Advantages and Disadvantages of Simple Moving Average – Analytics & Forecasts – 23 October 2023

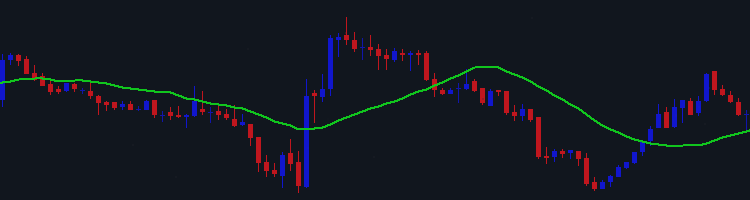

Most forex traders, irrespective of their trading skill levels, prefer using SMA because of its simplicity and ease of understanding. Using the indicator tool involves dividing the accumulated total of data points over a set period with the number of periods basing everything on the current currency prices.

Furthermore, the indicator tool creates signals that alert traders when to enter and quit an active currency trading market. SMA computes the opening and closing times of currency prices and the lows and highs of the prices. The majority of forex traders apply 10, 20, 50, 100, and 200 average lengths to their trading charts, depending on their currency trading time zones.

Advantages and Disadvantages of Simple Moving Average

Advantages

- It is one of the least sophisticated forex trading tools making it easy to use even for first-time traders.

- Unlike other trading tools, it is not prone to fluctuations. Instead, the ups and downs of the currency prices do not affect the trading tool.

- It is one of the most reliable technical analysis tools for identifying market resistance and support points.

- It is one of the best trading start bases for first-time forex traders

- It helps to remove trading charts short-term noises

Disadvantages

- It puts more emphasis on past price movements without acknowledging recent changes.

- Each price taken gets the same emphasis.

- It is not a practical trading tool for intraday and short-term traders

If you don't like the standard Moving Average, you can try the Magic Moving.

Comments are closed.