USD/JPY slides as US economic wows mount, BoJ signals policy shift

- USD/JPY trades down 0.13% at 145.68, pressured by disappointing US labor market data and lower-than-expected Q2 GDP growth.

- US 10-year Treasury Note yield dips to 4.102%, further weakening the dollar, as the DXY index slumps 0.43% to 103.041.

- BoJ board member Naoki Tamura signals inflation is “clearly in sight,” hinting at a potential end to negative rates next year, which could bolster the Yen further.

The Japanese Yen (JPY) registers back-to-back positive sessions against the US Dollar (USD), which remains downward pressured after last Tuesday’s data depicted the US labor market is cooling. Today’s data reinforced the latter, easing pressure on the US central bank to increase borrowing costs. The USD/JPY is trading at 145.68, down 0.13%, after reaching a daily high of 146.84.

Yen gains momentum vs. a battered US Dollar amid soft labor and GDP data

The Greenback extended its losses courtesy of weaker-than-expected growth data. The US Commerce Department Q2’s Gross Domestic Product (GDP) was 2.1% below the government’s previous estimates of 2.4%, an uptick from Q1’s 2%. That, alongside the ADP National Employment report missing estimates of 195K at 177K, revealed the labor market is losing steam.

On Tuesday, the US Department of Labor revealed 1.51 job openings for every unemployed person, the lowest ratio since September 2021, compared with 1.54 in June.

Given the worse-than-expected economic data, US Treasury bond yields fell. The US 10-year Treasury Note yield slides two basis points down to 4.102%, a headwind for the USD/JPY pair due to its close positive correlation. That undermined the US Dollar (USD), which, according to its index, the US Dollar Index (DXY) slumps 0.43%, down at 103.041.

On the Japanese front, the Bank of Japan (BoJ) board member Naoki Tamura said that inflation is “clearly in sight,” indicating that negative rates could end next year. Market participants are eyeing the BoJ’s next move, as it’s the only global central bank easing monetary policy. Once the BoJ normalizes its monetary policy, broad Japanese Yen (JPY) strength is expected. It could trim its 11.22% YTD losses against the Greenback, suggesting further USD/JPY downside is expected.

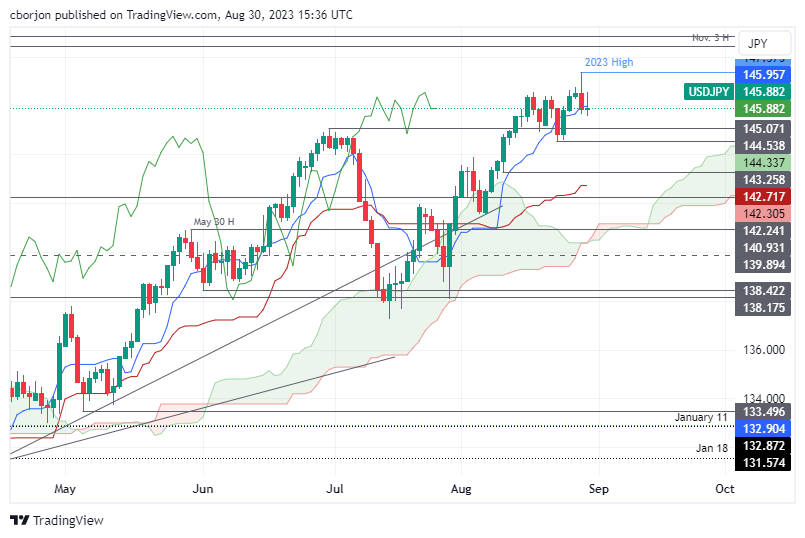

USD/JPY Price Analysis: Technical outlook

From a technical perspective, the USD/JPY remains upward biased, though the pair slide below the Tenkan-Sen line at 145.95 could open the door for a pullback, with support emerging at the June 30 daily high turned support at 145.07. Otherwise, if buyers reclaim the Tenkan-Sen line, the next stop would be 146.00. A breach of the latter could pave the way for a test of the year-to-date (YTD) high of 147.37.

Comments are closed.