XAU/USD: where will the pendulum swing? – Analytics & Forecasts – 8 September 2023

“If economic activity continues at a strong pace, it could lead to a return to inflation,” Dallas Federal Reserve Bank Governor Laurie Logan said Friday, adding that “the strength of the labor market indicates that we (at the Fed) haven't finished the work on restoring price stability yet.”

These important statements by a representative of the Fed management came after positive macro data from the United States published the day before.

Thus, on Thursday, the US Department of Labor presented a positive weekly report on applications for unemployment benefits, the number of which decreased during the reporting week.

In turn, the data published on Wednesday reflected an increase in the PMI business activity index in the services sector of the American economy (from the ISM, Institute for Supply Management) in August – to 54.5 (against 52.7 in July and the forecast of 52.5) after 53. 9 in June, 50.3 in May, 51.9 in April, 51.2 in March, 55.1 in February, 55.2 in January 2023. The US service sector employs the majority of the country's population and contributes more to GDP than the manufacturing sector (78% versus 21% from manufacturing and 1% from agriculture).

Positive macro statistics increase the chances of the American economy avoiding a recession, while the Fed will still decide to further increase interest rates in order to continue the fight against high inflation.

Coupled with positive data on the dynamics of national GDP, a strong labor market is a bullish factor for the dollar, as it forces the country's Central Bank to adhere to a tight monetary policy, while at the same time limiting the more active growth of its competitor among protective assets – gold (as is known, its quotes are very sensitive to changes in the parameters of the monetary policies of the world's largest central banks, primarily the Fed).

Thus, on Thursday, the DXY dollar index renewed its maximum since March 3 at 105.12, rising for the 8th week in a row and maintaining positive dynamics.

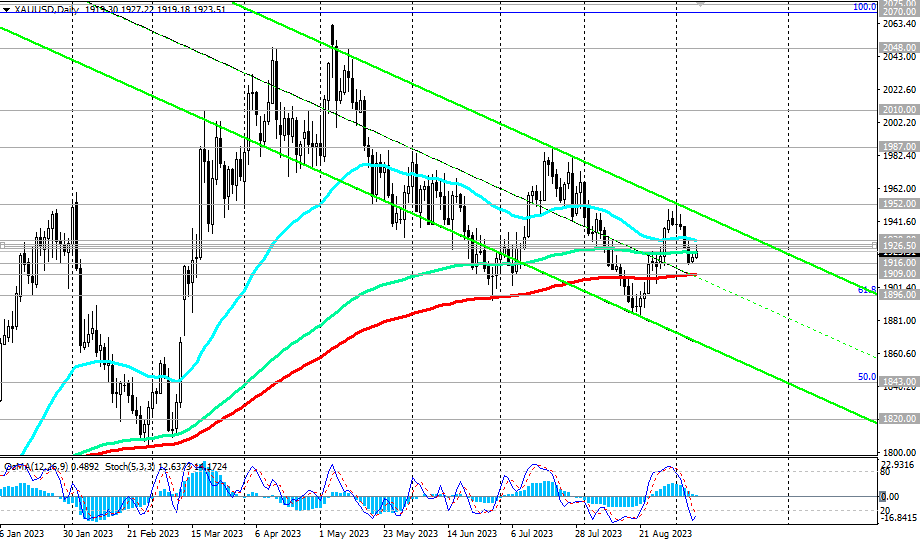

At the same time, the XAU/USD pair, having broken through important support levels of 1927.50, 1926.50 earlier in the week, moved into the short-term bearish market zone.

A more successful attempt to break through the important support levels 1909.00, 1900.00, 1896.00 and further decline will take XAU/USD into the medium-term bearish market zone.

Next week (Wednesday) new US inflation data will be published.

If they again point to a resumption of its growth (annual inflation in the US rose by +3.2% in July from 3.0% in June, although slightly less than the forecast for growth of +3.3%), then this will force the Fed to at a minimum, keep the interest rate at high levels, and at a maximum, continue to increase it.

This is certainly a bullish fundamental factor for the dollar and bearish for US stock indices and gold.

And on Thursday the ECB makes its decision on interest rates. If it decides to make another increase, while maintaining hawkish rhetoric regarding the prospects for its monetary policy, then gold prices will come under additional pressure.

At the same time, with inflation remaining at high levels, ongoing geopolitical uncertainty, concerns about a global economic slowdown and deteriorating relations between the US and China, demand for gold will also be supported.

In an alternative scenario, the price will break through the resistance levels 1926.50, 1927.50, 1930.00 and resume growth. The nearest growth target is the local resistance level of 1952.00, the more distant one is the local resistance level of 1987.00.

Support levels: 1916.00, 1909.00, 1900.00, 1896.00, 1860.00, 1843.00, 1820.00, 1800.00, 1788.00, 1770.00, 1722.00

Resistance levels: 1925.00, 1926.50, 1927.50, 1930.00, 1952.00, 1987.00, 2000.00, 2010.00, 2048.00, 2070.00

*) see also

· “Technical Analysis and Trading scenarios” -> Telegram – https://t.me/traderfxcrypto, https://t.me/fxrealtrading

· chanel FXCryptoTrader – https://www.mql5.com/en/channels/fxcryptotrader

· · signal Insta7 – https://www.mql5.com/en/signals/2035208

Comments are closed.