Weekly FX Market Recap: Mar. 20 – 24, 2023

Banking sector woes were still the main theme early in the week before the spotlight shifted to the FOMC decision later on, along with other major central banks’ statements.

Efforts to shore up liquidity and restore confidence in the financial sector seemed to fall flat, though, as markets had varying views on how the latest plot twist would impact the global economic outlook.

Notable News & Economic Updates:

Chinese Foreign Ministry confirmed that President Xi visited Russia on March 20-22 for a state visit to discuss strategic cooperation

Russian President Putin praised Xi for his proposal to end the war in Ukraine, citing that it could be a basis for striking a deal with the West

Treasury Secretary Yellen assured that uninsured deposits might be covered if smaller institutions show signs of bank runs, but later clarified that the government is not looking into a “blanket” insurance for deposits

JPMorgan analysts estimate that some $1 trillion worth of deposits have already left the most vulnerable banks, following the collapse of SVB and Signature Bank two weeks ago

Coinbase gets “Wells notice” from SEC, which means that the regulator will bring enforcement action against the exchange, possibly related to institutional offering Coinbase Prime

Yellen reassured that regulators are prepared for further steps to support the banking sector if needed

Central bank updates:

- ECB Chairperson Lagarde clarified that, while price stability goes with financial stability, these are addressed by different policy tools

- ECB official Kazaks pointed out that their rate hike path could stay the course if market volatility calms down, but Stournaras noted that they might reach the end of their tightening cycle soon

- RBA Assistant Governor Kent spoke of slower cash flow rates in Australia but did not sound off concerns related to banking liquidity issues

- FOMC hiked interest rates by 0.25% to 5.00% as expected but warned that tighter credit conditions are in the cards for households and businesses

- SNB hiked interest rates from 1.00% to 1.50% as expected, with Chairperson Jordan citing that they could not rule out additional increases in rates to ensure price stability

- BOE increased interest rates by 0.25% in a 7-2 vote, although Governor Bailey hinted that the stronger than expected February CPI might be followed by a decline in price levels for the rest of the year

- At Friday’s Euro Summit, ECB President Lagarde told EU leaders that the euro-area banking sector is strong.

Intermarket Weekly Recap

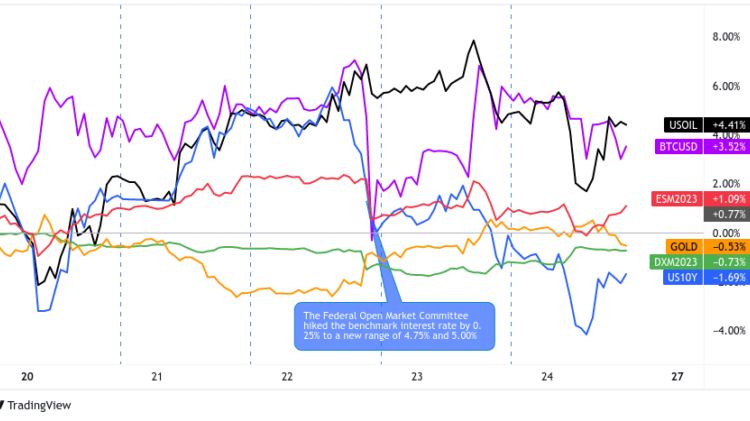

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay 1-Hour by TradingView

Market players were greeted at the start of the week with news of Credit Suisse’s takeover by UBS, putting risk assets on shaky footing as investors zoomed in on the AT1 bonds wipeout, and what that may signal about the rest of the global banking system.

We also got news that there was a coordinated effort by major central banks (Fed, BOC, BOE, ECB, BOJ, and SNB) to shore up liquidity by increasing the frequency of U.S. dollar swap operations. It’s tough to say but this may have been a calming factor, possibly contributing to bottoming out of the negative risk-off move in Asia on Monday.

The safe-haven yen managed to benefit from these risk-off flows while the U.S. dollar struggled to hold on to gains as traders priced in their FOMC expectations. U.S. bond yields failed to hold on to their early Asian session gains and wound up plunging to new lows not seen since September last year.

Another big beneficiary of banking contagion jitters was gold, as the precious metal busted through the key $2,000 level, lifting silver and bitcoin a.k.a. “digital gold” along with it.

A bit of calm was observed in the markets on Tuesday, with investors warming up to the idea of a scaled down Fed interest rate hike (from 0.50% to 0.25%) as the central bank would likely account for the fresh round of banking sector driven headwinds.

Global stock indices even managed to chalk up a decent rebound, as the Hang Seng index recovered by nearly 1% while S&P 500 futures rallied 2.2%, while gold lost some of its luster when the dollar pulled up.

Likely contributing to this slight boost in confidence were reassurances from U.K. and EU regulators that losses for Credit Suisse’s junior creditors would be minimized, along with Lagarde’s remarks that price stability tools remain separate from measures supporting financial stability.

Risk assets were able to extend their gains the following day, as Treasury Secretary Yellen mentioned that uninsured deposits might be covered if smaller lenders start showing signs of a deposit run as well.

While gold rounded up another day in the red, copper prices refused to back down and instead rallied for the fourth consecutive session to trade around $4 on signs of stronger demand from China.

As widely expected, the FOMC hiked interest rates by 0.25% during their announcement, with Powell warning that tighter credit conditions might be observed for households and businesses in the meantime.

Although the Fed refrained from making any other adjustments to its current policy stance and dot plot forecast, markets took the statement as generally dovish. The dollar index dipped 0.5% after the announcement and presser, dragged further south by Yellen’s clarification that the government is not considering a “blanket” insurance to backstop deposits.

Equities still managed to pull higher after an initial bearish FOMC reaction, as the likelihood of slower hikes and even the possibility of rate cuts could offer some relief down the line.

Meanwhile, hotter than expected U.K. CPI also took center stage, as the surprise pickup in headline inflation bolstered BOE tightening hopes ahead of their actual statement. The U.K. central bank increased borrowing costs by 4.00% to 4.25%, with policymakers voting 7-2 in favor of a hike and assuring that their banking sector maintains robust capital and strong liquidity.

However, Governor Bailey noted that the February inflation surprise might be a one-off since they expect price pressures to ease sharply over the rest of the year. Short-term gilt yields advanced after the official announcement before paring gains and ending 20bps lower on the day.

Global risk-off flows returned on Friday, once again focusing the banking sector as Deutrsche Bank and UBS shares sunk in price. This was likely catalyzed by the sudden spike higher in Deutsche Bank’s five-year credit default swaps (CDS) on Thursday, then once again on Friday.

That was taken as a signal by traders of little faith that the banking sector’s issues are not over yet despite reassurances of stability from government and banking officials this week. Risk assets broadly fell throughout the morning London session before calming down ahead of the U.S. session open. This was likely a response to comments from European Central Bank President Christine Lagarde and German Chancellor Olaf Scholz that the euro area banking sector is strong.

Most Notable FX Moves

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

U.S. existing home sales improved from 4.00 million in January to 4.58 million in February, chalking up the strongest monthly rebound since COVID-19 lockdowns and ending its 12-month losing streak

The Federal Open Market Committee hiked the benchmark interest rate by 0.25% on Wednesday to a new range of 4.75% and 5.00%; sees greater uncertainty ahead due to stress in the banking system

U.S. February new home sales came in at 640K vs. estimated 650K reading, still higher than earlier downgraded figure from 670K to 633K

U.S. initial jobless claims came in lower than expected at 191K versus 198K consensus and previous 192K figure

U.S. Flash Manufacturing PMI for March: 49.3 vs. 47.3 previous; Services PMI at 53.8 vs. 50.6

U.S. Durable Goods Orders in February: -1.0% m/m vs. -5.0% m/m in January; core durable goods orders was flat vs. +0.2% m/m forecast & +0.8% m/m previous read

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

BOJ Summary of Opinions for March Meeting: “must maintain its massive stimulus to support the economy and ensure Japan would sustainably achieve the central bank’s 2% inflation target

Japanese Chief Cabinet Secretary Matsuno says the gov’t will allocate 2 trillion JPY from reserves for measures to alleviate the economy from rising prices

Japanese national core CPI fell from 4.1% to 3.3% year-over-year in February, headline rate fell from 4.3% to 3.3% vs. projected 4.1% reading

Reuters Tankan survey showed large Japanese manufacturers remaining pessimistic for a third month in a row in March

Japanese flash manufacturing PMI increased from 47.7 to 48.6 to reflect slower pace of contraction vs. estimated 48.2 figure in March, as output increased at fastest rate in nine months

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

German ZEW economic sentiment index tumbled sharply from 28.1 to 13.0 vs. 14.9 consensus in March, as banking sector troubles weighed heavily on confidence

Eurozone ZEW economic sentiment index slipped from 29.7 to 10.0 vs. 16.0 forecast in March

Euro area current account for January: rose to a €17B surplus vs. €13B surprlus in December

ECB President Lagarde reinforced the central bank’s hawkish plans, saying that the “rate path is data-dependent,” but stressed that “bringing inflation back to 2% over the medium term is non-negotiable.”

Eurozone consumer confidence index stayed unchanged at -19 instead of improving to estimated -18 figure in March, leaving sentiment below its long-term average

Flash Eurozone PMI Manufacturing PMI for March: 47.1 vs. 48.5; Services PMI at 55.6 vs. 52.7

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

U.K. headline CPI jumped from 10.1% to 10.4% year-over-year in February vs. estimated dip to 9.9% on higher prices of housing and household services, including electricity and gas

U.K. core CPI up from 5.8% to 6.2% year-over-year in February vs. estimated drop to 5.7%

U.K. PPI input prices fell by 0.1% month-over-month in February after earlier 0.4% uptick, PPI output prices tumbled 0.3% vs. estimated 0.1% increase

U.K. CBI industrial order expectations index fell from -16 to -20 in March vs. estimated improvement to -15, marking its third consecutive monthly disappointment

U.K. GfK consumer confidence index rose from -38 to -36 vs. estimated -35 figure for March, still a rebound off historic lows as measures for personal financial situation and general economic situation improved

U.K. retail sales surged 1.2% month-over-month in February vs. projected 0.2% uptick, previous reading upgraded to show 0.9% growth from initially reported 0.5% increase

CHF Pairs

Overlay of CHF Pairs: 1-Hour Forex Chart

On Monday, UBS announced that it will acquire Credit Suisse for 3B CHF through Swiss government-brokered deal, which includes 9B CHF gov’t guarantee and 10 billion CHF liquidity assistance

Switzerland’s trade surplus narrowed down from 2.9B CHF to 2.5B CHF in February as exports fell by 1.1% while imports rose by 1.3% for the month.

Swiss National Bank (SNB) raised its interest rates by 50 bps to 1.5%, doesn’t rule out further rate hikes or currency interventions.

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

RBA monetary policy meeting minutes sounded less hawkish, as central bank officials acknowledged that inflation remains too high but that warding off price pressures has been complicated

RBA policymakers also noted that employment growth has slowed and hiring intentions point to further moderation with job vacancies declining

Australia Weekly Consumer confidence was down .5 to 76.5 from the previous week, the lowest read since April 2020

Australia’s MI leading index posted another 0.1% m/m dip in February, chalking up its seventh consecutive negative reading

Australia’s flash manufacturing PMI for March fell from 50.5 to 48.7 to reflect industry contraction, as demand conditions deteriorated

Australia’s flash services PMI for March tumbled from 50.7 to 48.2 to signal contraction, as higher costs weighed on new business activity

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

Canada’s headline CPI dipped from 0.5% to 0.4% month-over-month in February vs. expectations of another 0.5% increase, bringing annual CPI down to 5.2%

Canadian median CPI dipped from 5.0% to 4.9% year-over-year vs. 4.8% estimate in February, as grocery prices remained elevated due to supply constraints and bad weather conditions

The Bank of Canada’s Summary of Deliberations showed that members were concerned that inflation will be hold above the 2% target and see a potential further need to tighten monetary policy.

Canada new housing price index for February: -0.2% m/m vs. -0.1% m/m forecast (-0.2% m/m previous)

January Canadian retail sales rose 1.4% m/m to $66.4B; core retail sales—excluding gasoline stations and fuel suppliers and motor vehicle and parts dealers—rose 0.5% m/m

Comments are closed.