Reasons for Resistance Breaks in Forex – Trading Strategies – 21 December 2023

When Bulldozers Bust Through Brick Walls: Reasons for Resistance Breaks in Forex

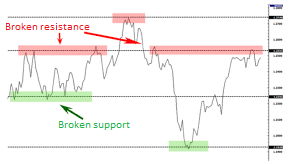

We've all been there: staring at a chart, price hovering just beneath a seemingly impenetrable resistance level. Orders poised, adrenaline pumping, we wait for the bounce, the confirmation of our analysis. And then… CRACK! That stubborn barrier shatters like a stale baguette, price surging past with the force of a runaway bulldozer. What just happened? Why did resistance, once so resolute, crumble like a sandcastle under a rogue wave?

Fear not, fellow trader, for understanding these breakouts is the key to unlocking hidden opportunities and avoiding painful false dawns. So, grab your coffee and buckle up, because we're diving into the five main reasons why resistance levels in forex get pulverized into trading dust:

1. The Gathering Storm: Shifting Market Sentiment

Imagine a battle between buyers and sellers. When resistance holds, it's like a stalemate – neither side can overpower the other. But sometimes, external forces tip the scales. A surprise economic release, a geopolitical earthquake, or even a juicy rumor can shift market sentiment like a hurricane's winds. Suddenly, that stubborn resistance line turns into a flimsy beach umbrella in the face of a tidal wave. Buyers surge in, fueled by newfound optimism, and boom! Resistance is history.

2. The Cavalry Arrives: Institutional Intervention

Picture this: big banks and hedge funds, the market's heavy cavalry, have been quietly accumulating positions before reaching a key resistance level. They wait patiently, like wolves circling their prey. Then, at the opportune moment, they charge in, unleashing a torrent of buy orders that overwhelms the existing selling pressure. Resistance crumples under the sheer weight of their combined might, paving the way for a sustained uptrend.

3. The Power of Technicals: Confirmation Candles and Breakouts

Sometimes, the reason for a resistance break is as simple as pure technical validation. A series of bullish confirmation candles, like engulfing patterns or breakaways, can ignite buying momentum, pushing price through the barrier like a battering ram through a cardboard door. Conversely, bearish engulfing candles or failed breakouts on lower timeframes can warn of impending weakness, triggering a wave of selling that shatters resistance from below.

4. The Illusion of Strength: False Breaks and Retests

Not all resistance breaks are created equal. Sometimes, price spikes through a level only to quickly reverse, leaving bewildered traders scratching their heads. These “false breaks” can be caused by fleeting bursts of buying or selling pressure that quickly evaporate. Remember, true breakouts usually have volume confirmation and follow-through on higher timeframes. So, don't jump the gun just because price pokes its head above resistance – wait for the cavalry to arrive before charging in yourself.

5. The Unseen Hand: Fundamental Shifts and Long-Term Trends

So, there you have it, traders. Remember, resistance levels are not ironclad fortresses, but rather psychological lines in the sand. By understanding the forces that can cause them to break, you can turn these breakouts from trading booby traps into lucrative opportunities. Keep your eyes peeled for shifting sentiment, institutional maneuvering, technical confirmations, and don't forget the whispers of the fundamentals. Armed with this knowledge, you'll be ready to surf the waves of volatility and conquer even the most formidable resistance levels. Now go forth and trade with confidence, knowing that even the sturdiest walls can crumble when the right forces collide.

Bonus Tip:

Remember, context is key. Analyse resistance breaks within the broader market environment, considering timeframes, technical indicators, and fundamental news. Don't chase every breakout blindly – wait for confirmation and trade with proper risk management.

Happy trading!

Comments are closed.