S&P 500 at new medium-term highs – Is correction coming?

The S&P 500 accelerated its rally yesterday – will it continue even higher?

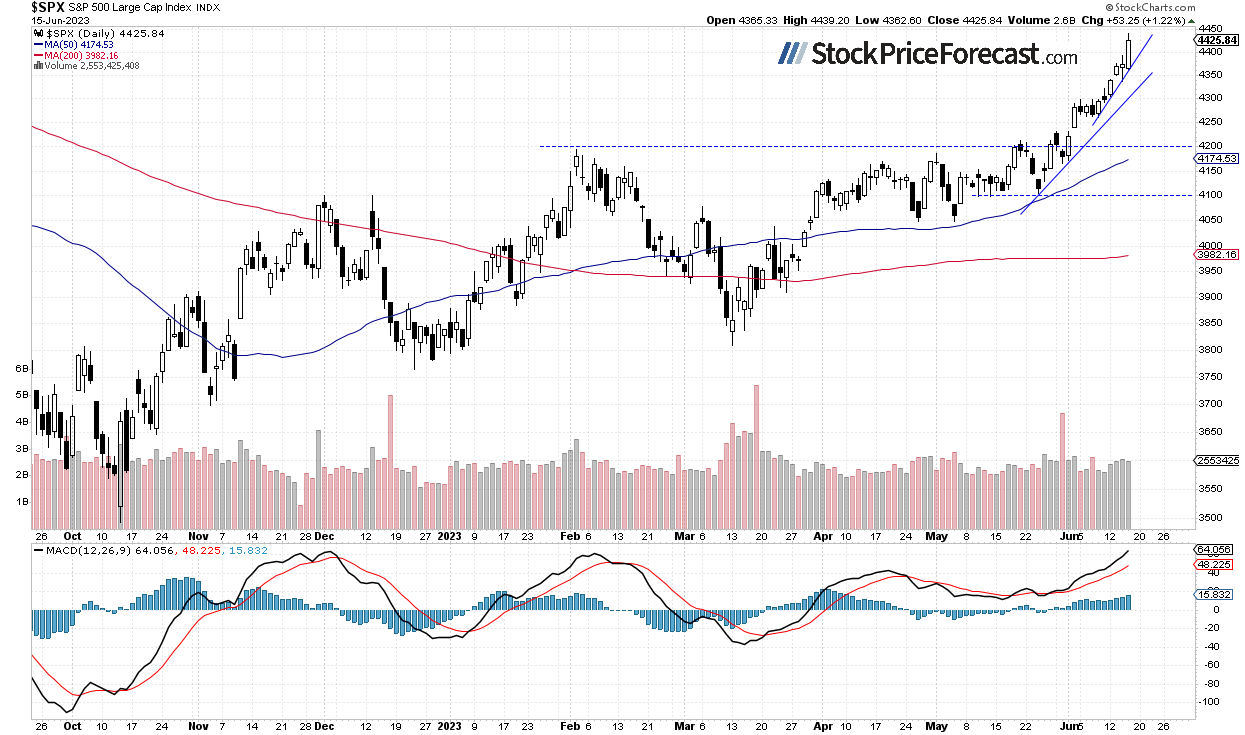

The broad stock market index gained 1.22% on Thursday as it further extended its uptrend after breaking above the previous local highs two weeks ago. The S&P 500 was the highest since April of 2022 again.

There is still a lot of uncertainty concerning monetary policy, some technology stocks’ valuation concerns, but overall, the investors’ sentiment is still bullish.

Stocks will likely open 0.2% higher this morning as investors’ sentiment remains bullish ahead of a long holiday weekend. The S&P 500 is trading above its month-long upward trend line and above a steeper short-term trend line as we can see on the daily chart:

Futures contract trades along new high

Let’s take a look at the hourly chart of the S&P 500 futures contract. It rallied up to around 4,485 level yesterday. Today it’s trading within a short-term consolidation. The resistance level is now at 4,500 and the support level is at 4,440, among others.

Conclusion

The S&P 500 index will likely open higher this morning. The market may fluctuate following its recent rally. There have been no confirmed negative signals so far. However, stocks may see a profit-taking action at some point.

Here’s the breakdown

-

The S&P 500 extended its rally as it broke above the 4,400 level yesterday.

-

There have been no confirmed negative signals so far.

-

In my opinion, the short-term outlook is bullish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Comments are closed.