Gold Prices Stick To Uptrend As Market Mulls US Rate Path

Gold Price, Chart, and Analysis

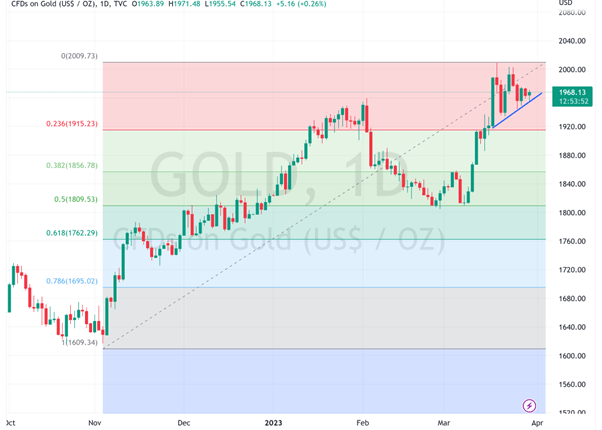

- Gold prices remain under $2000, but their uptrend is also clear

- Markets are weighing up the chances of another US rate rise

- Key data releases are still due this week, which could give a steer

Recommended by David Cottle

Building Confidence in Trading

Gold prices remain pinned below the psychologically important $2000/ounce level as markets wonder how much further United States interest rates might have to rise, if at all.

Federal Reserve Chair Jerome Powell reportedly and quite understandably steered Republican Congresspeople to the central bank’s forecast of one more quarter-percentage-point increase this year when asked in a closed-door meeting on Wednesday what the likely rate path was.

The markets are less certain about this, which may explain current hesitancy in the gold space. Higher interest rates make non-yielding assets like gold much less attractive.

Still, prices remain close to one-year highs having risen consistently since October. The prospect that rate increases could be close to a hiatus has supported the market, as has inflation, which remains above target in most developed markets and way above in some, such as the United Kingdom. Jitters about the global banking system as lenders grapple with higher rates have also provided demand for so-called ‘haven assets’ like gold, but the worst of those seem to be fading, with markets content that trouble at a few banking names won’t lead to another broad financial crisis.

The gold market may also be awaiting data cues in what is a back-loaded week for key numbers. We’ll get Gross Domestic Product and inflation data out of the US before the week ends, along with the closely watched manufacturing Purchasing Managers Index and the University of Michigan’s venerable monthly snapshot of consumer sentiment. All have the potential to bear on interest-rate views ahead, and, thereby, on gold.

Still, even at current elevated levels, the metal remains in clear uptrends both in the short and medium term.

Gold Prices Technical Analysis

Chart Compiled Using TradingView

The last ten days’ trading have resulted in an interesting chart of higher lows and lower highs. There’s some chance that we’re seeing a classic ‘pennant’ formation here. These are generally thought of as continuation patterns, which see the market return to its previous momentum once they play out. If so that might be bullish for gold as it would mean a return to gains.

However, so close to the $2000 level which is bound to bring out the profit takers, it might be rash to be too sure, especially as the upper slope of the pennant is a good deal less clear than the supportive base. That, at least forms a clear trend line, currently offering the market near-at-hand support of $1956.55.

A break below that would put march 21’s close of 1934.31 back into play, ahead of Fibonacci retracement support at $1915.23. Clearly, a test of this would be more serious for the market, with a fall below it taking prices back to levels not seen since early February.

IG’s own sentiment data for the gold market is moderately bullish, with 59% of traders on the long side as of Thursday. As the weekend looms much may depend on whether the current, fairly new uptrend can survive.

–By David Cottle For DailyFX

Comments are closed.