US Dollar, Gold, Dow Jones, FOMC Minutes, PCE, NZD/USD, RBNZ

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

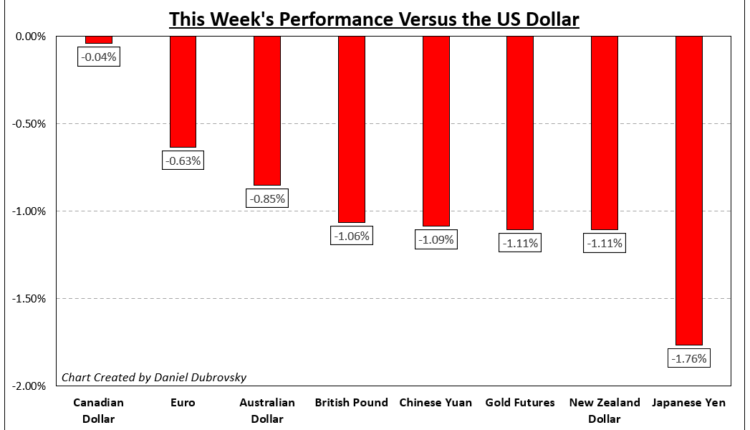

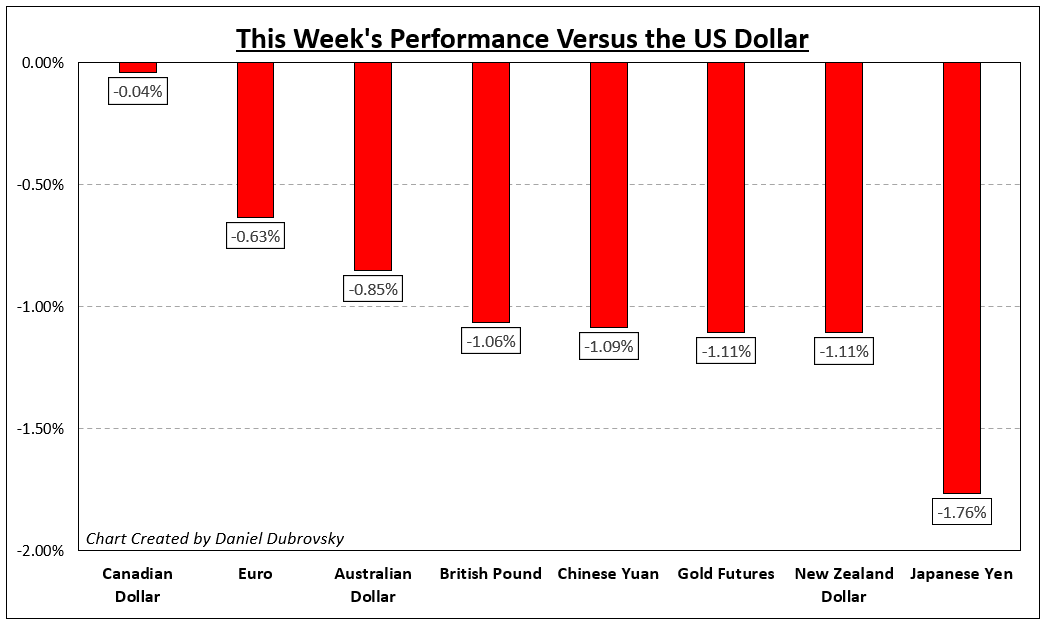

The US Dollar outperformed its major counterparts this past week. Looking at the chart below, the Japanese Yen was the worst-performing major currency followed by the New Zealand Dollar and then the Chinese Yuan. USD/JPY is a pair that tends to be quite sensitive to the direction of Treasury yields, which have been on the rise lately.

Meanwhile, the Chinese Yuan was already looking overbought based on a model I constructed to look ahead for the coming few quarters. Markets spent much of this past week focusing on unwinding dovish Federal Reserve policy expectations. This was emphasized by Tuesday’s unexpectedly strong US CPI report.

Gold was another notable underperformer last week considering the combination of a stronger US Dollar and bond yields. All things considered, equity markets were relatively resilient despite the rise in bond yields. On Wall Street, the tech-heavy Nasdaq 100 was still up 0.6% last week as the Dow Jones was left little changed.

There was some vocal debate between Fed policymakers in terms of what we could expect for the pace of tightening going forward. A couple of officials opened the door to potentially returning to bigger hikes while others focused on smaller incremental steps. Either way you look at it, a tighter Fed is here to stay, for now.

How is event risk shaping up in the days ahead? We have FOMC meeting minutes, which could continue reinforcing the need to remain vigilant despite a cautious ebbing in inflation. For NZD/USD, the Reserve Bank of New Zealand is seen raising rates by 50-basis points. Towards the end of the week, we will wrap up with the Fed’s preferred inflation gauge – PCE. What else is in store for markets in the week ahead?

How Markets Performed – Week of 2/13

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

Fundamental Forecasts:

S&P 500, Nasdaq 100 Sell-Off Continues, Strong US Dollar Sours Equity Sentiment

US equity markets are battling against a strong US dollar and higher US bond yields. Monthly option expiry and Monday’s US bank holiday will increase volatility.

Pound Forecast: UK Retail Data and Inflation Improve, Sterling Does Not

Both UK retail sales and inflation data printed better than expected and yet the local currency showed no improvement, reinforcing the negative sentiment around sterling.

Australian Dollar Outlook: Watch the Fed for AUD Direction

The Australian Dollar slid last week as the US Dollar found firmer footing on the prospect of more aggressive Fed rate hikes coming down the pipe. Will AUD/USD turn around?

Dollar Bullish Outlook Will Need to Shift from Rates to Volatility to Continue

The Dollar’s attempt to forge a true reversal from the past four months’ bear trend will likely need to shift its source of strength from rising Fed rate expectations to its discounted role as a safe haven. That means a focus on the VIX rather than Treasury yields.

Canadian Dollar Outlook: Canada’s CPI Eyed as USD/CAD Challenges Key Resistance

Canada’s January inflation report and broad market sentiment following the hawkish repricing of the Fed’s policy outlook will be key catalyst for USD/CAD in the coming days.

Oil Forecast: Crude Prices Sink on Rising Rates & China’s Slow Demand Recovery

Oil prices slumped this week as rising rates raised fears of an economic downturn. China’s slow fuel demand recovery following the reopening of its economy also weighed on sentiment.

Technical Forecasts:

US Dollar (DXY) Technical Forecast: Prints Fresh 6-Week High, Retracement Incoming?

Dollar Index rallied higher this week as Fed hawks and US data put the Dollar back on top. Can the rally continue?

Dow Jones, S&P 500, Nasdaq 100 Technical Outlook: Will Key Support Levels Hold?

Upside momentum is fading on Wall Street, with the Dow Jones, S&P 500 and Nasdaq 100 in a neutral state heading into the new week. Will key support levels hold?

Gold Price Forecast: Fed Fears Drive XAU/USD to an Attractive Level

Gold prices experienced further losses this week, driving XAU to a new 2023 low of $1,827.7. As GC fell into oversold territory, bulls rushed in driving prices back toward $1,850.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.