USD/JPY, EUR/JPY Analyzed Post BoJ Minutes Release

JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

Most Read: USD/CAD Price Forecast: USD/CAD Breaks 5-day Range Despite Resumption of WTI Rally

Ever wondered what traits make a trader successful? Look no further and get professional insights in the complementary guide below.

Recommended by Zain Vawda

Traits of Successful Traders

YEN FUNDAMENTAL BACKDROP

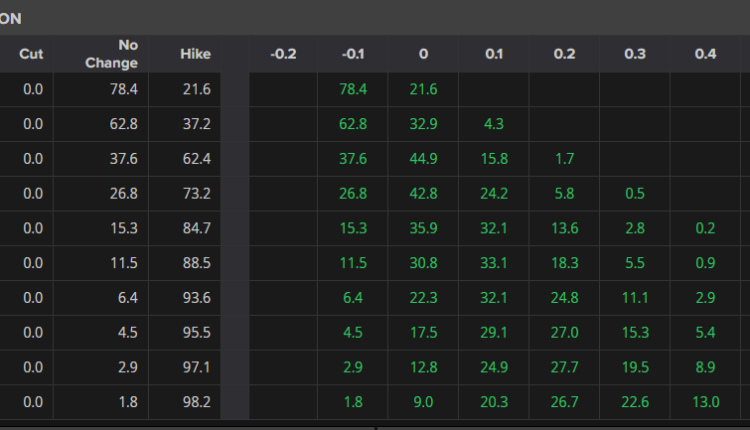

The Bank of Japan (BoJ) minutes were released this morning from the July meeting which indicated that members felt it was important to explain the tweaks to the Yield Curve Control (YCC) policy. Policymakers were adamant that an explanation be made so market participants do not view the tweaks as a sign that the end of accommodative monetary policy is near. Market participants meanwhile are now pricing in just above a 60% chance of a rate hike in January 2024 even with the BoJ not yet achieving sustainable wage growth above inflation.

BoJ Rate Hike Probabilities

Source: Refinitiv/LSEG

The Yen itself has continued its struggle of late against the Greenback in particular but has gained some ground against both the Euro and GBP. This largely down to fears of a slowdown for both the UK and EU which has seen both currencies weaken significantly following the recent Central Bank meetings.

The Yen continues to find support thanks to the looming threat of FX intervention. Comments from Japanese officials and BoJ policymakers continue to help the Yen stave of a larger slide. Former BoJ officials had commented around the 150.00 psychological level proving pivotal for the BoJ despite insistence of late that the Central Bank do not target levels it does seem to be playing on the minds of market participants. The closer we get to the 150.00 mark or break above the greater the chance of pullback in USDJPY as bulls may take profit on longs as the threat of intervention will no doubt grow louder.

Recommended by Zain Vawda

Traits of Successful Traders

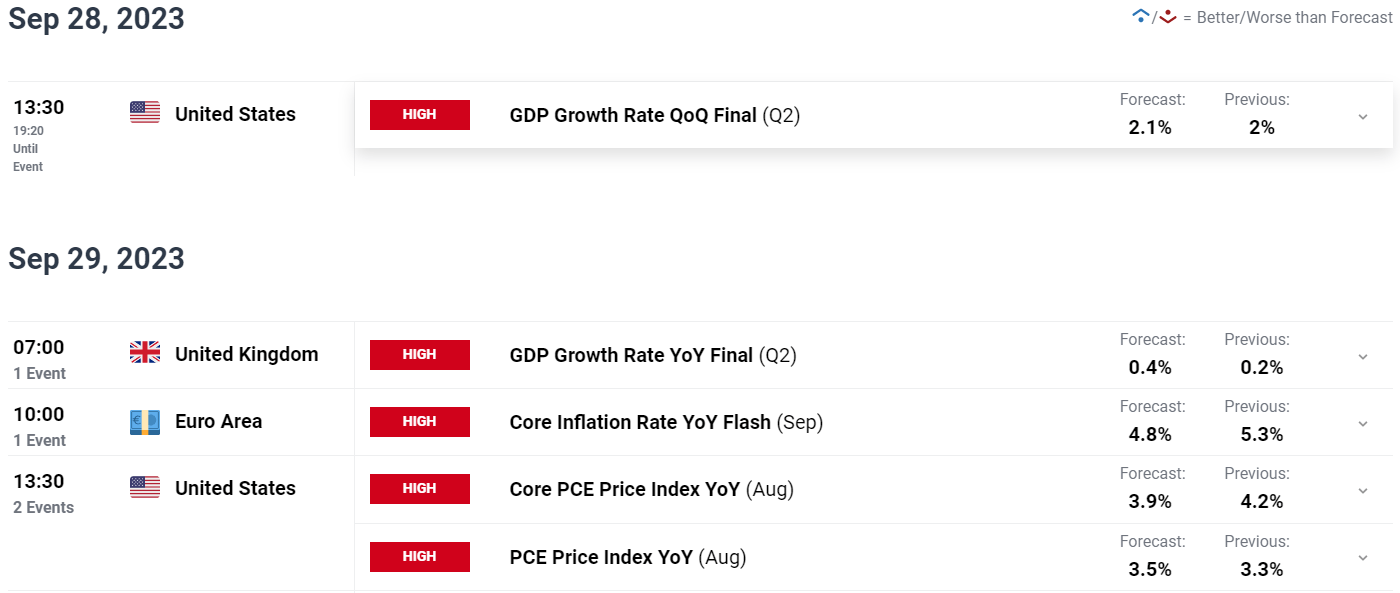

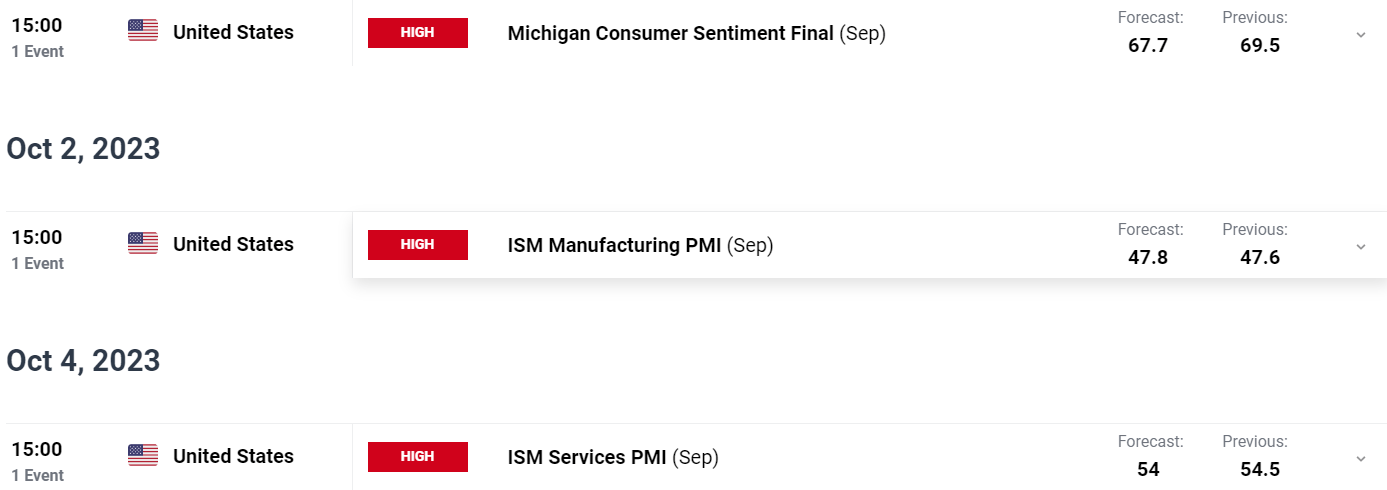

RISK EVENTS AHEAD

Looking at the next week or so and the majority of risk to Yen pairs will come from the US, UK and EU. There are very limited high impact risk events and none from Japan with any market moving events likely to be in the form of comments around intervention. This has been used rather effectively by the BoJ as a means of support for the currency.

Looking at the data releases expected, none jump out at me as potentially altering the current narrative of higher rates for longer. Weak data from the EU and the UK could however facilitate further weakness in the Euro and the GBP while strong data from the US could keep the Dollar Index (DXY) advancing and thus facilitating the need for intervention by BoJ officials.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

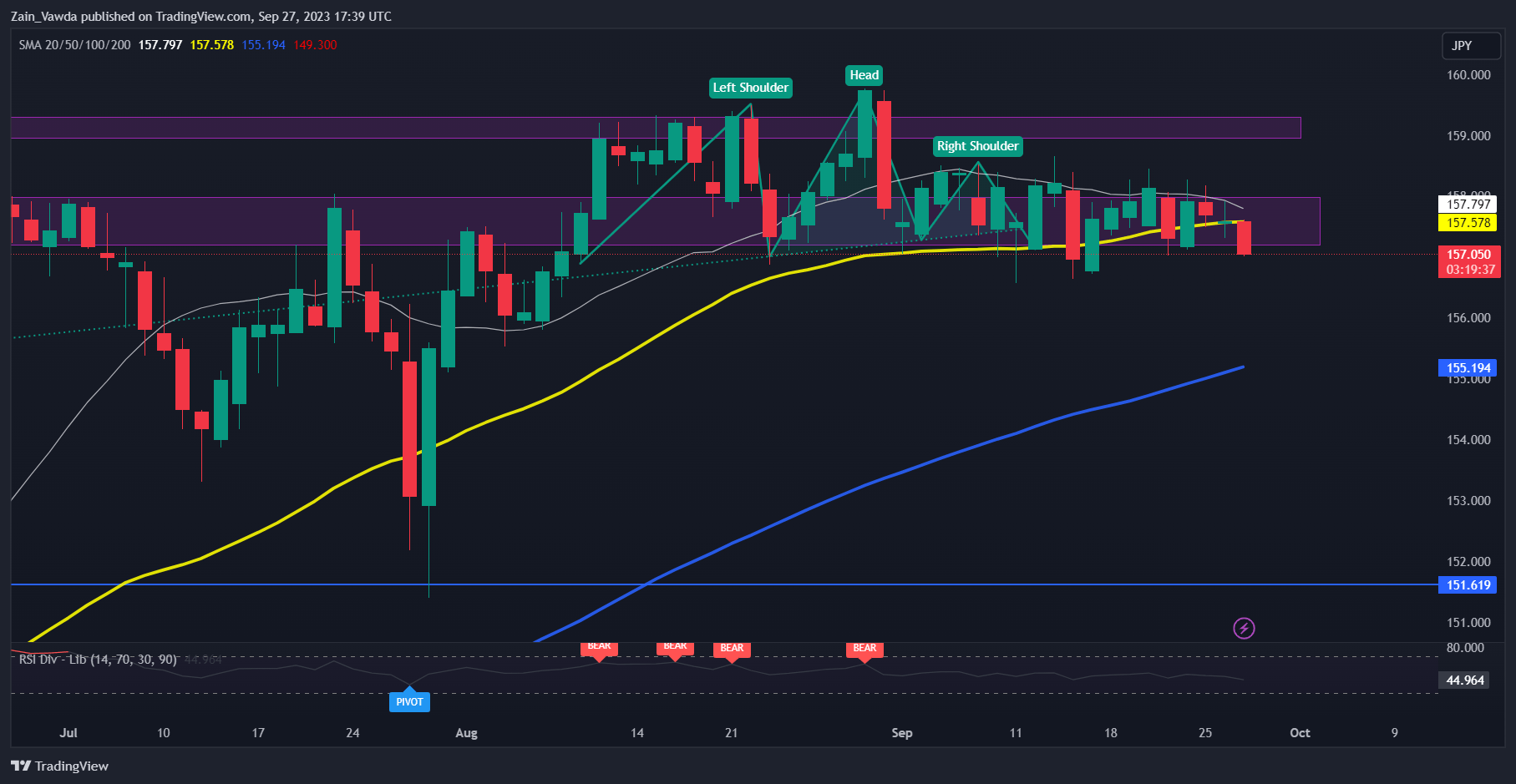

EURJPY

EURJPY has held firm of late trading in a 200-pip range for the majority f September. This is surprising for a currency pair which usually records a 200-pip move in a day. This is just a sign of the weakness in the Euro as well as the support offered to the Yen through comments around FX intervention.

EURJPY had printed a Head and Shoulders pattern around the 12 September and looked set to invalidate the pattern a few days later. However, the failure of a daily candle close above the right shoulder swing high of around 158.70 keeps the setup alive and could be precursor to what I expect could be a significant retracement should intervention occur.

The 20-day MA is also attempting to cross the 50-day MA in a death cross pattern which could further cement the idea of a deeper retracement. Downside support will be provided by the 100-day MA which rests at the 155.00 mark before any further move can materialize.

EURJPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 158.70

- 160.00 (psychological level)

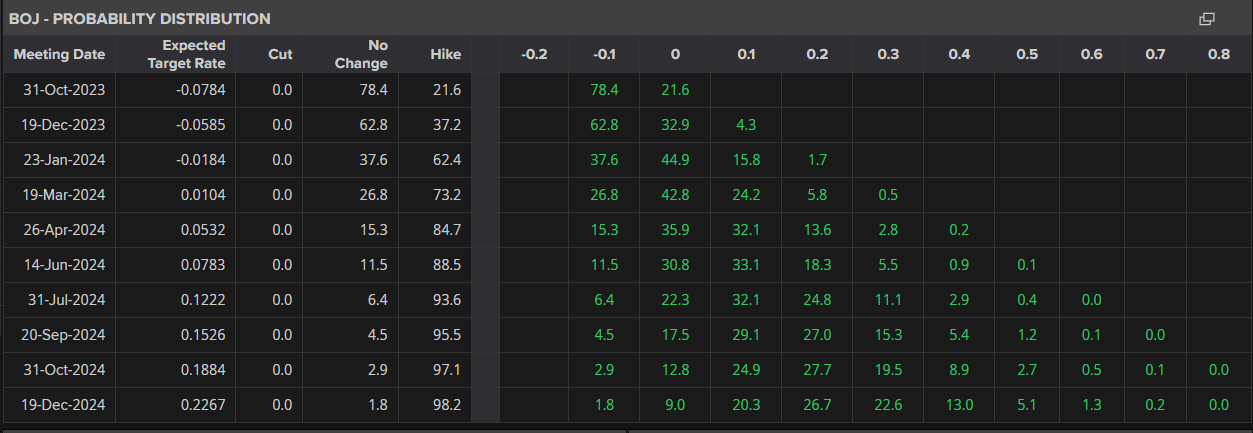

USDJPY

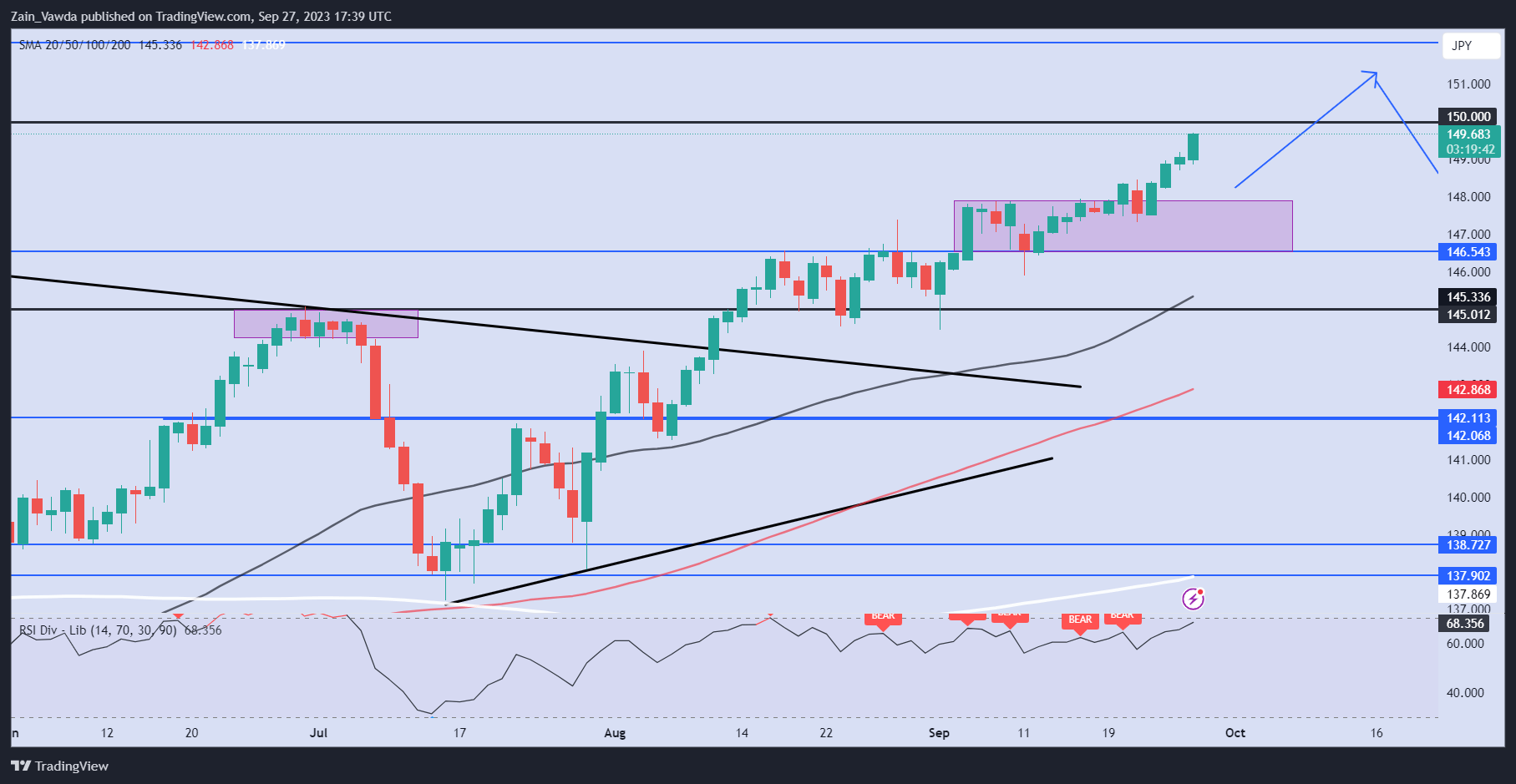

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY has continued to advance this week as the DXY found its legs once more. The US Dollar benefitting from the higher for longer narrative while the carry trade opportunity continues to keep USDJPY on the front foot.

USDJPY is now in touching distance of the 150.00 psychological mark which could be a massive one for the pair. A positive for USDJPY bulls and those hoping that intervention does not occur soon lies in the fact that despite broad-based USD strength the rise in USDJPY has been steady and gradual. This is something the BoJ have emphasized in comments as a key point they pay attention to.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 150.00 (Psychological level)

- 152.00 (2022 Highs)

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 80% net-short on USDJPY.

For a more in-depth look at USD/JPY sentiment and tips on how to use sentiment, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 5% | -1% | 0% |

| Weekly | -9% | 9% | 4% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.