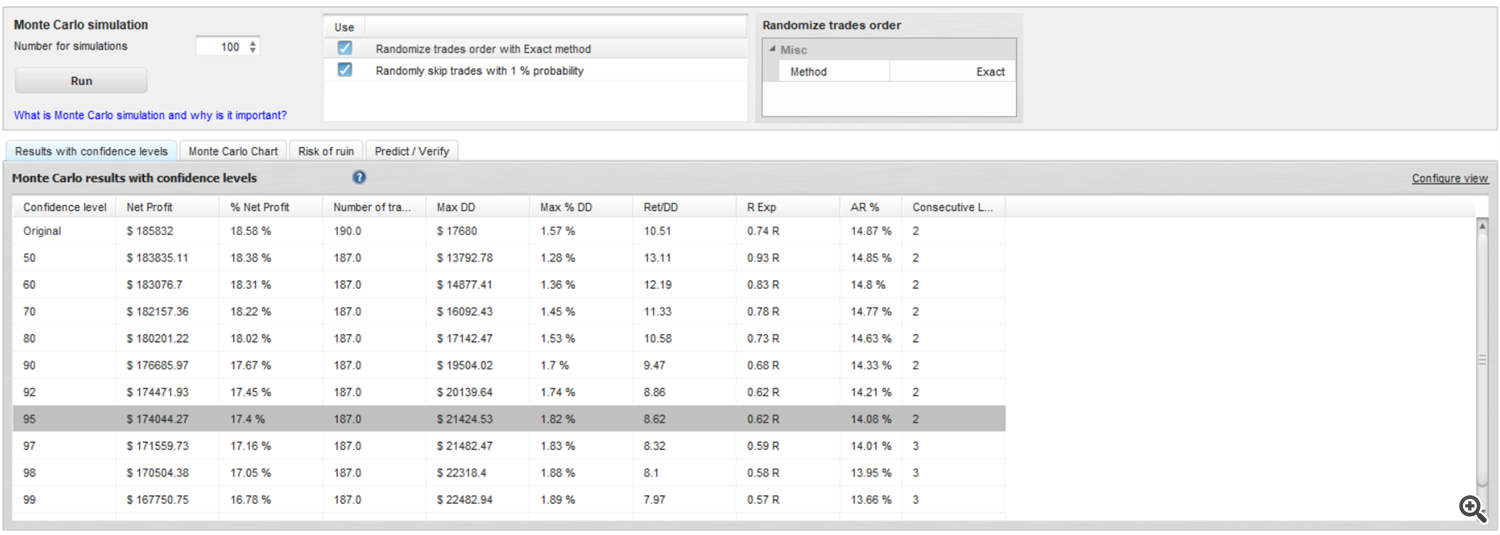

Pivot Point Master – Trading Strategies – 24 March 2023

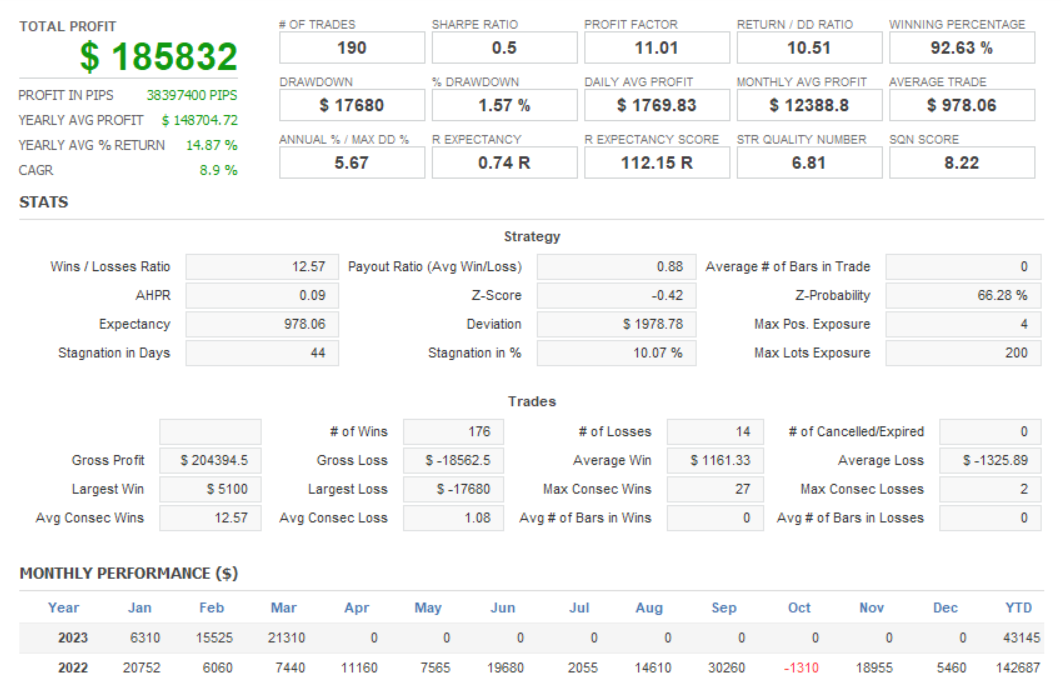

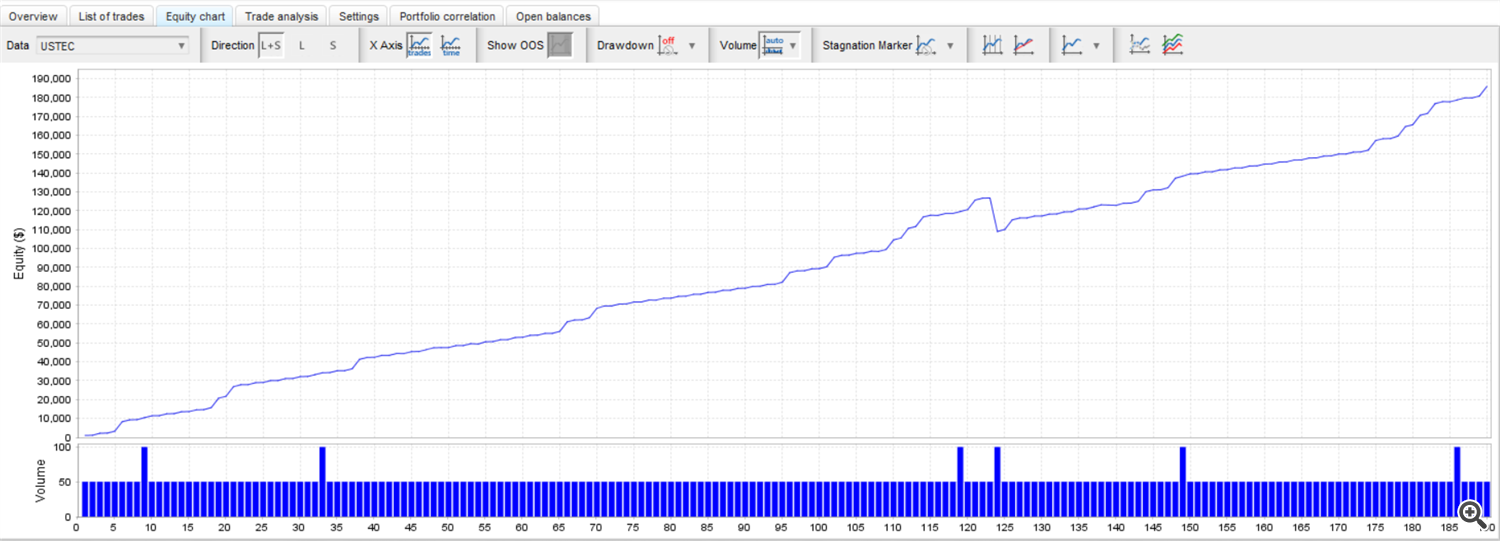

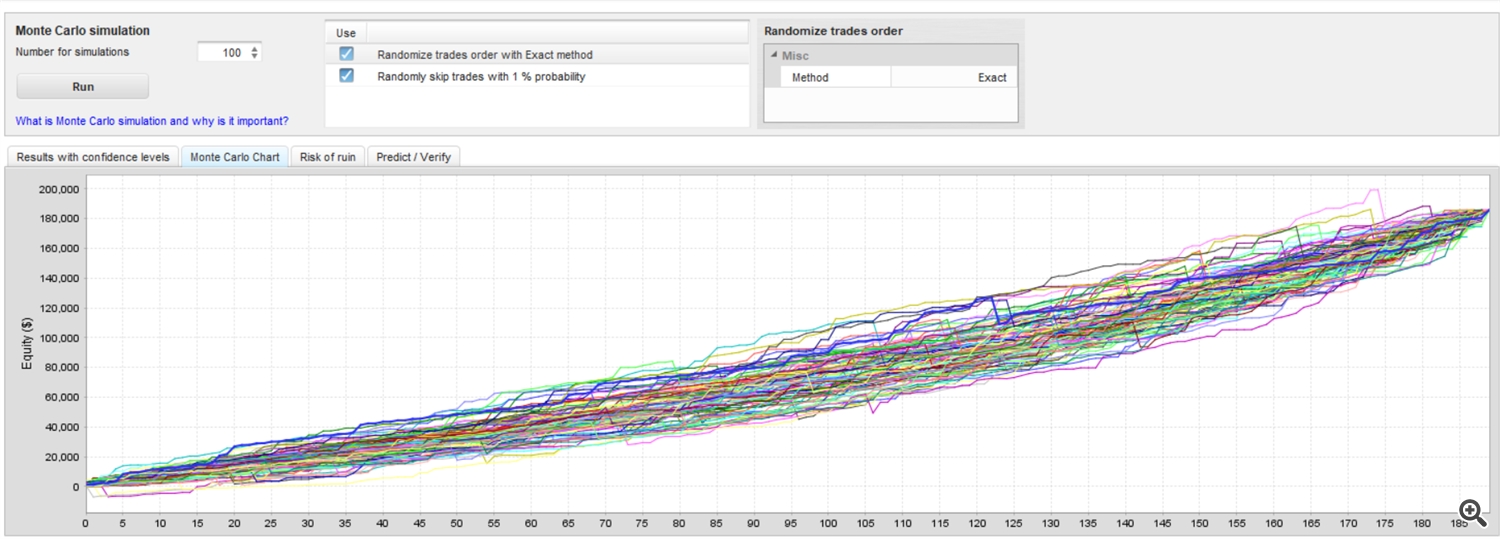

In this article we will explore a popular trading strategy that uses pivot points which are considered important psychological levels for investors. This strategy is often used by technical traders looking to take advantage of short term and long-term price movements. Pivots Points Master which has incredible results as you will see in the rest of this article takes advantage of this strategy.

First of all, what is a pivot point? It is a key price level that is calculated based on the closing price, the opening price and the high and low of the previous day (week, month, …). Pivot points are widely used in technical analysis to identify potential support and resistance levels. A pivot point is one of the many technical indicators used by traders. It tells us about the market’s overall trend over various time windows. Traders often consider pivot points to be psychological levels, as they can influence the decisions of investors and traders and thus influence the direction of the market. When the price of an asset bounces off a pivot point, it may indicate a reversal of the trend or a strengthening of the current trend.

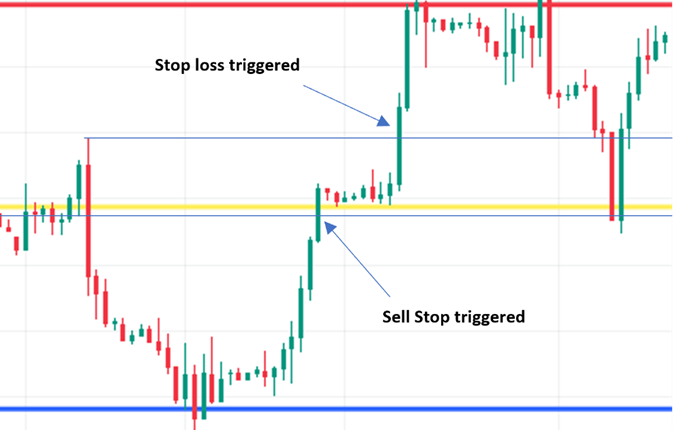

One of the most common trading strategies using pivot points is to place a stop order on or below the pivot point and wait for the price to trigger the order. This trading strategy may seem simple and effective, but it does not always work even when using other indicators, as financial markets can be unpredictable and volatile.

Why does this strategy not generally work?

- Considering lines (pivot points) as support or resistance is not relevant as it is commonly accepted that psychological levels are materialised by price zones rather than lines. The price can therefore break the pivot point slightly or strongly before reintegrating the level.

- This strategy does not take into account market trends and economic events. Financial markets can be influenced by many factors, such as interest rates, economic data, political events and natural disasters. When there is a strong trend or major news, pivot points are no longer effective as support or resistance and can easily be broken which can result in fairly large losses or stop loss triggers.

- Using a fixed stop loss or no stop loss can be detrimental to this strategy. If the stop loss is too close, the price may break the pivot point slightly, triggering the stop before rebounding. However, if the stop loss is too far away, the price may break the pivot point by a large amount and come back for the stop loss causing a large loss or the loss of the account.

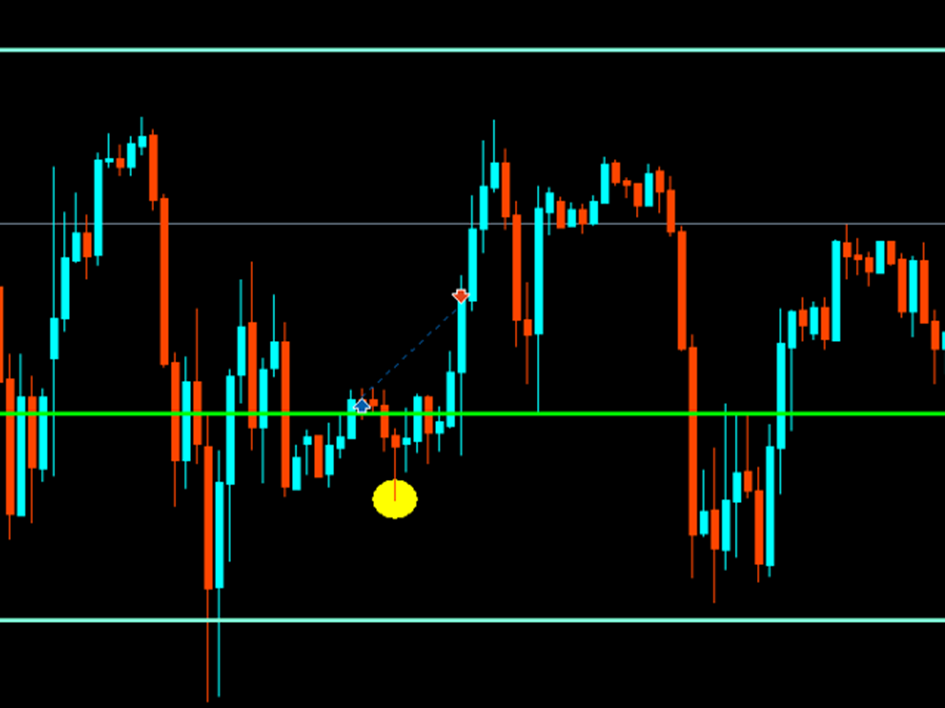

Image illustration :

Why does Pivot Point Master work and is different?

Like the previous strategy, the Pivot Point Master trading strategy consists of opening a buy or sell order when the asset price bounces off a pivot point. The fundamental difference that changes everything is that Pivot Point Master buys or sells at the market and requires several levels of confirmation through the use of the Reinforcement Learning (RL) techniques. The robot constantly monitors price movements and reacts quickly to trading signals through extensive learning from multi-asset data over several years.

If the price reaches a predefined pivot point, the robot automatically opens a buy or sell order if it has all the necessary confirmations and automatically exits its position as soon as possible if it goes wrong. Indeed having designed the robot myself I am personally unable to predict when the robot will exit a losing position, this is why this EA incorporates the use of a stop loss allowing the most risk conscious user to control their losses. However it is necessary not to put the stop loss too close to the position to give the Pivot Point Master algorithm enough room to make good choices. Below is an illustration of how Pivot master handles a position that would have been a loss if there was a stop loss below the previous 5 candle low but ended up being a gain.

If a stop loss had been placed below the previous low, it would have been executed. So, we can see that it is important to leave enough margin to Pivot Point Master to make his own choices. This position was taken on 2023.03.14 on the S&P500 in real trading conditions which you can check on my signal : https://www.mql5.com/en/signals/1891033

Explanation of the strategy

I specify one thing, so that it is clear, I want to explain the system, how the EA manages the position, how it proceeds, but I will not explain why it opens the position. I make sure my configuration works but if you use completely crazy setting, I do not want to be responsible for that.

Overall, there are three main parameters for this pivot point bounce strategy.

1. The choice of pivot points

EA uses monthly pivot points as they are major psychological levels and widely used by asset managers who generally act on a long-term basis. The choice is given to the user for the selection of the pivot points that he considers relevant to trade.

2. Confirmations

EA uses several levels of confirmations but many of them are hidden. The user is only allowed to act on:

– Candle_back: this is an integer number to filter the probability of bounce as much as possible. The higher this number is, the more impressive the bounce quality will be, but the less trades the robot will open. The lower the number the more trades will be opened but with lower quality bounces.

– Signal_restrictions: when the EA detects with a high probability a possibility of bounce on the pivot point it keeps the signal active during this time (in hours). The longer the time, the more likely it is that market conditions will change, and the signal will not allow a profitable trade. On the contrary, the lower this number is, the less time the EA will have to make the other confirmations necessary to execute the trade.

– Restriction_hours: this is the number of hours after the execution of a buy that you have to wait before you can make another buy. The same applies to sells.

3. The use of the breakeven

The user can choose to use this function to close half of his position and to put his stop loss at the level of his entry point as soon as the price will have crossed a number of points that the user will have predeterminate (trigger) . The buffer allows the breakeven to be set at a certain number of points from the opening price of the position.

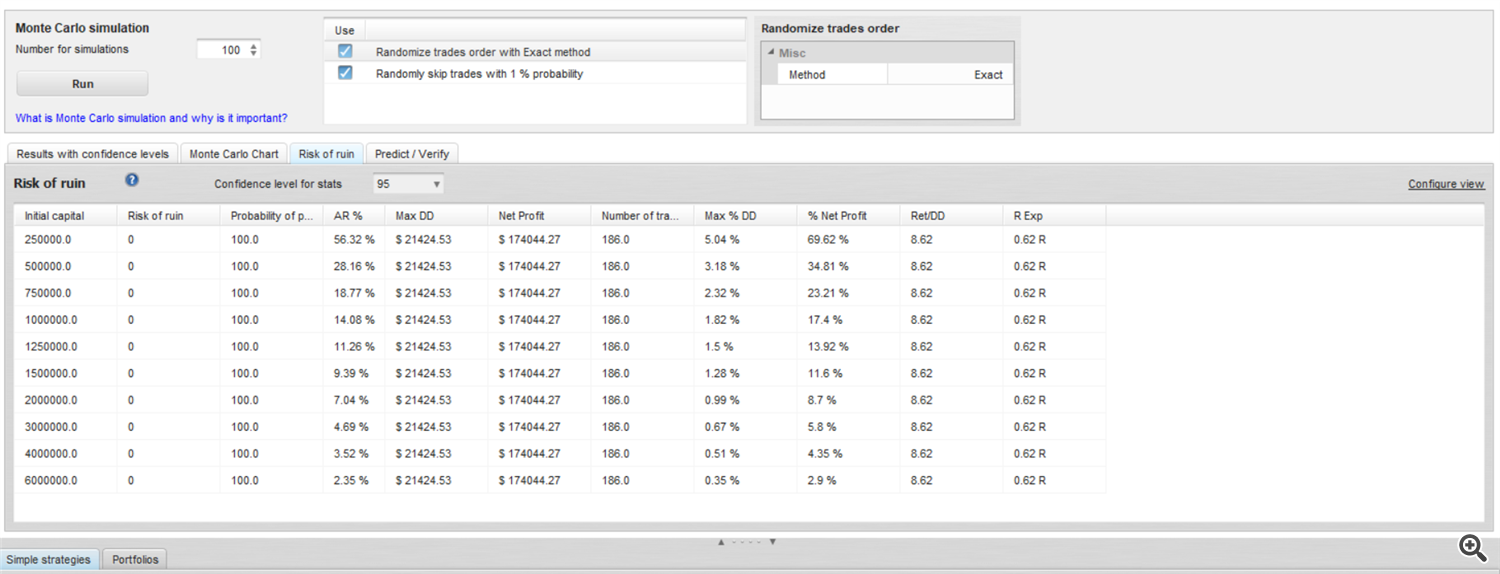

4. The risk

The EA uses a fixed lot that the user will have to choose and enter manually. This choice was made because the EA uses machine learning to know when to close the position, so it is not possible to know this level before opening the trade. It is therefore advised to use a maximum of 10% of the portfolio based on a theoretical maximum stop loss of 20,000 points on the Nasdak for example which gives 1 lot for a capital of $1000. As a result, in no circumstance this EA could lose your capital (Used with the settings that is provided to you by default and for major indices US100, US500 and US30).

A Message to Beginners in Trading

When I launched my first EA on mql5 I found that many people who bought it had no trading knowledge and were just looking for the miracle robot. So some, after only one loss, started to blame the efficiency of the EA without trying to understand the strategy and how to take advantage of the full potential of the EA. My question to them is: already, how can you select an EA more than another, if you do not know how the Forex works? Do you know how to make the numbers speak? Ratios? Profit factors? statistics? Slippage? do you know that it is impossible to have 100% Winrate in the long run?

Others have even raised the point that some trades were different by a few points between the backtest and the reality as if the backtest could reproduce the reality. I don't judge you but I invite you to learn about trading and programming if you need to and this even in a totally free way because all the information is available for free nowadays.

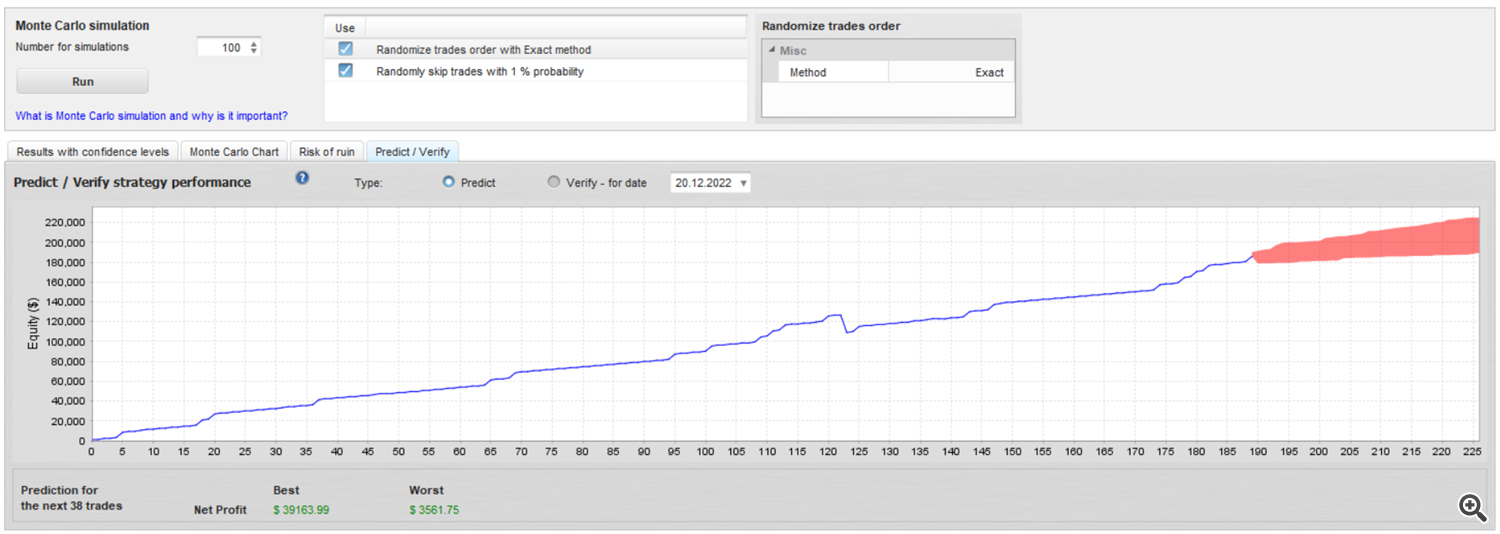

Having learnt from the philosophy of some of my clients I decided to favour live results over backtesting. This is why Pivot Point Master already has a proven track record (https://www.mql5.com/en/signals/1891033) which I believe is a lot more valuable than back testing that don't always align with the live results. As you can see in the description it's all 100% algo trading so my question to you is: do I want perfect back testing or actual steady live performance?

However, do not hesitate to backtest as much as possible but know that the real conditions sometimes differ. It happened to me when I made a backtest for this EA to obtain a loss on 01/01/2022 but when I use the visual mode of the backtest this loss never happens.

Do not hesitate to contact me if you want more information.

Comments are closed.