US Dollar Gains on Soft Data that May Signal a Shift in Market Perception for USD

US Dollar, DXY Index, USD, Federal Reserve, Japanese Yen, Momentum – Talking points

- The US Dollar rallied in a move that snapped recent inter-market relationships

- Treasury yields went lower reflecting the unfurling economic headwinds

- If the market response to data has shifted, what does it mean for the DXY index?

Recommended by Daniel McCarthy

Get Your Free USD Forecast

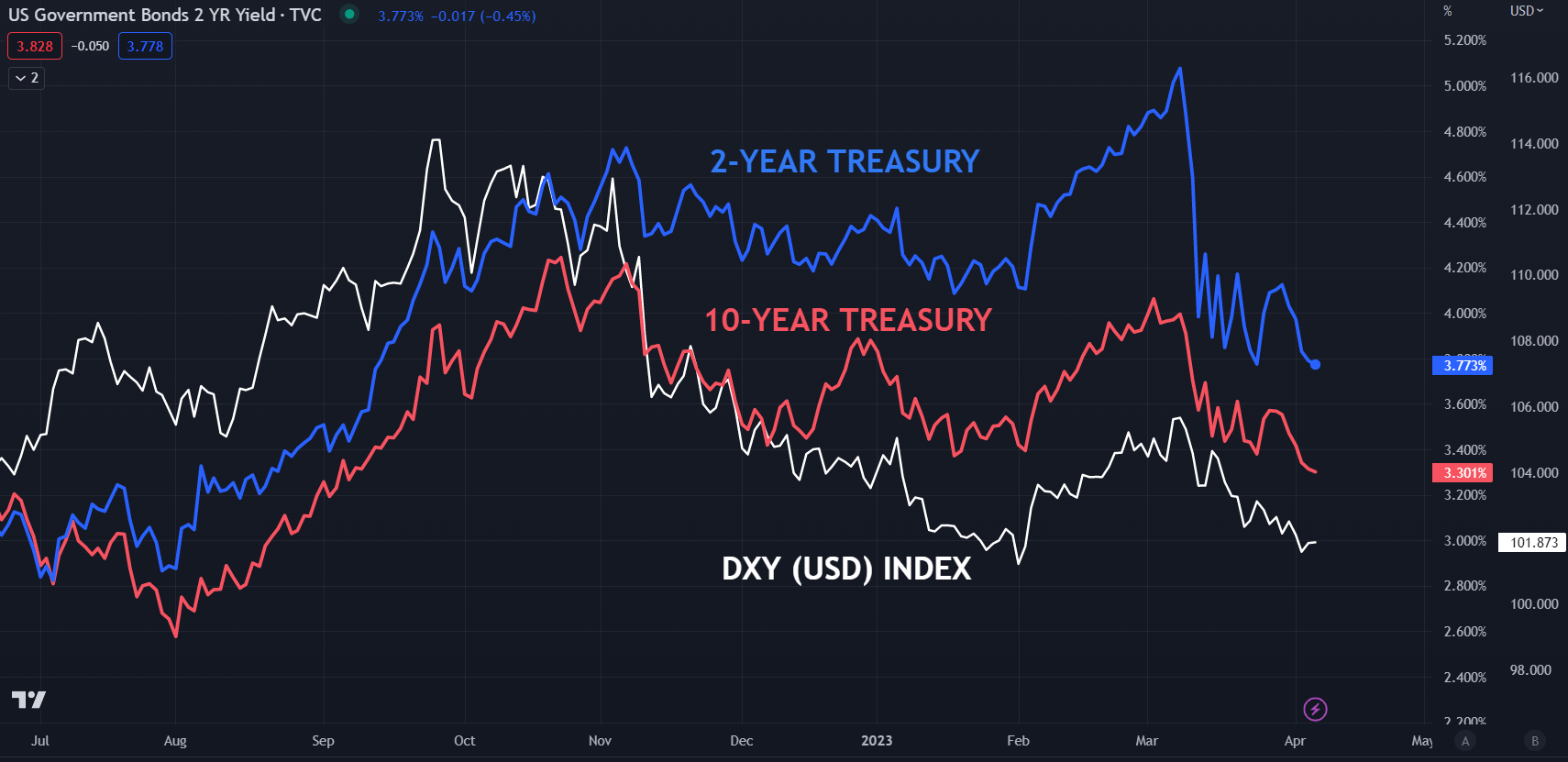

The US Dollar ticked up overnight in a move that goes against the grain of recent price action. Treasury yields dipped again on soft US data and equity markets also lost ground on the news. The data can be viewed here.

The trend of late has seen bad news being interpreted as good news for equities in hopes that it might lead to the Federal Reserve taking its foot off the tightening pedal.

Treasury yields reflected this perspective of a less hawkish Fed to some degree, but the US Dollar found some support. Recent trading sessions have typically seen the greenback loosely track Treasury yields up or down.

This disconnection might be saying about a broader shift in the response mechanism for markets. There is potential that FX markets might be returning to a more traditional view around bad news boosting perceived safe-haven currencies.

The only currency to outperform the US Dollar in the last session was the Japanese Yen, a currency that is often interpreted by markets to outperform in tough economic conditions and underperform in times of economic expansion.

This inter-market price action might be worth paying attention to for positioning in markets. US payrolls data on Friday might provide the impetus for significant market movement.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

US DOLLAR (DXY), US 2- AND 10-YEAR YIELDS

Chart Created in TradingView

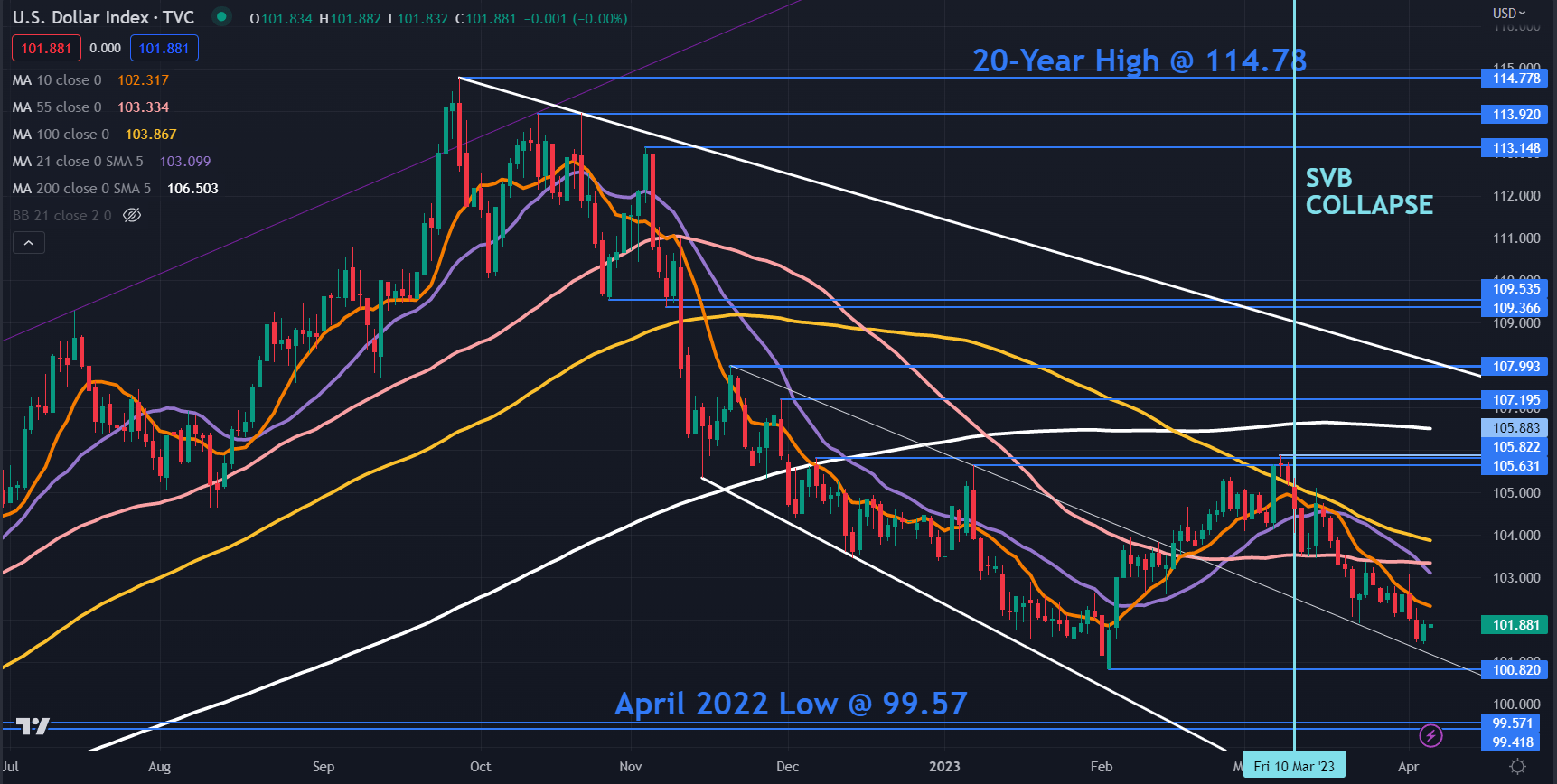

DXY (USD) INDEX TECHNICAL ANALYSIS

The DXY index remains in descending trend channel despite a rally yesterday. The price is below all period daily Simple Moving Averages (SMA) and this may suggest that bearish momentum is unfolding.

Since the collapse of SVB Financial, the DXY index has been moving lower and support might be at the recent low of 102.59 ahead of the prior lows of 100.82 and 99.57.

On the topside, the triple tops seen in the 105.63 – 105.88 area may provide a resistance zone. The previous peaks 107.70 and 1.08.00 could offer resistance ahead of the breakpoints at 109.37 and 109.54.

Chart Created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

Comments are closed.