When is the UK inflation data and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for January month is due early on Wednesday at 07:00 GMT.

Given the recently released mixed employment data, coupled with the firmer economic activity numbers and the doubts over the Bank of England’s (BOE) next moves, today’s British inflation data will be watched closely by the GBP/USD traders.

That said, the headline CPI inflation is expected to decline further from the 41-year high marked in October while easing to 10.3% YoY in January, versus 10.5% prior. Further, the Core CPI, which excludes volatile food and energy items, is likely to decline to a 6.2% yearly figure versus 6.3% previous readings. Talking about the monthly figures, the CPI could slump to -0.4% versus 0.4% prior.

Also important to watch is the Retail Price Index (RPI) figures for January, expected to ease to -0.2% MoM and 13.2% YoY versus 0.6% and 13.4% in that order.

In this regard, FXStreet’s Dhwani Mehta said,

A softer-than-expected headline print could prompt the Bank of England to weigh a pause in its rate hike trajectory, sending GBP/USD sharply lower.

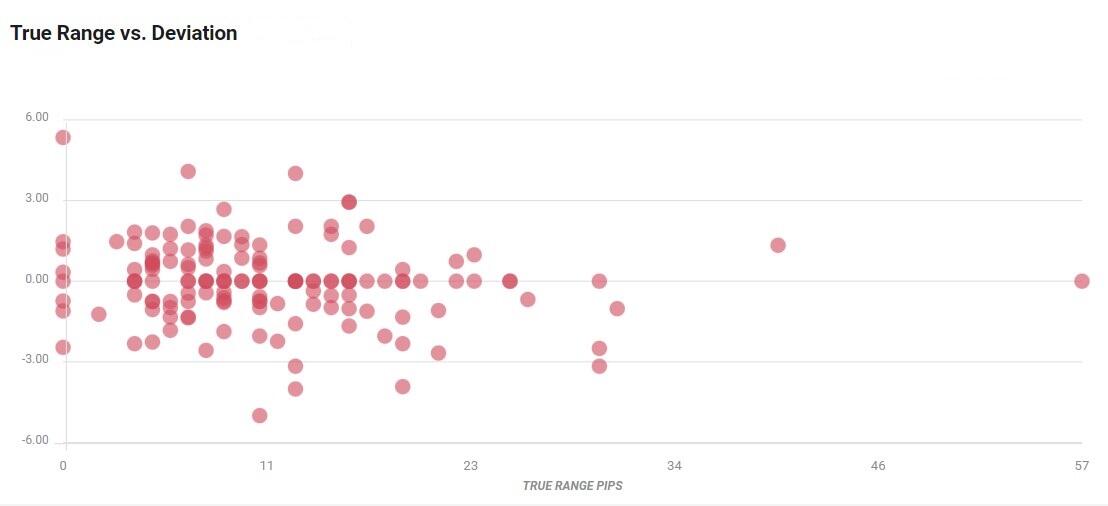

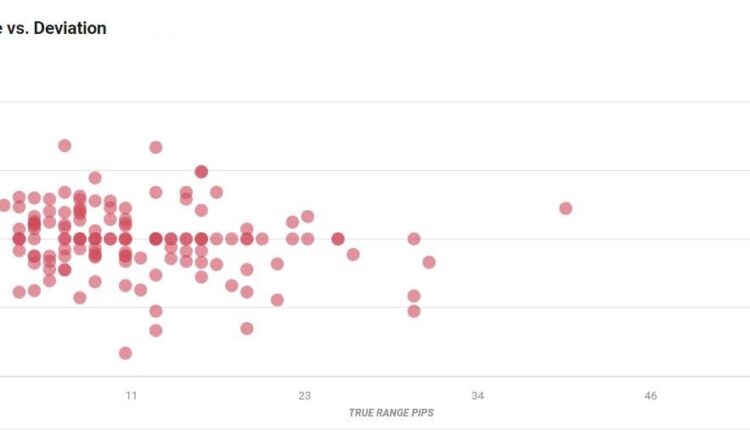

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed, the reaction is likely to remain confined around 20-pips in deviations up to + or -3, although in some cases, if notable enough, a deviation can fuel movements over 50-60 pips.

How could it affect GBP/USD?

GBP/USD holds lower grounds near 1.2150 heading into Wednesday’s London open. The Cable pair’s latest weakness could be linked to the broad US Dollar rebound amid hawkish Federal Reserve (Fed) talks despite the unimpressive increase in the US inflation data.

In doing so, the Cable pair snaps a two-day winning streak while easing from a one-week high. It should, however, be noted that the hopes of overcoming the UK’s labor crisis and the recent hawkish comments from the Bank of England (BoE) Officials seem to put a floor under the GBP/USD prices.

Given the recent improvement in the British data and expectations of overcoming the labor problems, softer UK inflation data may help the GBP/USD bears to tighten their grips.

Technically, a successful break of the 50-DMA, around 1.2190 by the press time, becomes necessary for the GBP/USD buyers to keep the reins. Until then, the Cable pair remains vulnerable to declining towards the one-week-old ascending support line, near 1.2070 at the latest.

Key notes

UK Inflation Preview: Will softer CPI raise odds of a BoE pause?

GBP/USD grinds toward 1.2200 ahead of UK inflation, US Retail Sales

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of the GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Comments are closed.