Rand Suffers as Risk Sentiment Sours

RAND TALKING POINTS & ANALYSIS

- Less aggressive Fed speak unable to deter ZAR selloff.

- Investors look towards low-risk assets, weighing negatively on the rand.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/ZAR FUNDAMENTAL BACKDROP

The rand’s downside has moderated since Friday after the miss on Non-Farm Payroll (NFP), resulting in markets pricing in a higher probability for another Fed rate pause. In early European trade the US dollar reversed much of it’s weakness but has since slipped due to dovish remarks from the Fed’s Williams (New York) while the Fed’s Bowman toned-down his more aggressive observations from the weekend citing sticky inflation and a tight labor market.

The drawback on the ZAR has been somewhat limited as certain key South African commodity exports have been marginally up on the day but deteriorating global risk sentiment as a result of the drone attacks in the Black Sea (possibly escalating war tensions) have given the safe haven USD an upper hand on Emerging Market (EM) currencies.

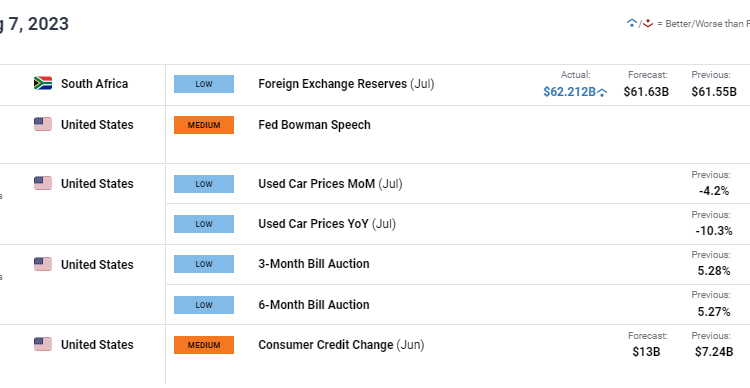

Later today, US consumer credit change will come into focus (see economic calendar) but should not significantly impact the pair as China balance of trade data and upcoming Fed speak take center stage tomorrow.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/ZAR price action keeps the pair above the 18.5000 psychological handle as well as the 50-day moving average (yellow). There is little conviction from bulls at present to drive the bullish narrative after breaking through the medium-term trendline resistance (dashed black line). Another push below 18.5000 and subsequently trendline support (black) could resume the longer-term downtrend – highly dependent on the current mix of fundamental dynamics.

Resistance levels:

Support levels:

- 18.5000/Trendline support/50-day MA

- 18.2500

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.