Real Yields Continue to Cast Shadow Over Gold: XAU/USD Price Action

Gold, XAU/USD – Outlook:

- Gold has pulled back from near key resistance and US real yields rebound.

- XAU/USD is approaching vital support on the 200-DMA.

- What is the outlook and what are the key levels to watch in XAU/USD?

Recommended by Manish Jaradi

How to Trade Gold

Gold is restarting to feel the heat of rising US real yields following upbeat US data in the past couple of days.

The yellow metal rebounded mid-August from quite strong support on the 200-day moving average and the June low of 1890. See “Gold, Silver Forecast: It’s Now or Never for XAU/USD, XAG/USD,” published August 13. This was associated with a brief reprieve lower in US real yields, also as data released in the second half of August failed to match up with overly optimistic expectations (the US Economic Surprise Index hit a two-year high at the end of July before cooling off).

With the US Federal Reserve unwilling to commit it is done with hiking rates, there is very little incentive for yields to fall meaningfully amid a resilient economy. Fed Governor Christopher Waller and Boston Fed President Susan Collins's comments reiterated the data dependency with regard to the path of monetary policy. The path of least resistance for yields remains sideways to up.

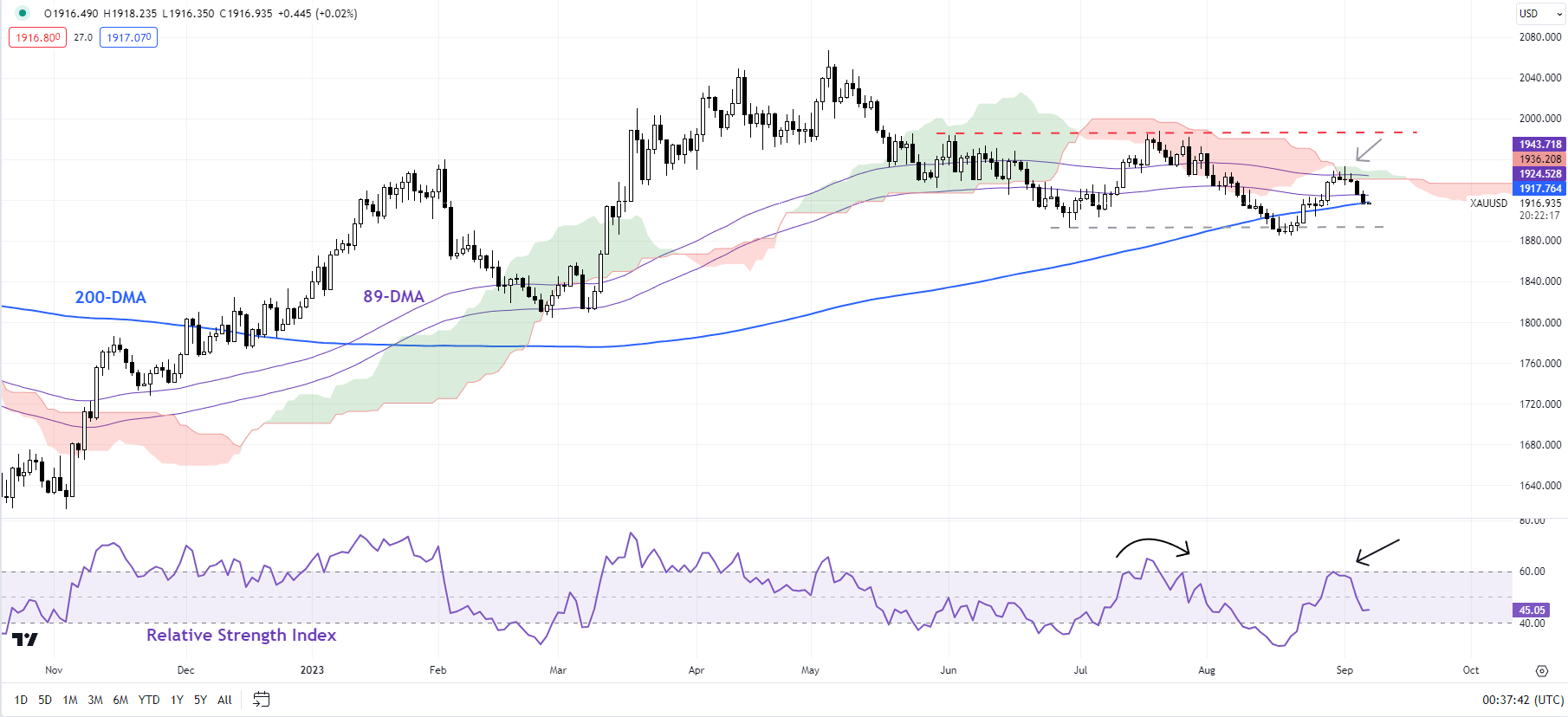

XAU/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

US real yields continue to hover around multi-month highs hit in August. Rising nominal interest rates coupled with easing price pressures/inflation expectations have pushed up real rates, raising the opportunity cost of holding the zero-yielding yellow metal. See “High Real Yields Starting to Bite Gold? XAU/USD Price Setup Ahead of US CPI,” published August 10.

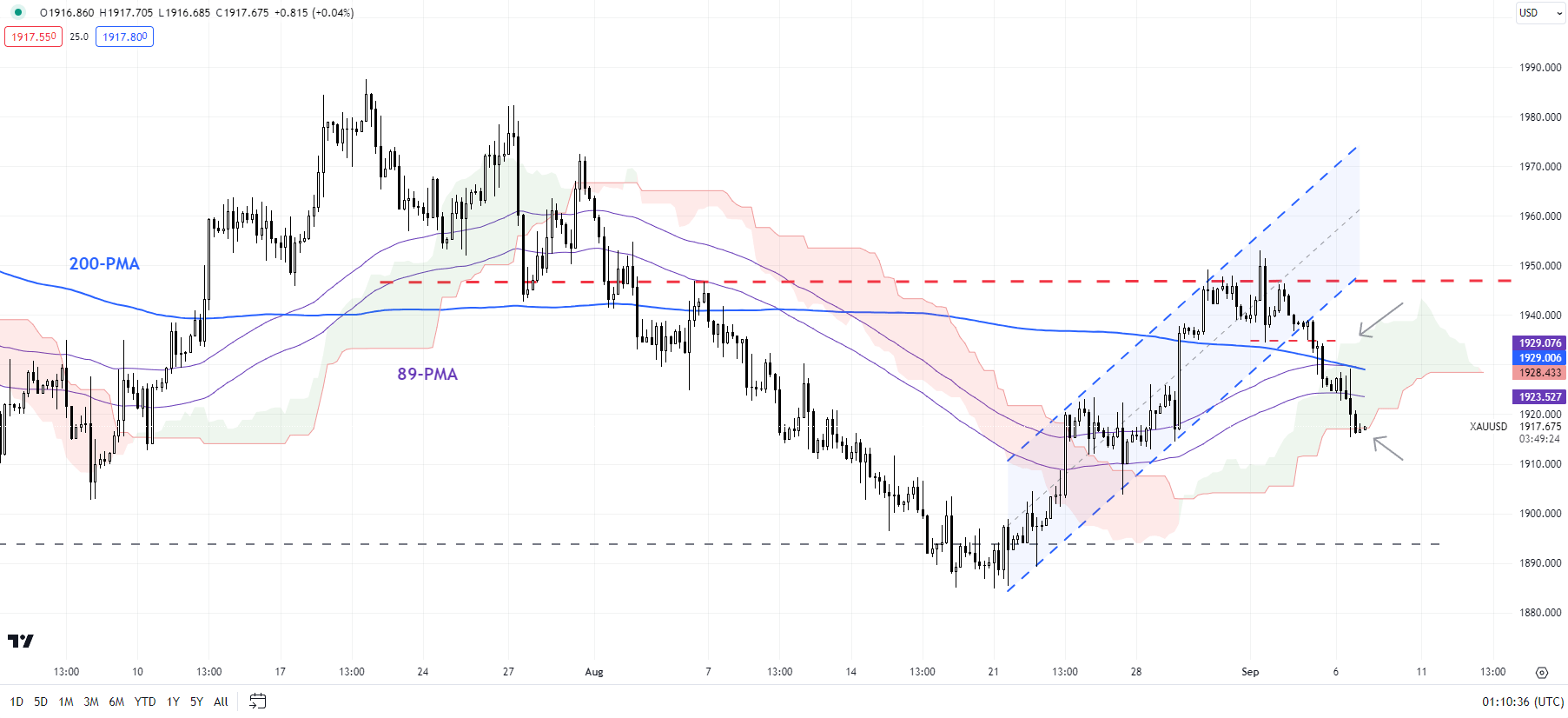

On technical charts, after a brief rebound from strong converged support in late August, gold has retreated from vital resistance on the upper edge of the Ichimoku cloud on the daily charts and the 89-day moving average. The recent turn lower has raised the odds of a lower-highs-lower-lows sequence since May. For this bearish pattern to reverse, the yellow metal would need to, at minimum, rise above last week’s high of 1952. In turn, for a rebound to occur gold needs to hold the crucial support on the lower edge of the Ichimoku cloud on the 240-minute chart that it is now testing.

XAU/USD 240-minute Chart

Chart Created by Manish Jaradi Using TradingView

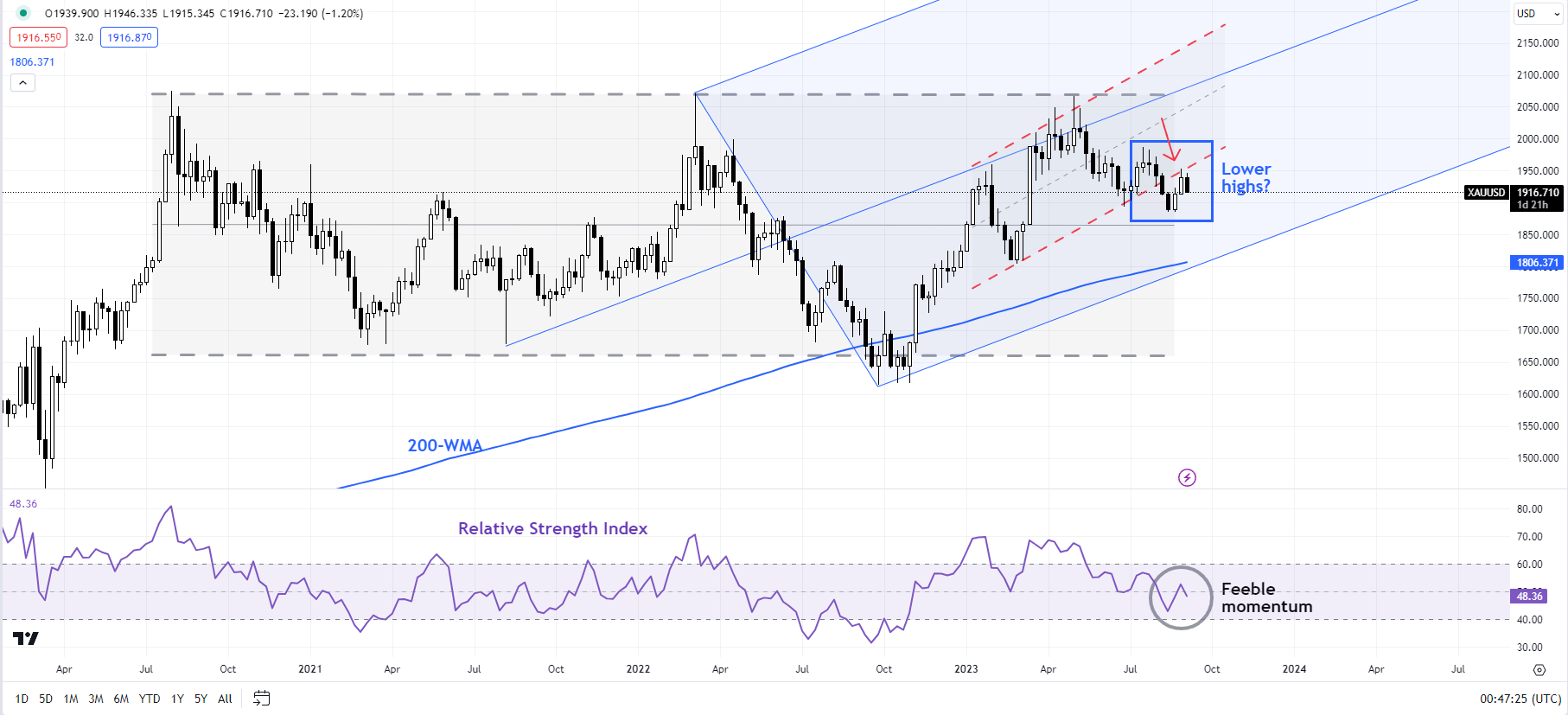

A failure to do so could push gold back toward crucial support on the 200-day moving average and the June/August low of 1885-1890. The importance of this support was highlighted in “Gold, Silver Forecast: It’s Now or Never for XAU/USD, XAG/USD,” published on August 13. As noted previously, any break below could pave the way toward the February low of 1805. Importantly, any break below 1885-1890 would truncate the uptrend that began in 2022.

XAU/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

Importantly, it would raise the odds that the spectacular multi-month rally was corrective and not the start of a new uptrend – a point highlighted in recent months. See “Gold Could Find It Tough to Crack $2000”,published March 28, and “Gold Weekly Forecast: Is it Time to Turn Cautious on XAU/USD?” published April 16.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

Comments are closed.