US Dollar Extends Losses as Fed Minutes Flag Recession Risks amid Banking Sector Turmoil

FED MINUTES KEY POINTS:

- Fed minutes stress the need for monetary policy flexibility in light of recent events

- Policymakers lower their expectations for the FOMC terminal rate in response to last month's banking sector turmoil

- The U.S. dollar extends its daily decline after the Fed minutes are released

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Bank of Canada Holds Rates Steady & Sticks to Data Dependency, USD/CAD Slides

The Federal Reserve today released the minutes of its March 21-22 meeting, at which policymakers unanimously decided to raise the benchmark interest rate by 25 basis points to 4.75%-5.00% as part of the ongoing tightening campaign to bring inflation back to the 2.0% target.

According to the summarized record of the proceedings, several Fed officials noted that inflation remains skewed to the upside, with little evidence pointing to sustained disinflation for core services, excluding housing, in recent data.

Despite concerns about the inflation profile, many participants lowered their expectations for the FOMC's terminal rate in response to the U.S. banking sector turmoil that sent investors into a tizzy a few weeks ago. The widespread view was that the financial system strains that erupted last month could lead to more restrictive lending standards in the coming months, paving the way for weaker price pressures over the medium term.

Recommended by Diego Colman

Top Trading Lessons

On the economy, the central bank’s staff projected a “mild recession” starting later in the year, a sign that the outlook is deteriorating amid growing risks of a credit crunch. This assessment may be a clear indication that the aggressive hiking cycle that began in 2022 has concluded or is coming to an end soon, possibly after next month's policy meeting.

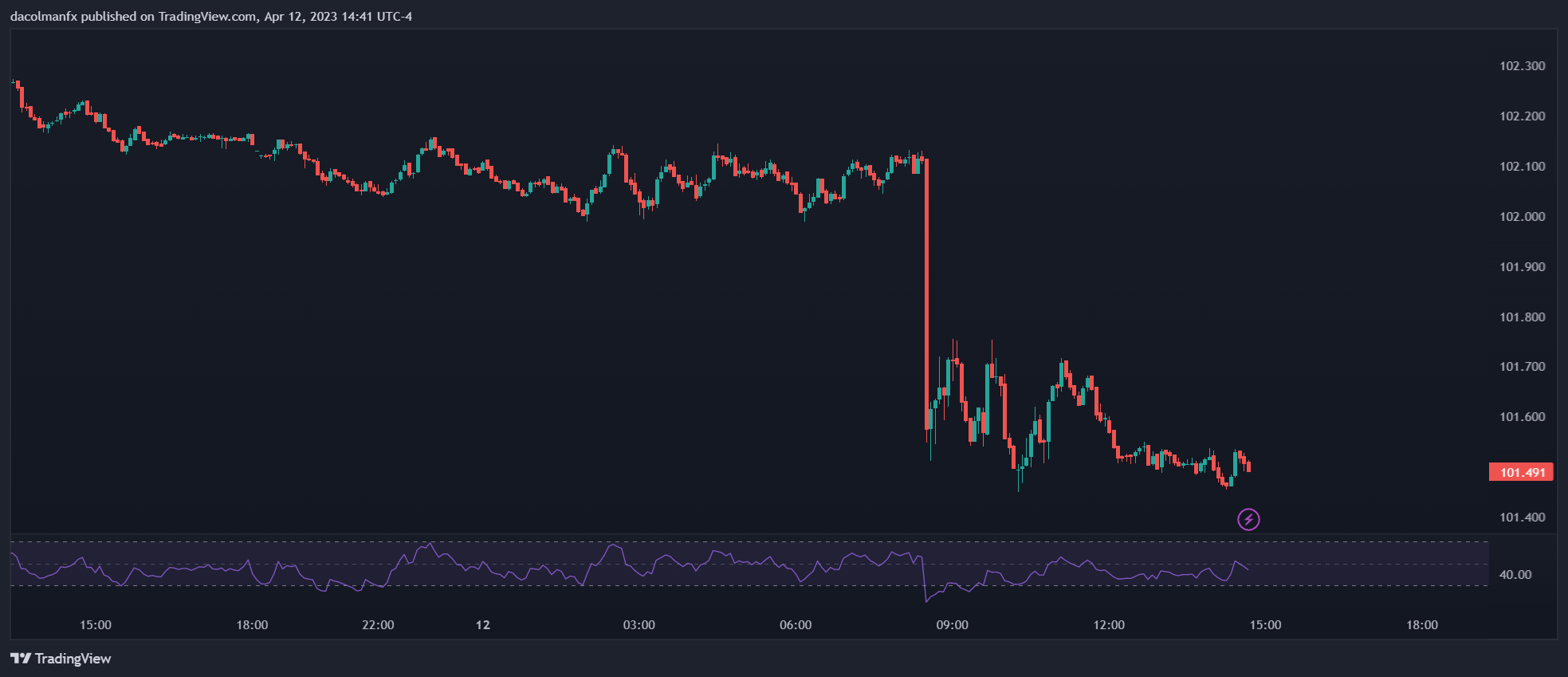

Immediately after the minutes were released, the U.S. dollar, as measured by the DXY index, extended losses, dropping as much as 0.65% to 101.50 on the day, pressured by falling bond yields, with the Fed’s monetary policy trajectory becoming a little more dovish as priced in by futures markets.

With a Fed pause around the corner, the path of least resistance is likely to be lower for the U.S. dollar in the near term, especially if sentiment manages to stabilize. However, if the mood sours again and volatility explodes higher, the greenback could be well-positioned to command strength against riskier peers by virtue of its safe-haven qualities.

Recommended by Diego Colman

Introduction to Forex News Trading

U.S. DOLLAR (DXY) 5-MINUTE CHART

Source: TradingView

Comments are closed.