S&P 500 on Edge Before Apple & Amazon, Gold Tanks as Yields Soar ahead of NFP

S&P 500 FORECAST

- The S&P 500 and Nasdaq 100 slide, but remain near multi-month highs ahead of key earnings and the U.S. jobs report

- Apple and Amazon will announce quarterly results on Thursday

- Meanwhile, the U.S. Bureau of Labor Statistics will release the July employment report on Friday

Recommended by Diego Colman

Get Your Free Equities Forecast

Most Read: US Dollar Rallies on Soaring Yields, USD/JPY Rockets Higher, Eyeing 2023 Peak

S&P 500 and Nasdaq 100 experienced slight declines on Tuesday but remained close to their multi-month highs. Meanwhile, gold prices suffered significant losses, plummeting over 1%, dragged lower by surging U.S. Treasury rates, with the 10-year note topping 4.0% and on the verge of reaching last month’s peak.

Shifting focus to the stock market, equities have demonstrated strong momentum recently, disregarding the price fluctuations observed in the past few trading sessions. The current earnings season has further consolidated the emerging bullish trend and demonstrated the resilience of U.S. companies to deliver constructive results in a difficult macroeconomic environment.

The July FOMC decision has also played a part in boosting sentiment. Despite the Federal Reserve resuming its rate-hiking campaign and raising borrowing costs to the highest level in 22 years, Chairman Powell's data-dependent approach and reluctance to commit to further policy firming have eased concerns about a more hawkish outlook. Some traders even suggest that the normalization cycle has concluded.

The benign market outlook has been reinforced by the latest batch of data, including second-quarter GDP, initial jobless claims, and consumer confidence. All these indicators have been bullish, aligning with the anticipated soft-landing scenario and instilling hope among traders that the Federal Reserve will successfully curb inflation without causing a major economic downturn.

For sentiment to remain upbeat, it is crucial for the earnings season to continue its positive trajectory with minimal negative surprises. With this in mind, traders should closely monitor financial reports from Apple and Amazon on Thursday, two of the largest tech companies in the world. Having large weights in the S&P 500 and Nasdaq 100, their performance will have a crucial impact on guiding the broader market's direction.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

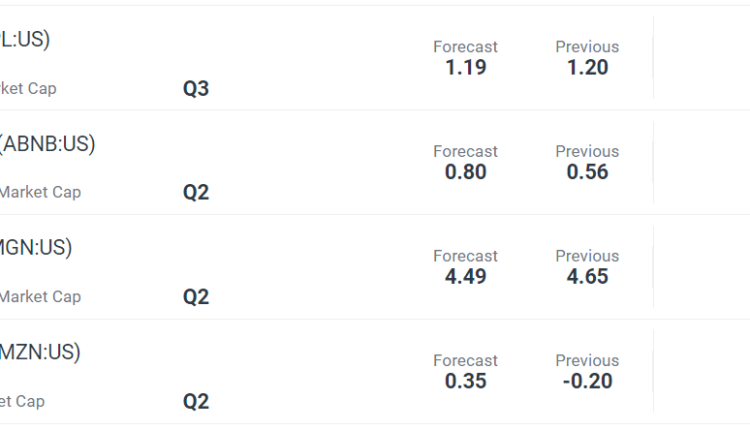

KEY EARNINGS COMING UP

Source: DailyFX Earnings Calendar

Apple (AAPL) is expected to post earnings per share (EPS) of $1.19 on revenue of $81.73 billion, while Amazon (AMZN) is projected to earn $0.35 per share on sales of $131.46 billion. Given their strong ties to consumers, paying attention to their remarks on household spending patterns is essential. Positive commentary could drive bullish sentiment in the market, while negative feedback might raise concerns about the road ahead.

Later in the week, all eyes will be on July's U.S. job report, set to be released on Friday. Projections suggest the addition of 200,000 workers, following 209,000 payrolls added in June, with the unemployment rate expected to remain steady at 3.6%.

For investors, a job report aligning with the consensus estimate is likely to have a bullish effect on the S&P 500 and Nasdaq 100. However, a significant deviation on the downside, such as job figures below 100,000, could raise concerns about a potential recession, negatively impacting risk assets.

On the flip side, an exceptionally strong NFP report, with a print above 275,000, may pose a different set of challenges, sparking fears of a wage spiral and leading traders to discount further policy firming for 2023.

| Change in | Longs | Shorts | OI |

| Daily | 4% | 1% | 2% |

| Weekly | -3% | 3% | 1% |

S&P 500 TECHNICAL OUTLOOK

Despite Tuesday's minor decline, the S&P 500 remains in close proximity to a critical technical resistance level near 4,635, where this year’s peak aligns with the March 2022 highs and the upper boundary of a short-term rising channel. If buyers manage to push the index above ceiling, upside impetus could gather pace, paving the way for a possible retest of the all-time highs. In contrast, if sellers regain control of the market and trigger a bearish reversal, initial support rests at 4,555, and 4,500 thereafter. On further weakness, we could see a slide towards 4,415.

S&P 500 TECHNICAL CHART

S&P 500 Futures Chart Created Using TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

NASDAQ 100 TECHNICAL OUTLOOK

Following recent price movements, the Nasdaq 100 hovers near the psychological 16,000 level. Surmounting this technical barrier might prove challenging for buyers, but if a breakout occurs, it could provide the bullish impetus needed to propel the market back toward its 2022 record. Conversely, should prices pivot downwards and begin to decline, initial support is seen at 15,500, followed by 15,275. If these levels are taken out, a potential drop towards 14,865 could be in sight.

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Futures Chart Created Using TradingView

Comments are closed.