Cable Coils into Narrow Range Ahead of Blockbuster Week

GBP/USD Analysis

- Markets brace for a week of high importance event risk (FOMC, BoE, ECB, NFP and mega-cap tech earnings)

- GBP/USD technicals highlight major reversal pattern and the potential for increased volatility

- Fund managers’ sentiment aligns with the contrarian indicator

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free GBP Forecast

Global Markets Brace for a Week of High Importance Event Risk

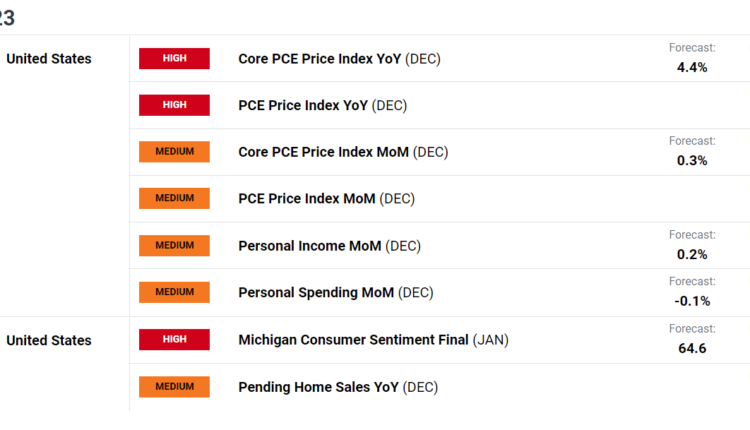

It is not surprising to have witnessed a drop-off in FX volatility in recent days as markets anticipate a massive week of high importance event risk to come. Today, however, sees the core PCE print which garners much attention due to the Fed’s preference for this measure of inflation but is anticipated to see rather muted price action in the absence of a massive surprise of course. The final look at the University of Michigan’s consumer sentiment reading is expected to complement the recent optimism around the state of the US economy after Q4 GDP surprised to the upside yesterday.

Customize and filter live economic data via our DailyFX economic calendar

Next week will perhaps provide an over-stimulus of economic data and central bank meetings which have the potential to deliver sharp, volatile moves. The big question mark over any sustained follow through remains a mystery and many will be looking to Jerome Powell for clues of a change in the path of monetary policy. On the basis of what we have heard from prominent FOMC members in the lead up to next week, the Fed aren’t risking complacency after witnessing the highest levels of inflation in decades. Markets still suggest that the Fed will have to pause hikes sooner than the Fed has previously indicated meaning someone will need to bridge the gap. If markets concede the more dovish outlook, DXY and US yields may see some upside relief, which suggests some softening on cable.

GBP/USD Technicals Highlight Major Reversal Pattern and the Potential for Increased Volatility

Cable has been flirting with an upside break of the head and shoulders neckline, retreating at each attempt. As mentioned earlier, this isn’t surprising given what is to come next week but underscores the importance of a potential surge in volatility.

GBP/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

The daily chart helps to refine the analysis and reveals the narrow range that cable has found comfort within. This is the range around the prior high of 1.2445 and the zone of support and psychological level of 1.2300. The trading landscape for next week is potentially a treacherous one, given the potential for outsized spikes and false breakouts if momentum remains nowhere to be seen.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Fund Managers’ Sentiment Aligns with the Contrarian Indicator

According to the most recent commitment of traders (CoT) report from the CFTC, dollar positioning from hedge funds and other top money managers has become more net-short – aligning with the warnings of the IG client sentiment indicator.

GBP/USD:Retail trader data shows 40.65% of traders are net-long with the ratio of traders short to long at 1.46 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

The number of traders net-long is 8.60% higher than yesterday and 4.95% higher from last week, while the number of traders net-short is 6.73% lower than yesterday and 4.68% lower from last week.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.