Australian Dollar Skips a Beat on Chinese PMI and Domestic Data. Where to for AUD/USD?

Australian Dollar, AUD/USD, China PMI, Retail Sales, Credit, CPI, RBA – Talking Points

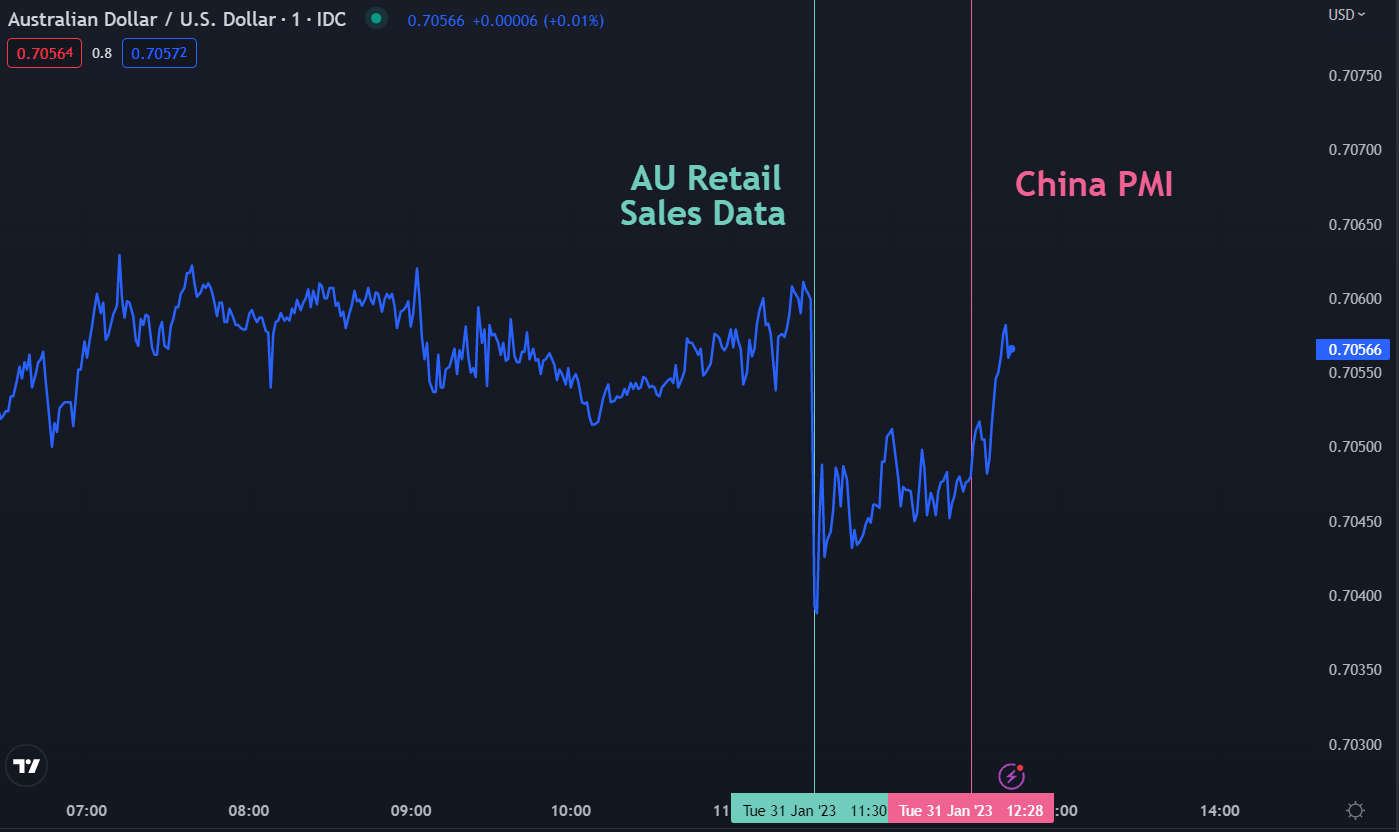

- The Australian Dollar inched north on improving Chinese PMI

- AUD/USD had been under pressure post soft retail sales and credit data

- Tuesday next week will see the RBA decide on rates. Will it impact AUD/USD?

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

The Australian Dollar recalibrated after Chinese PMI showed signs of an economic recovery which followed domestic data that revealed an easing of conditions.

Chinese manufacturing PMI for December printed in line with expectations at 50.1 and the non-manufacturing read came in at 54.4, way above the 52.0 forecast. This combined to give a composite PMI read of 52.9 against 42.6 previously, a massive boost in sentiment.

The China PMI indices are the result of a survey of 3,000 manufacturers across China, mostly large firms. It is a diffusion index, a reading over 50 is viewed as expansionary for the economic outlook of the world’s second-largest economy.

Today’s data encompasses the easing of Covid-19 restrictions seen in December and appears to illustrate the immediate benefits of the re-opening. China’s CSI 300 equity index is up over 12% since the December low and 22% from the October low.

Recommended by Daniel McCarthy

How to Trade AUD/USD

An hour before the Chinese PMI, Australian month-on-month retail sales fell by -3.9% for December, notably below the -0.2% expected and a prior number of positive 1.4%.

Additionally, Australian private sector credit for December showed growth of 0.3% month-on-month, below the 0.5% forecast. This contributed to an annual read of 8.3% year-on-year which was less than 8.9% previously.

This comes on top of a hot headline CPI of 7.8% last week, beating estimates of 7.6% year-on-year to the end of December and against 7.3% previously. The RBA has a mandated CPI target band of 2-3% over the cycle.

This might be good news for the RBA that meets Tuesday next week to decide on the cash rate target. The futures market is leaning toward a 25 basis point hike.

The bank has previously stated that they expect CPI to get to 8% later this year and a slowing of economic conditions could help avoid a re-acceleration of price pressures.

If CPI sails past their 8% estimate earlier than they expect, it could lead to further tighter monetary conditions.

AUD/USD SHORT TERM CHART OVER THE DATA RELEASES

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Comments are closed.