Q3 the Catalyst for Crude Oil?

Higher Q3 Oil Demand Amidst OPEC+ Supply Cuts

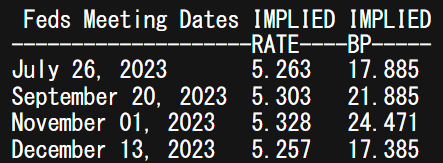

Crude oil prices have been on a downward trajectory this year with various fundamental factors influencing the overall trade dynamic. OPEC+ has been at the center of discussions once more by imposing their sway by recently cutting production to bolster crude oil prices. The actions of OPEC+ highlighted their persistence to support oil prices giving traders an underlying backing that there is a floor as to how low OPEC+ is willing to let prices slide. In June 2023, OPEC+ members approved production cuts through to the end of 2024 likely stoking a bullish bias for Q3 2023. According to OPEC forecasts (refer to table below), Q3 is expected to pick up slightly for both OECD and Non-OECD regions.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

OPEC World Demand Forecast

Source: OPEC

China to Dominate Demand Side Factors

China’s re-opening after COVID restrictions were lifted has not been as robust as many anticipated and this is evident through recent Chinese economic data releases. On a positive for China is that inflationary pressures have been comparatively low allowing for the PBoC to cut rates to stimulate the lagging economy. This has already begun and is likely to continue throughout the year leaving room for commodity prices to rally; however, major institutions including Goldman Sachs have slashed their forecasts for the Chinese economy. Markets are looking for deeper rate cuts than the 10bps reduction most recently in order to become optimistic around China’s rebound. Key metrics comprising manufacturing, exports, housing, unemployment and retail sales will be monitored closely for signs of a turnaround.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

Where to Next for the USD?

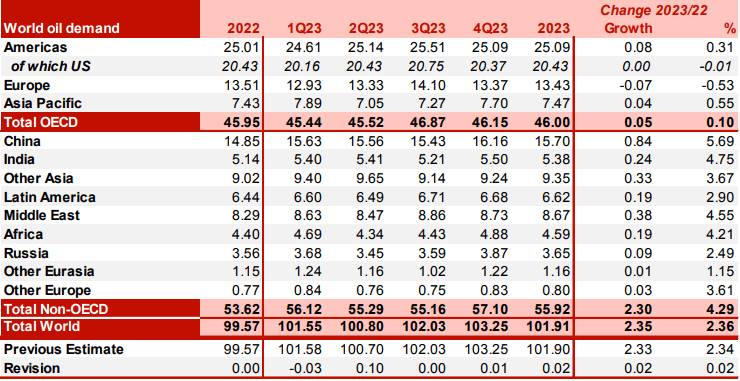

The traditional inverse relationship between crude oil and the US dollar may be of significance this upcoming quarter as the Federal Reserve nears its peak rate. Although there is a divide between Fed guidance and money market pricing, markets are aware that the terminal rate for this cycle is close. Lower inflation has been the recent trend despite stickier than expected core inflation but certain Fed officials are now favoring a more cautious approach to monetary policy that could land up supporting oil prices.

As it stands, implied interest rate expectations point to one more potential 25bps hike but with data playing such a crucial role in the Fed’s decision making, weak US economic data could remove this from the table.

Implied Fed Funds Futures

Source: Refinitiv, Prepared by Warren Venketas

Supportive Factors

1. Weather

US, European and Asia enter their summer period that generally leads to higher crude oil demand as consumption increases. Cooling usage tends to pick up as more energy is required and with lesser supply by OPEC+, higher demand and lesser supply could bolster over oil prices.

2. Hurricane Season

Alongside the summer months, the Gulf of Mexico region will face its annual hurricane season in Q3 that could disrupt supply production and systemically result in higher oil prices.

Potential Risks Limiting Crude Oil Prices

1. Central Banks

Should global central banks maintain their largely hawkish rhetoric by persisting with an aggressive monetary policy and constraining consumer spending and demand for goods and services, demand for oil may dwindle leaving little room for upside support.

2. Russia

Russia’s inclusion in the OPEC+ consortium has been rather contentious lately as the war in Ukraine drains its coffers. Russia needs to maintain a high level of oil exports to fund the country’s regular activities on top of any war associated costs leaving Saudi Arabia and Russia at loggerheads in terms of their primary objectives. A close eye should be kept on the relationship moving forward but for now these two major players seem to be publicly amicable.

3. Recession

Recessionary fears are being mentioned more and more by analysts across the globe but for the purpose of Q3, this may be too soon to call. After global markets averted a banking crisis and the US shows signs of resilience, this factor may be more relevant to Q4 and beyond.

Comments are closed.