Scale up your Trading Performace with Multi-dimensional Predictive algorithms and Machine Learning Networks – Analytics & Forecasts – 4 May 2023

Trading at the apex level requires dynamism and adaption to the prevalent market condition. The traditional method of using a static signal to evaluate the market has been long jettisoned due to the increased competition in the foreign exchange market.

The use of multi-dimensional predictive algorithms and machine learning networks is one of the most prevalent means to ride the market storm successfully.

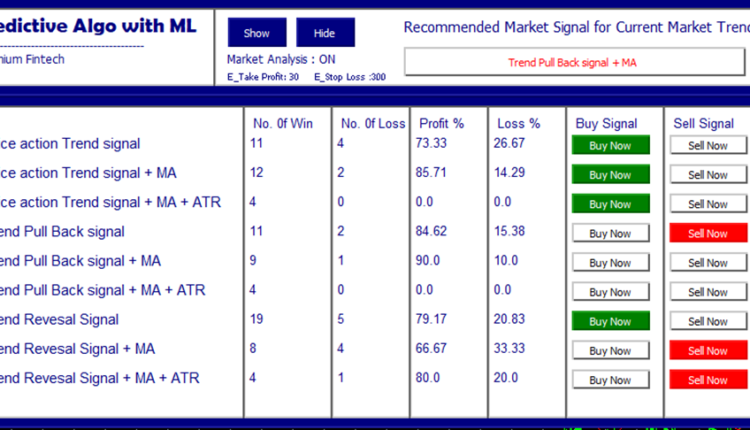

Predictive Algo is a new generation tool that is built with machine learning technology to monitor and learn the performance of multidimensional signals and display the most reliable signal within a trend regime.

It predicts the most successful trade execution using a high-performance trade simulation system to train an algorithmic network model which notifies the trader of the currently reliable market analysis.

It is built on 9 multiple-dimensional price action signals, the trend signals, trend pulls back and trend reversal price action. The trend signal is set up on the first and most reliable 4 to 5 consecutive bullish and bearish signals of a trend. Trade simulations are activated when there are pullbacks on trend and a high tendency for reversals. Moving average is used to analyse trend regimes (the beginning and end of trends), while the average true range is used to determine market volatility for high or low-volatility trading.

Features:

Price Action Trend Signal

Price Action Trend and Trend Regime signal

Price Action Trend and Market Volatility Signal

Price Action Trend pull back signal

Price Action and Trend Regime Pullback Signal

Price Action and Market Volatility Pull Back Signal

Price action Trend Reversal Signal

Price Action and Trend Regime Reversal Signal

Price action Trend Reversal Signal Price Action and Market Volatility Signal.

Trade Simulation and modelling using Machine Learning

Display of most prevalent signal

seamless market analysis

Cumulative records of Profit performance per signal

Cumulative records of loss performance per signal

Email Notification per signal

Mobile Notification

Trade Terminal Alerts

Easy to use Operation Mode

Ultra-Colour Display

New Generation GUI

Best performance on VPS

Meta Trader 4 Version Available

Get Meta Trader 5 Version Now

How to use:

Predictive Algorithm is composed of 9-dimensional signals. These are well-positioned to understand the market's current tendency.

Price action trend indication:

This is a trend indicator that identifies a purchase trend by using 4 to 5 consecutive bullish candles and a sell trend by using 4 to 5 consecutive bearish candles.

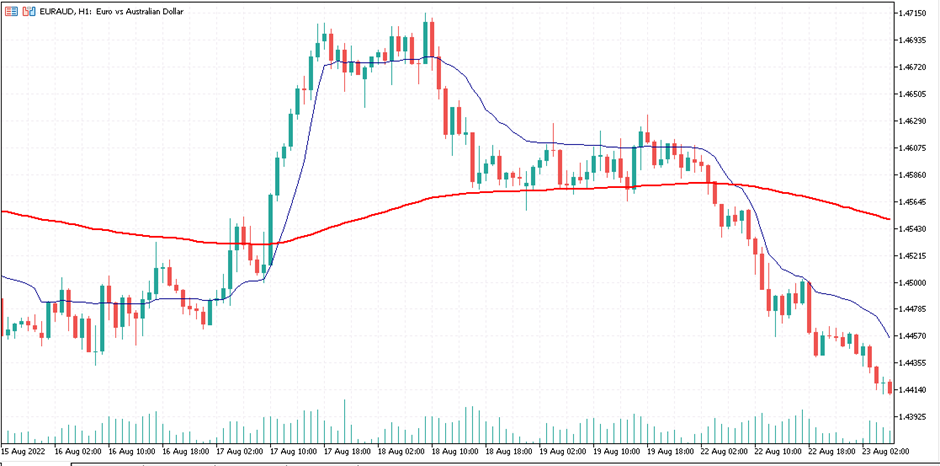

The Price Action Signal +Ma: uses a double-moving average to filter the Price action trend signal using a fast-moving average and a slow-moving average, when there are 4 consecutive bearish in the market we confirm the trend by using checking if the fast-moving is below the slow-moving average when these three conditions are positive, Predictive Algo signals for a sell order. If the fast-moving average is above the slow-moving average, and there are 4 consecutive bullish candles, Predictive Algo signals for a buy order. Predictive Algo assists the trader in analysing the market before making a final move by automatically printing well-defined trend lines for buy signals and sell signals.

These chart objects are auxiliary tools used by traders worldwide to confirm signals and they are automatically deleted when signal strength expires.

When volatility is high the market is more liquid and take profit limits are most likely to be reached, the price action trend + MA + ATR signal combines the price action, a double moving average indicator and a set volatility level to confirm actual trends.

The next is the trend pull back signal, after a 4 consecutive bullish trend is followed by a pull back a buy signal is triggered, this is more reliable since most traders all over the world follow the trend and after a little resistance from the bears, the bullish trend is most likely to continue.

The Trend Pull back + MA filters trends using the double moving average while The Trend Pull back + MA + ATR includes the market volatility in its analysis.

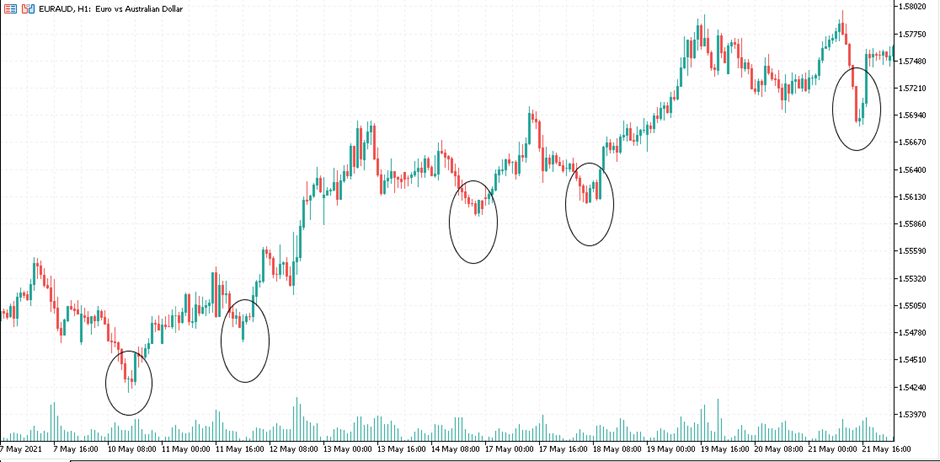

The Predictive Algo uses one of the most advanced techniques to detect a reversal in the market, when is the market more likely to reverse? in a bullish market series of bearish candles show a form of resistance, usually, the first few attempts of resistance against a trend fail however, they are the building blocks to a potential reversal, a trader that capitalizes on a reversal makes a huge profit when the reversal has strong momentum and volatility.

Predictive Algo analyses a series of strong pullbacks on a bullish trend to signal a reversal. in a bearish trend pull back of high momentum is analysed critically to signal a buy trend, other indicators used to confirm signals include the double moving average cross-over and average true arrange. Reversal horizontal lines are displayed for chart analysis and are automatically deleted when signal strength expires.

When Signals are detected, Predictive Algo uses a machine learning algorithm which simulates trade orders and records win and loss rates, percentage gain and percentage loss. These data are used to estimate the success of these signals, and a machine learning model is trained to evaluate the most prevalent and profitable signal in the market and displayed it on the ultra-show display panel. Email notifications are also sent to traders when trade signals are confirmed.

User Instructions:

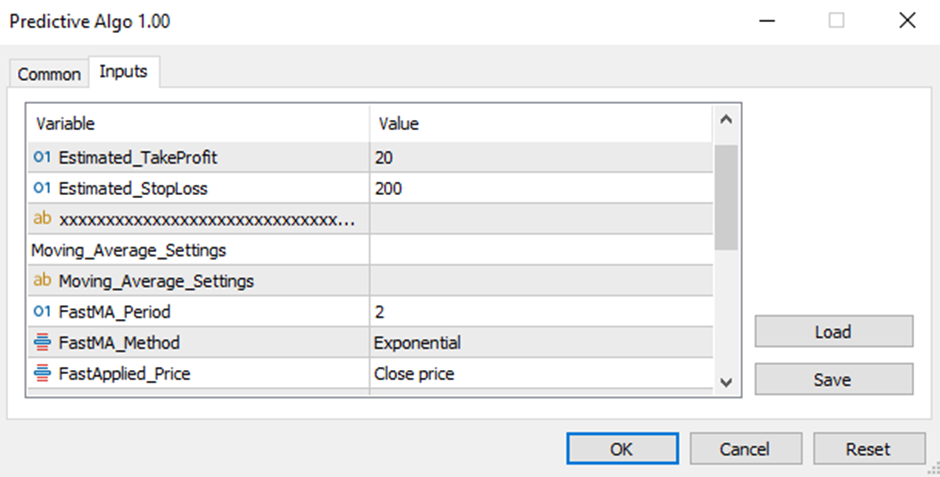

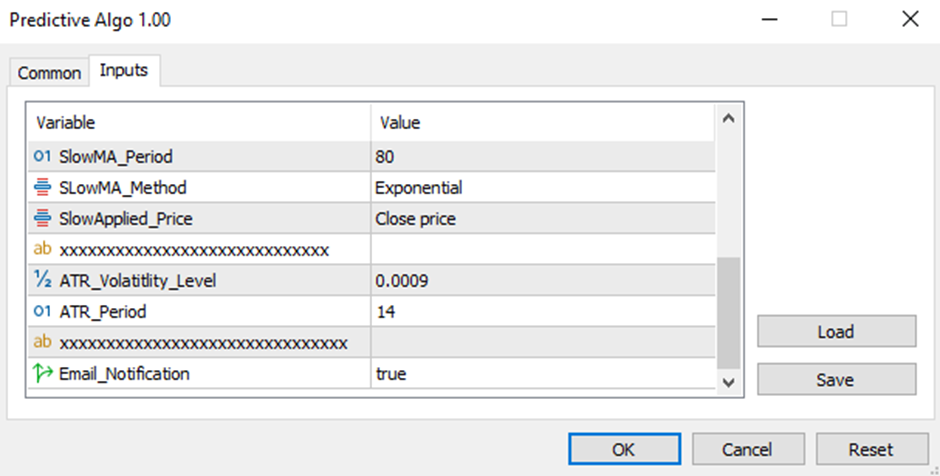

The Estimated Take profit and estimated Stop loss are used by predictive Algo to Simulate trade orders per signal. The fast-moving average is set to 2, we use the Exponential moving average and Close price as the applied price by default. The slow-moving average is a 160-period EMA using the close price of candle bars as its applied piece.

The Estimated Take profit and estimated Stop loss are used by predictive Algo to Simulate trade orders per signal. The fast-moving average is set to 2, we use the Exponential moving average and Close price as the applied price by default. The slow-moving average is a 160-period EMA using the close price of candle bars as its applied piece.

The ATR volatility level is set to 0.0009 for 14 candle periods, traders can adjust these settings based on trading strategy.

Email Notification is turned on, emails on signal reports are sent to the trader automatically. Please remember to setup the mail SMTP setting to enable mailing protocol.

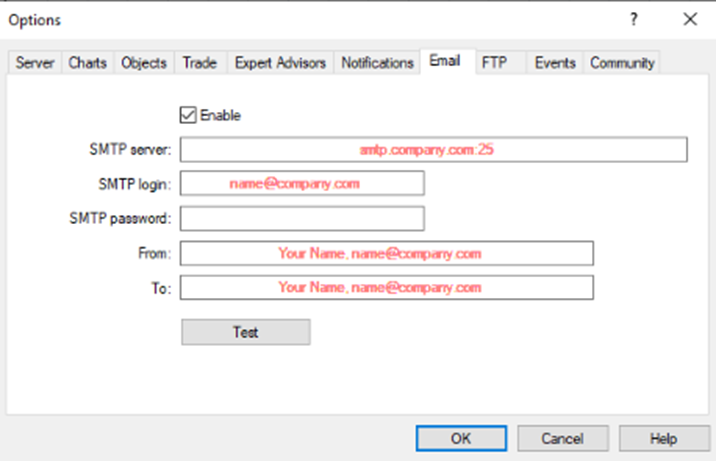

Email notification

On your Meta Trader application, Select Options from the Tools menu, then click on Email Notification from the dialogue box. Fill in the relevant details: SMTP server, SMTP password, SMTP login, receiving email address, and sending email address are all required. Please obtain the required information from your email hosting provider.

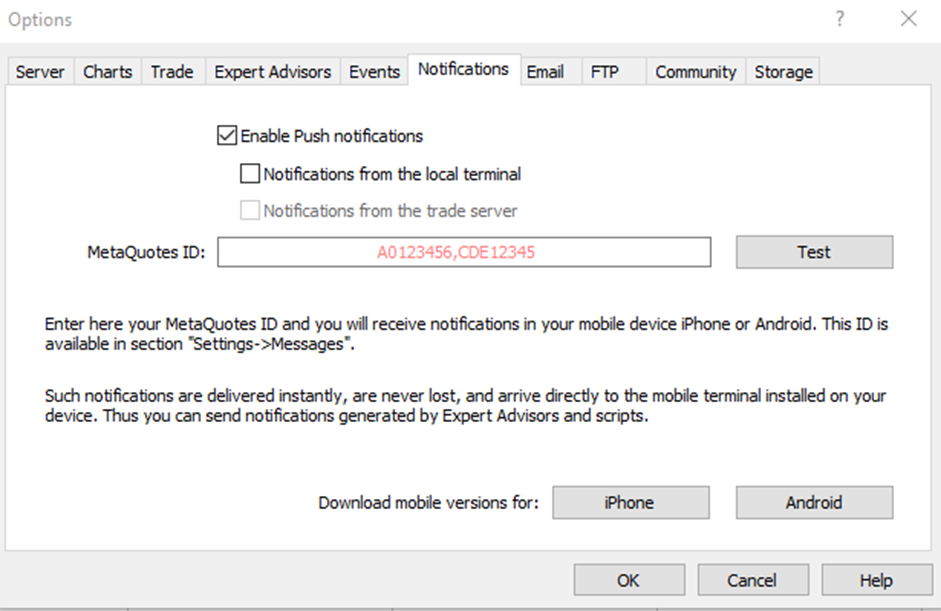

Mobile alerts are available on iOS and Android devices such as phones and tablets. The Meta Trader app, which is accessible on the Google Play and Apple App Stores, is an important tool for receiving transaction notifications.

You can receive notifications on this app by configuring it as follows. Click Options from the tool menu to access the mobile notification, go to the mobile notification tab and add your Meta Quotes ID.

Expand Memory

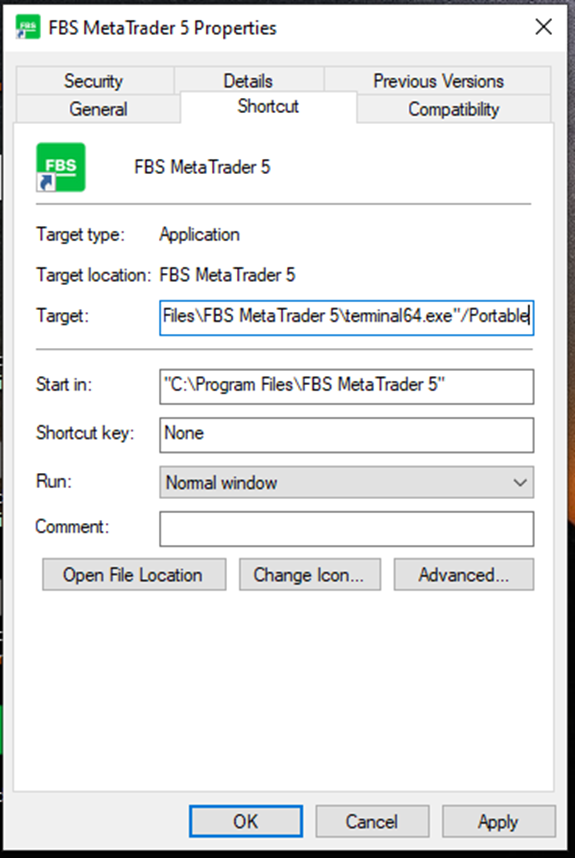

By default, Meta Trader allocates less memory to trade operation on a computer in order to be compatible with all computer operating systems for a consistent user experience, thus we may need to boost such capacity to utilize Predictive Algo. This speed up MetaTrader and allows for customisation not available with the default settings.

To employ a large capacity software such as Predictive Algo, we set Meta Trader to portable mode. Change the Meta Trader 5 / Meta Trader 4 operating mode to Portable mode by right-clicking on the application's shortcut. The addition of the extension “/Portable” allows for more flexible operation and storage of your trading engine.

Meta Trader 4 Version Available

Get Meta Trader 5 Version Now

Comments are closed.