WTI and Brent Advance as Conditions Remain Favorable for Oil Prices

OIL PRICE FORECAST:

Most Read: What is OPEC and What is Their Role in Global Markets?

Oil prices continued their advance this morning helped by geopolitical fears and depleting inventories. A slightly stronger dollar this morning also failed to arrest the rise in Oil prices ahead of a slew of US data.

Recommended by Zain Vawda

Top Trading Lessons

OPEC, SAUDI ARABIA AND GABON COUP

This morning news came through around a coup in Gabon who is a member of OPEC, albeit a smaller one. Concerns had been raised as to the production supply of Oil and any interruptions which may occur. Gabon being one of the smaller OPEC members pumps around 200k barrels a day and the instability in Gabon could in part explain the continued rally in Oil prices.

This was followed by a poll which was released stating that Saudi Arabia are expected to maintain their Oil cut heading into October in a further positive for black gold prices. China has attempted to provide stimulus to its economy and just the announcement alone has added some optimism to markets with the risk assets gaining as a result.

US DATA CONTINUES POOR RUN

The biggest factor could possibly have come in form inventories with the API Weekly Crude Oil stockpiles recording its biggest slump since 2016. The print which showed Oil stockpiles decline by 11.486 million barrels compared to the previous week's decline around 2.2418 million. This had a knock-on effect as market participants look for an increase in demand as stockpiles fall.

The US data which came out a short while ago continued a trend for US data of late as the economy shows definite signs of a slowdown. Dollar weakness prevailed in the aftermath, and now it will be key to see if these whipsaw moves are set to continue or whether we will enter another rangebound phase for oil prices.

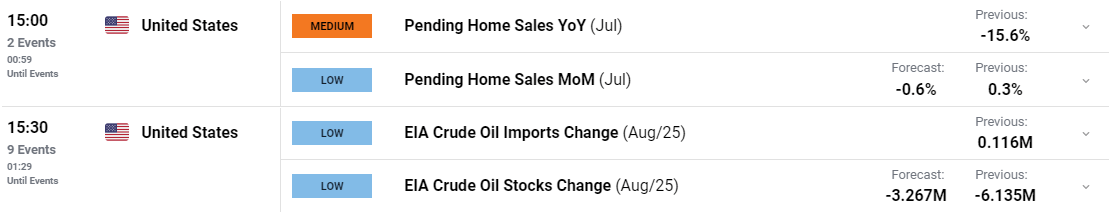

EIA data is due later in the day and could stoke some volatility More data to come later this week and we should have a clearer picture of where the Fed stand regarding a rate hike in September.

For all market-moving economic releases and events, see the DailyFX Calendar

To learn more about trading ranges and patterns download the Guide below.

Recommended by Zain Vawda

The Fundamentals of Range Trading

TECHNICAL OUTLOOK AND FINAL THOUGHTS

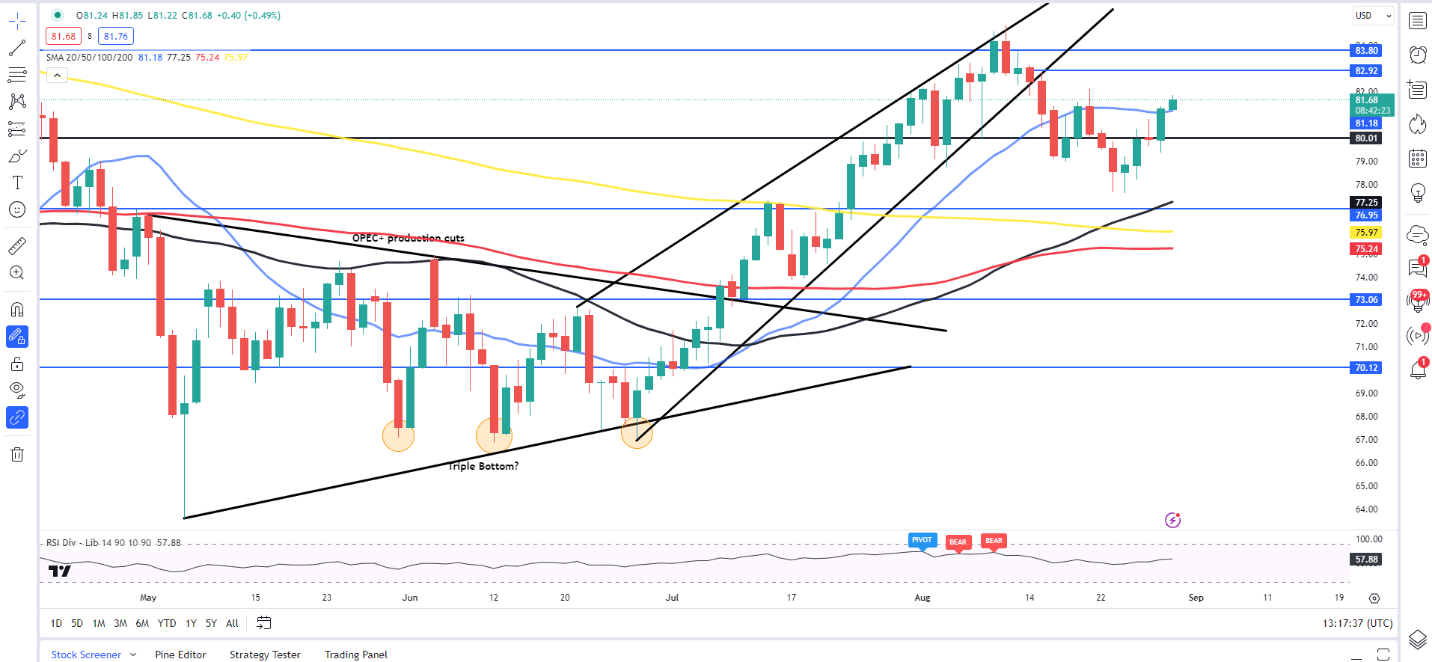

From a technical perspective both WTI and Brent has started with a bang this week to trade above the 20-day MA and back above the $80 a barrel mark. Given the macro picture in play and the bullish nature of price action we could be in for a run toward the $82.92 resistance level before $83.80 and then the YTD high. This may seem a stretch for now but improving sentiment, weaker US data and depleting stockpiles could keep Oil moving forward.

Having shifted to a bearish structure on the daily timeframe, a daily candle close above $81.50 would see momentum shift ounce more. Bulls would seem to be in control then as we have a change in structure and could staircase our way higher.

Key Levels to Keep an Eye On:

Support levels:

- 81.17 (20-day MA)

- 80.00 (psychological level)

- 78.50

Resistance levels:

WTI Crude Oil Daily Chart – August 30, 2023

Source: TradingView

IG Client Sentiment data tells us that 79% of Traders are currently holding short positions.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 0% | -1% |

| Weekly | -18% | 10% | -5% |

For a more in-depth look at WTI/Oil Price sentiment and the changes in long and short positioning, download the free guide below.

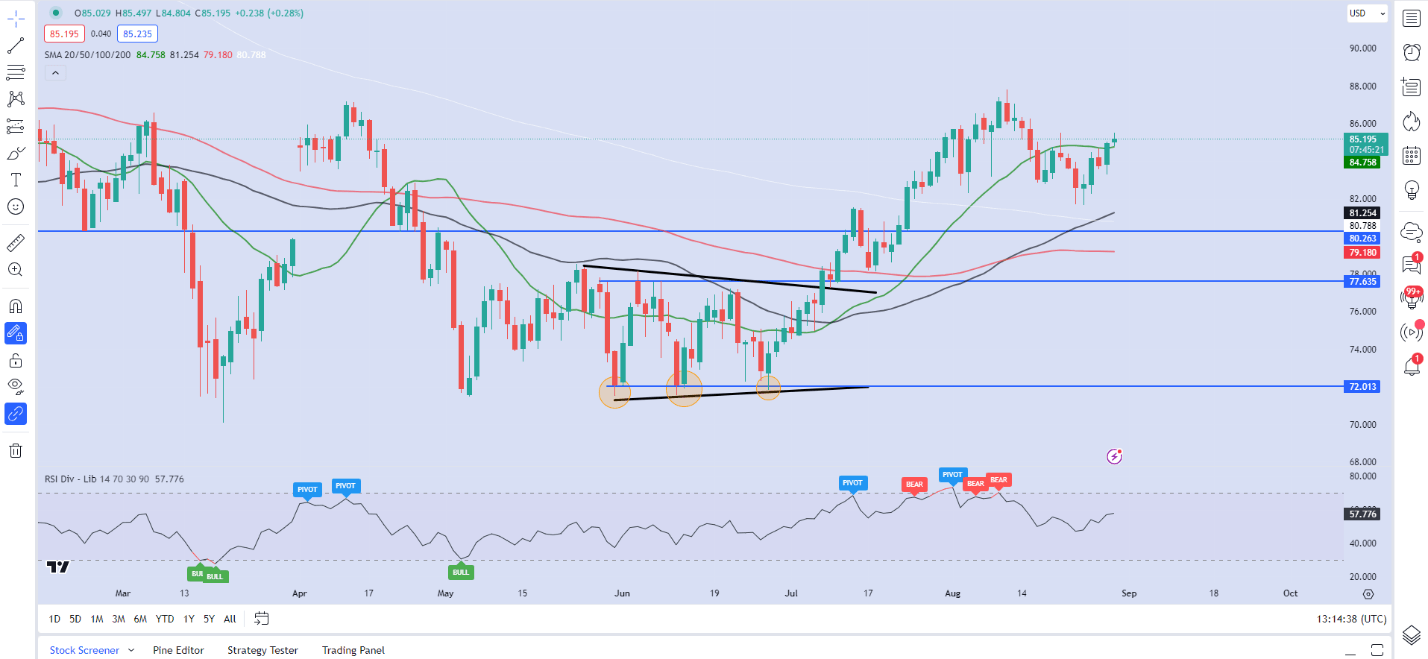

Brent Crude is beginning to look like a mirror image of WTI with the MAs and price action almost moving in sync at the minute.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

Brent Oil Daily Chart – August 30, 2023

Source: TradingView

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.