US Dollar Wavers Ahead of Fed Decision. What Should Forex Traders Expect?

US DOLLAR OUTLOOK:

- U.S. dollar lacks directional conviction, moving between small gains and losses, as traders avoid taking large positions ahead of the FOMC decision

- The Fed is expected to hike interest rates by 25 basis points to 4.75%-5.00%, though some market participants anticipate a pause in the central bank’s tightening cycle

- The US dollar’s near-term outlook is likely to hinge on FOMC’s guidance

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: EUR/USD Bounce Facing Strong Resistance at the 1.08 Level Ahead of FOMC

The U.S. dollar, as measured by the DXY index, lacks directional conviction on Wednesday morning, moving between small gains and losses around the 103.15 level, as traders avoid taking large positions ahead of a high-impact event: the March FOMC announcement.

At the conclusion of a two-day meeting, the Fed will release its monetary policy decision this afternoon. Expectations have been in flux, but a majority of traders believe that the central bank will raise interest rates by a quarter of a percentage point to 4.75%-5.00%. Meanwhile, a small segment of the market anticipates a “pause” in the tightening cycle in the wake of the collapse of two U.S. lending institutions.

Prior to the recent banking sector turmoil, investors were convinced that the Fed would plow ahead with its hiking cycle forcefully in its efforts to strangle high inflation, but the backdrop has changed, leaving room for potential surprises at today’s event.

WHAT HAS CHANGED?

Although tighter policy may be necessary to ensure inflation convergence towards the 2.0% target, the financial system is in a fragile position, with the two bank runs earlier this month exposing the banking sector’s vulnerabilities to rapidly rising borrowing costs.

While sentiment has improved somewhat following coordinated actions by government authorities to shore up struggling lenders, underlying headwinds have not dissipated entirely. This means that systemic risks could emerge at any time if stress in the system continues to build.

To preserve financial stability and avoid rocking the boat at a time of heightened uncertainty, the Fed could err on the side of caution, halting its hiking cycle temporarily to assess the situation and take stock of how tightening is rippling through the real economy. Another possible option would be to hike rates by 25 basis points while offering dovish guidance.

The two scenarios described above are likely to be bearish for the US dollar in the near term, suggesting that more losses could be around the corner for the greenback.

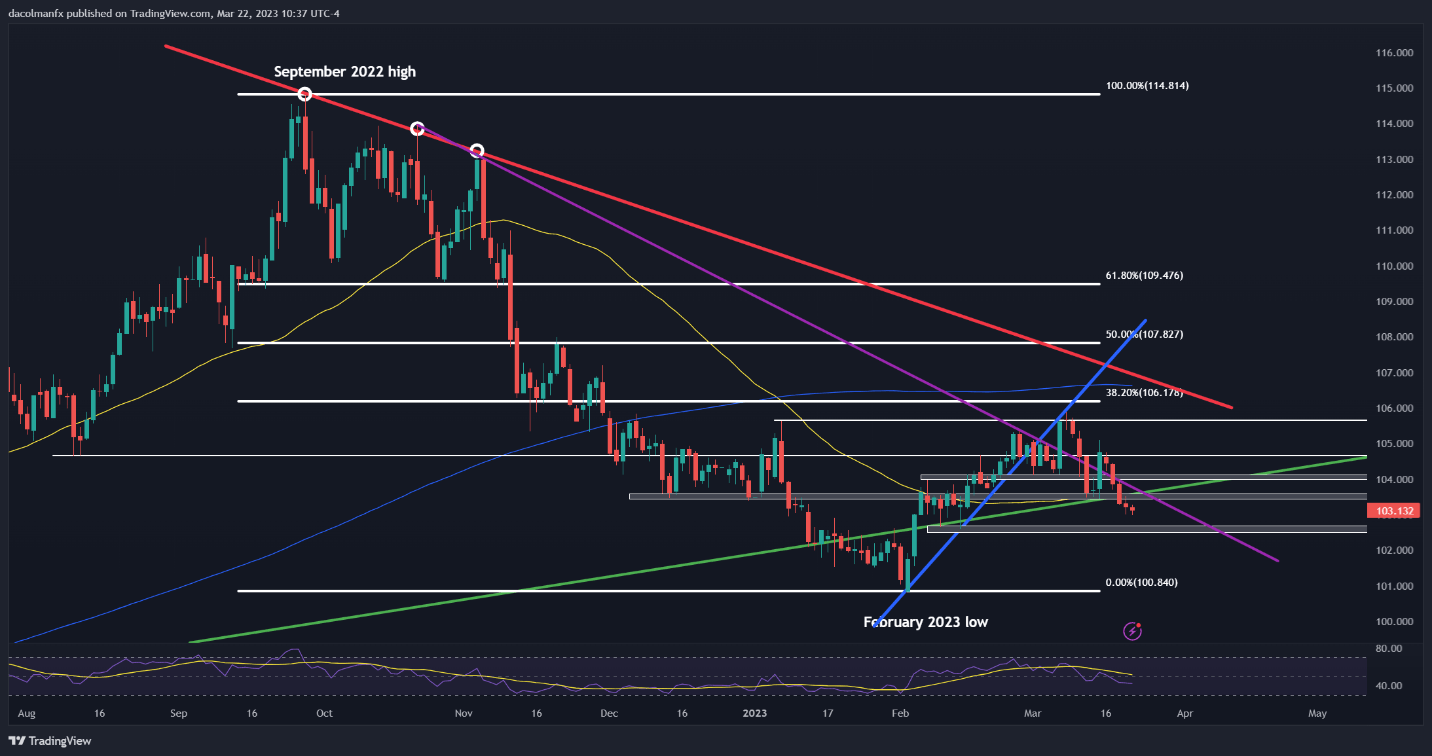

In terms of technical analysis, the DXY index’s trading bias has turned negative following recent losses, with prices now eyeing key support in the 102.60 region. A break below this floor could accelerate the US dollar’s decline, setting the stage for a retest of the 2023 lows. Conversely, if the bulls regain the upper hand, resistance lies between 103.50 and 103.65, followed by 104.10. Above that, the next upside target lies at 104.65.

Recommended by Diego Colman

Forex for Beginners

US DOLLAR TECHNICAL CHART

US Dollar Index (DXY) Chart Prepared Using TradingView

Comments are closed.