WTI and Brent Rally Approaches Confluence Area, Where to Next for Oil Prices?

WTI, BRENT PRICE, CHARTS AND ANALYSIS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Dollar Index (DXY) Surprisingly Lower as US PMIs Point to a Strong Private Sector, Gold Bounces Toward $1970/oz

WTI, BRENT FUNDAMENTAL OUTLOOK

Crude Oil has enjoyed a strong bounce to start the week with back-to-back days of gains despite broad based US dollar strength. We have heard a host of comments and a report from the International Energy Administration (IEA) which have certainly aided the recent bounce in oil prices.

The IEA warned that a shortage in oil could materialize in the second half of 2023 as they expect demand to outstrip supply by some 2 million barrels a day. These comments were met with skepticism from the Saudi Oil Minister in particular who stated that the IEA have a talent for consistently getting it wrong.

The Saudi Oil Minister Prince Abdulaziz Bin Salman issued a warning to speculators and short sellers as well ahead of the upcoming OPEC+ meeting in Vienna on June 4. Is the Saudi Oil Ministers warning a sign of further production cuts?

Another variable to consider in the oil price rise of late should be the recent wildfires which have engulfed Canada over the past week. Officials in Alberta were hoping for some respite as heavy rains are forecast over the coming days as they grapple with the worst start to a fire season on record. This could raise concerns from market participants regarding production and supply from Canada in the short-term providing a further boost to WTI and Brent prices.

Recommended by Zain Vawda

Understanding the Core Fundamentals of Oil Trading

DOWNSIDE RISKS FOR WTI AND BRENT

Of course, one doesn’t have to look far for the most pressing downside risk to oil prices at present. The ongoing US Debt Ceiling negotiations have thus far failed to reach any form of agreement as the June 1 deadline nears. The US dollar has been the biggest beneficiary thus far and the longer this drags on the likelihood of a stronger dollar grows which could hamper further upside in oil prices.

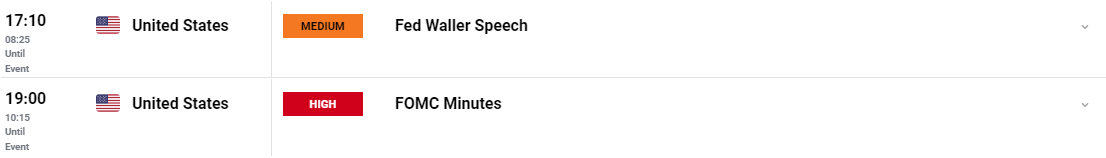

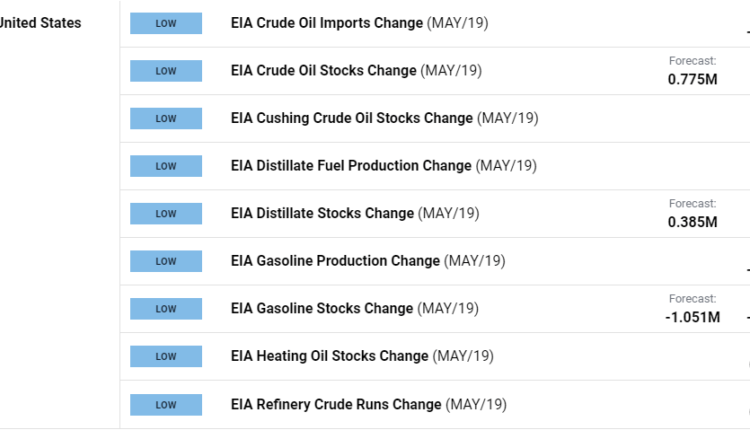

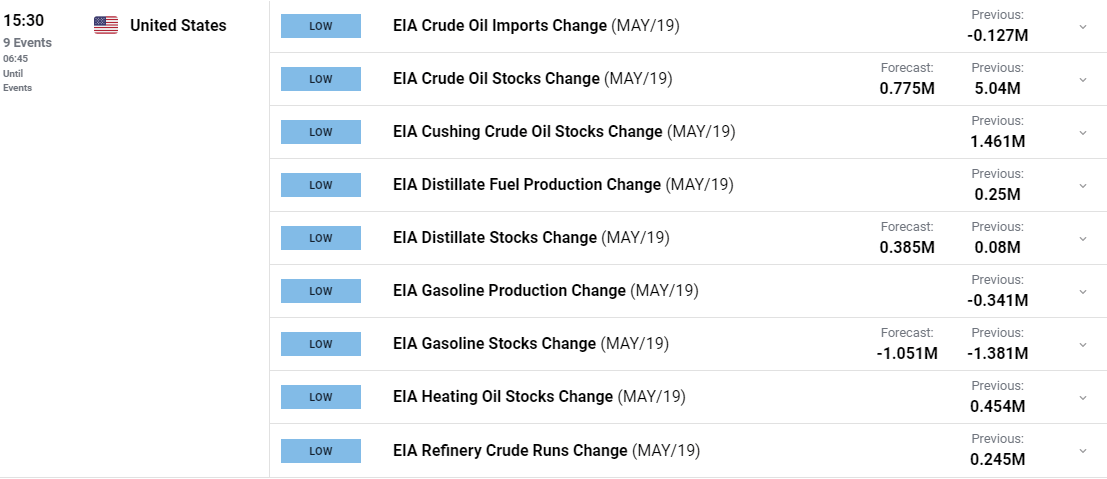

There is very limited high impact data on the docket today with Fed policymaker Waller speaking ahead of the FOMC minutes release. On the oil front we have data from the EIA for the week ended May 19 as well.

For all market-moving economic releases and events, see the DailyFX Calendar

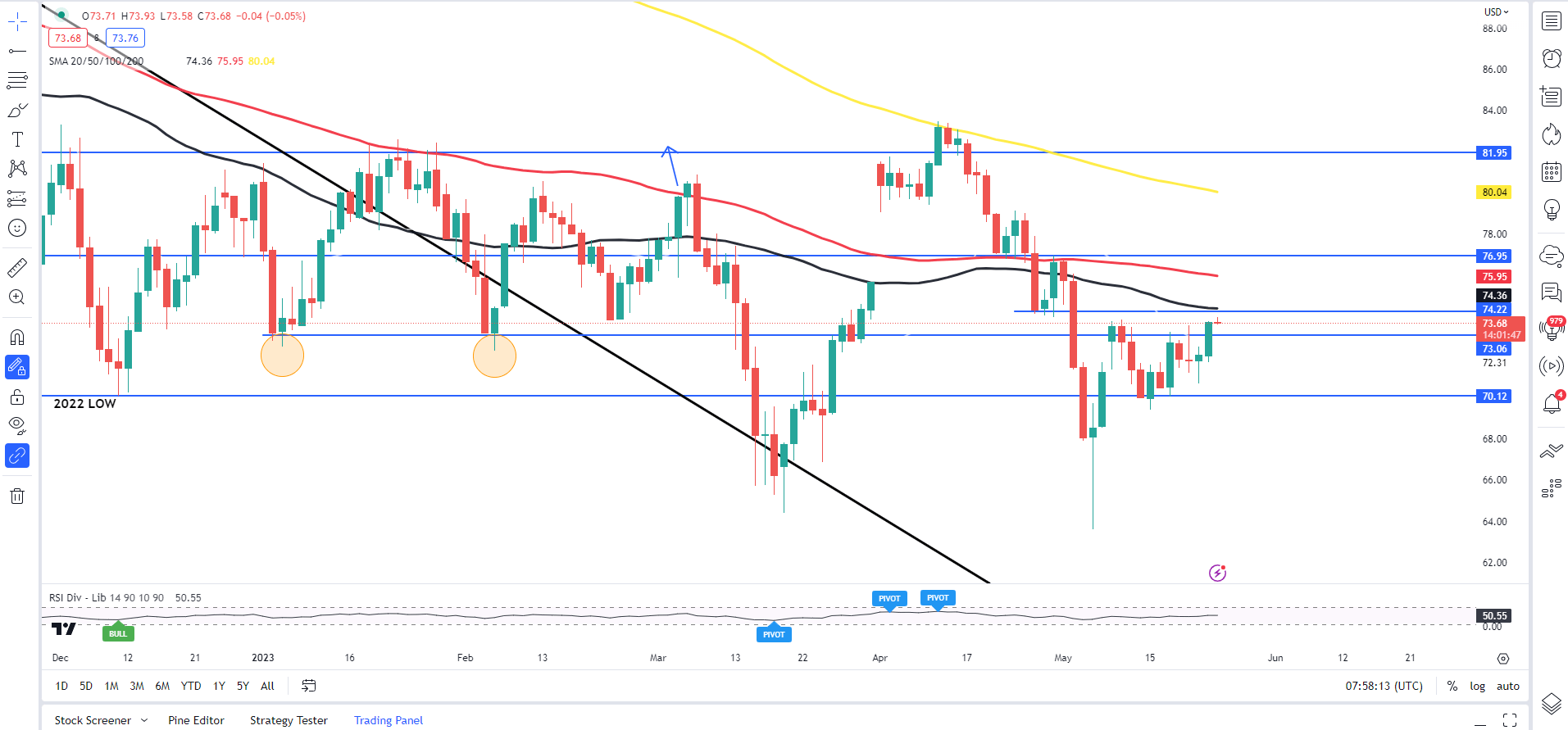

TECHNICAL OUTLOOK AND FINAL THOUGHTS

From a technical perspective both WTI and Brent have staircased their way higher, printing higher highs and higher lows since the recent low on May 4. At the moment however we are running into some significant technical hurdles with the swing low from April 27 and the 50 and 100-day MA all resting just above current price. We could be in for some form of retracement in the short-term with a daily close below the 71.75 a barrel mark invalidating the bullish structure and opening up a retest of the 70.00 a barrel mark.

WTI Crude Oil Daily Chart – May 24, 2023

Source: TradingView

Recommended by Zain Vawda

How to Trade Oil

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.