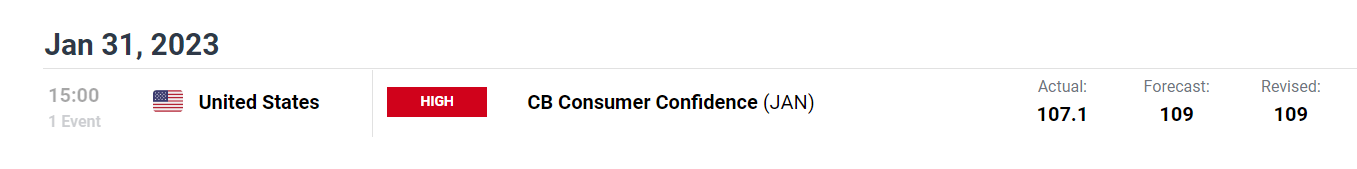

- CB Consumer Confidence decreases to 107.1 (vs est 109) – higher interest rates weigh on the business confidence and the short-term employment outlook.

- FOMC rate decision remains key for the near-term economic outlook – can the Fed avoid panic and ease recession fears?

Recommended by Tammy Da Costa

Get Your Free USD Forecast

CB Consumer Confidence Decreases – Higher Interest Rates Reduce Short-Term Growth Prospects

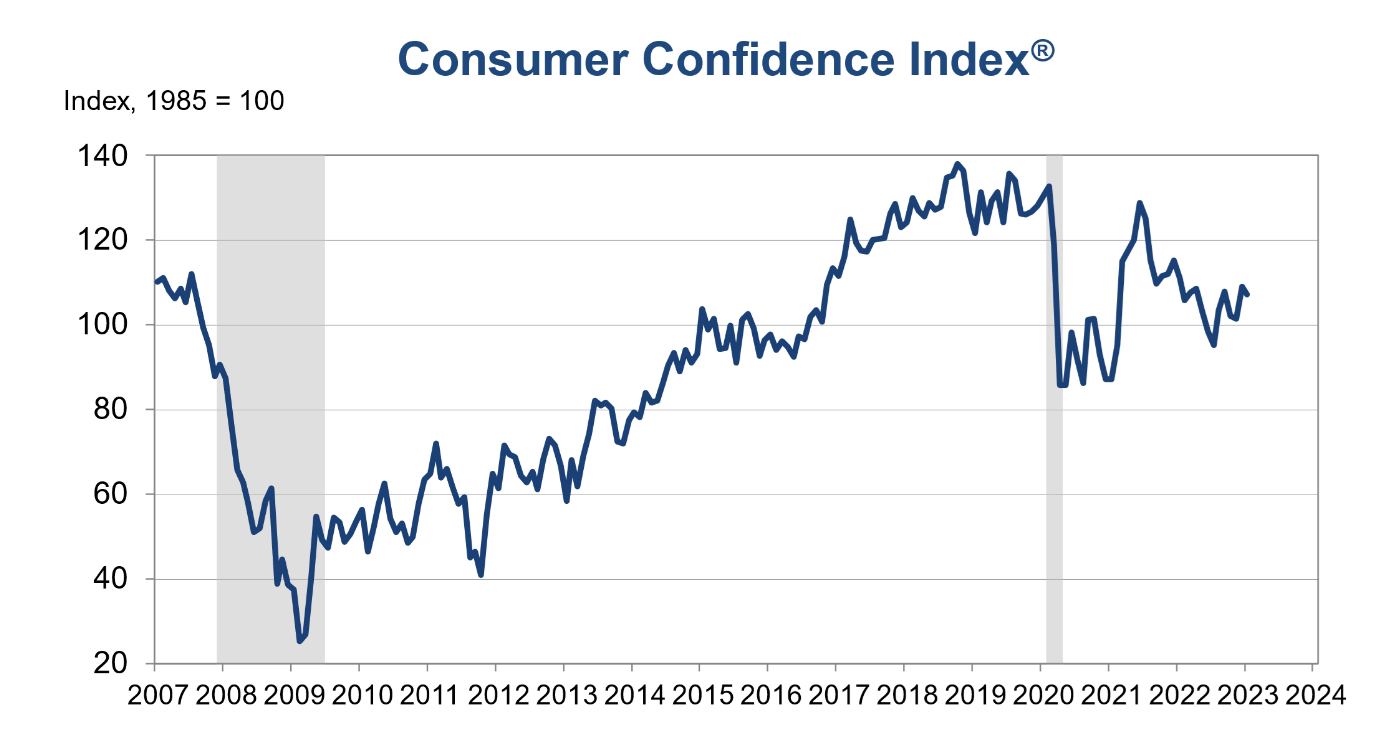

The Conference Board Consumer Confidence Index® has decreased for the month of January to 107.1, down from the December reading of 108.3.

DailyFX Economic Calendar

On the last Tuesday of every month, the CB confidence report is released to the public. For the month of January, the findings of the report can be summarized as follows:

- The Present Situation Index—based on consumers' assessment of current business and labor market conditions—increased to 150.9 from 147.4 last month.

- The Expectations Index—based on consumers' short-term outlook for income, business, and labor market conditions—declined to77.8 from 83.4 in December.

After the implementation of a series of aggressive rate hikes, lower wage growth and higher borrowing costs have contributed to the reduction in short-term business conditions and labor outlook.

In response to the declining six-month growth outlook, recession fears remained mixed as investors focus on monetary policy and the upcoming Fed decision..

Source: Conference Board

As the Federal Reserve strives to balance the objectives of its dual mandate (to achieve ‘full employment’ and price stability), investors continue to look for signs of a Fed pivot.

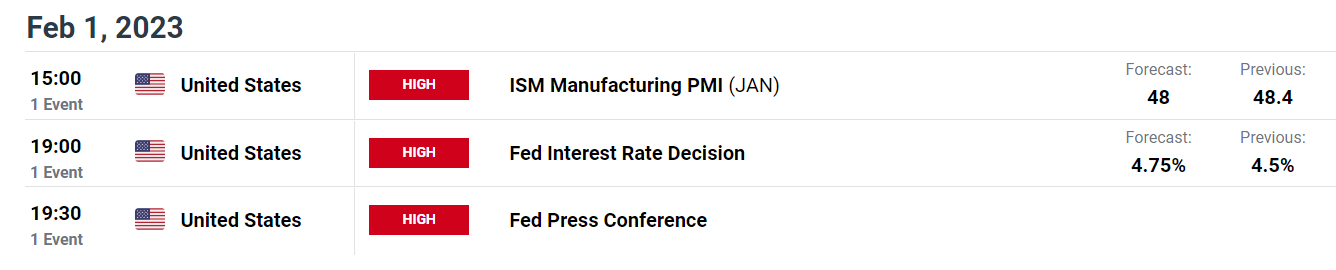

DailyFX Economic Calendar

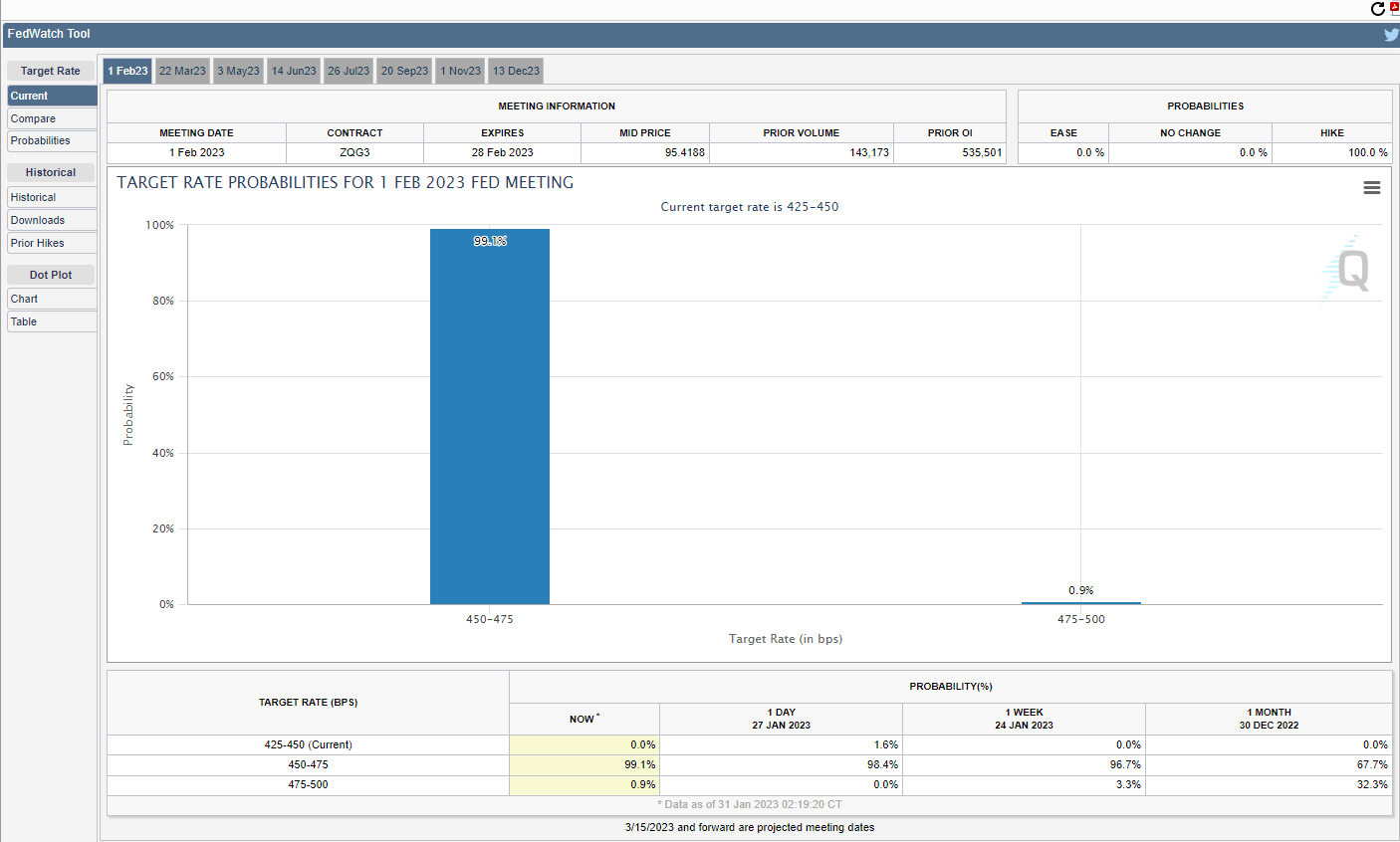

With market participants currently pricing in a 99% probability of a 25-basis point rate hike at tomorrow’s FOMC rate decision. Although the anticipated slowdown in the pace of tightening has been priced in, the Fed has maintained its hawkish narrative which could see rates remaining elevated for a longer period of time.

Contractionary Monetary Policy: What is it and How Does it Work?

Source: CME fedwatch tool

Although the IMF has recently updated the interim US GDP growth forecasts by 0.4% for 2023 (revised to 1.4% vs the October forecast of 1.00%), higher interest rates and elevated price pressures remain a key concern for growth prospects.

While tomorrow’s event risk could contribute to rising volatility, Friday’s NFP report could provide an additional catalyst for price action for both the US Dollar and risk assets.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

Comments are closed.