US Dollar Gains as Markets Digest Rosy Retail Sales After CPI Data, Where to?

US Dollar, Retail Sales, Australian Jobs Data – Asia Pacific Market Open:

- US Dollar was on the move on Wednesday after red-hot CPI data

- Greenback focused on a rosy US retail sales print and Fed bets

- Asia-Pacific session contains key Australian jobs report for AUD

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

Asia-Pacific Market Briefing – US Dollar on The Move

The US Dollar rallied about 0.5% on Wednesday, with the DXY index closing at its highest since January 9th. A model that I built outlining the path ahead for the Chinese Yuan correctly showed that back in the middle of January, CNH was getting overbought. Since then, the latter has weakened back into the anticipated margin of error. Still, further gains might be in store for the Greenback.

The US Dollar continued climbing in the aftermath of yesterday’s hotter-than-expected local CPI report, which opened the door for the Federal Reserve to continue its hawkish policy stance. Markets continued pricing out once-anticipated rate cuts towards the end of this year, pushing up front-end government bond yields.

Over the past 24 hours, traders had more economic data surprises to digest. US retail sales unexpectedly gained 3.0% m/m in January. Economists were looking for a 2.0% rise. Meanwhile, homebuilder sentiment also surprised higher in February, climbing the most since the summer of 2020. For the US Dollar, it also didn’t hurt that UK CPI clocked in softer-than-expected in January, denting the British Pound.

Heading into Thursday’s Asia-Pacific trading session, Wall Street was able to shrug off what retail sales data could mean for the Fed, focusing on a resilient economy. As such, sentiment could remain relatively upbeat. All eyes turn to Australia’s jobs report in the wake of increasingly hawkish RBA policy anticipation. Upbeat data could further reinforce this, offering a boost to AUD/USD.

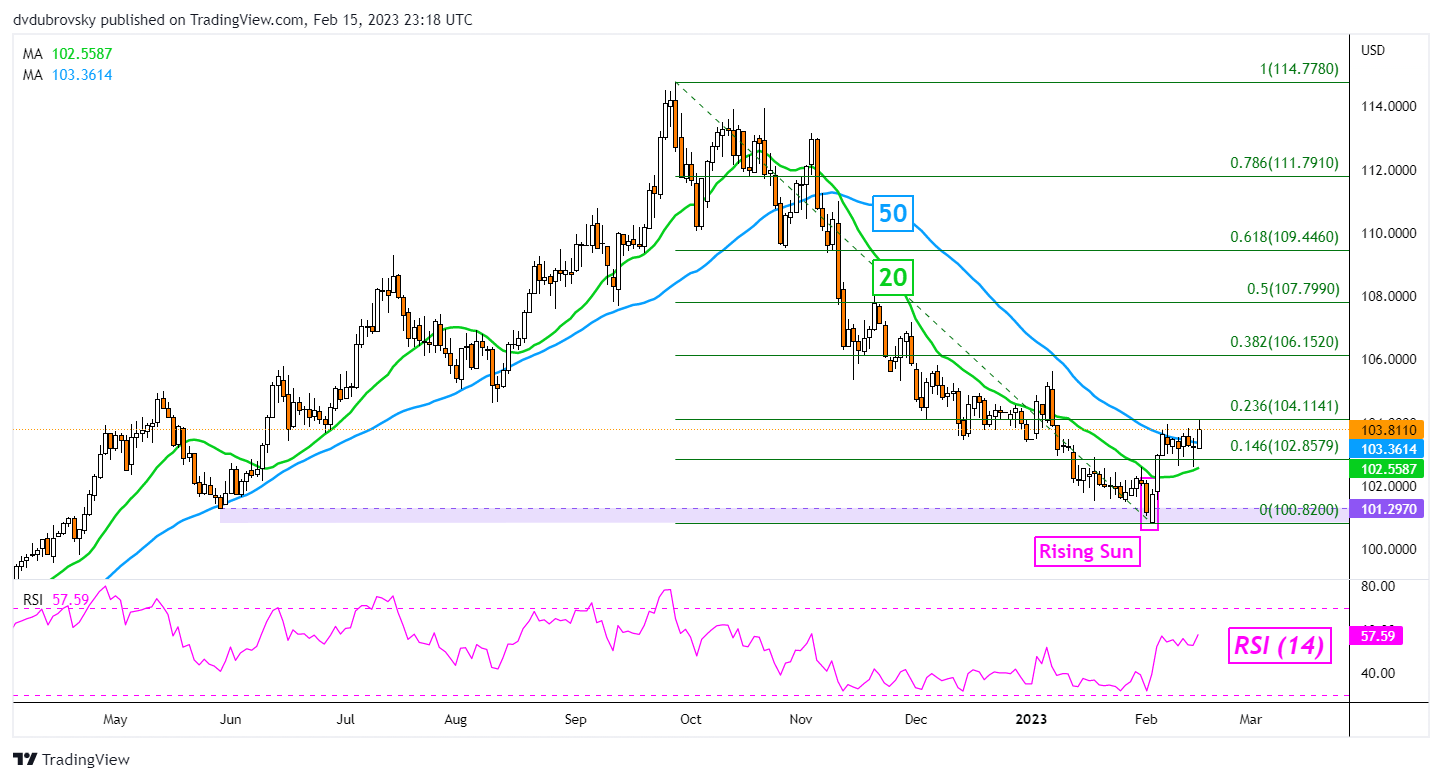

US Dollar Technical Analysis

On the daily chart, DXY continues to make upside progress in the aftermath of a bullish Rising Sun candlestick pattern. Prices closed above the 20-day Simple Moving Average (SMA), but remain under the 23.6% Fibonacci retracement level at 104.11. A confirmatory push above the latter could open the door to extending recent gains and reversing the downtrend from the end of last year.

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

DXY Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

Comments are closed.