Pound Resumes Where it Left Off, USD Pressing

POUND STERLING ANALYSIS & TALKING POINTS

- USD continues to dominate as money markets raise rate hike bets.

- US durable goods orders in focus later today.

- Brexit deal could provide some market volatility.

- GBP/USD trading at a key inflection point – 200 MA under pressure.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

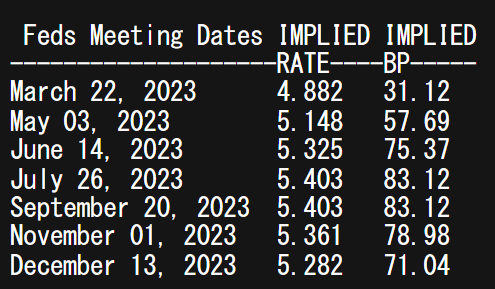

The British pound has not really moved much overnight in the Asian session largely due to the follow through from Friday’s US core PCE price index that showed elevated inflation pressures via the Fed’s preferred measure. Terminal rates for 2023 have now breached the 5.4% level (see table below) and could expose the pound to further downside against the greenback.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

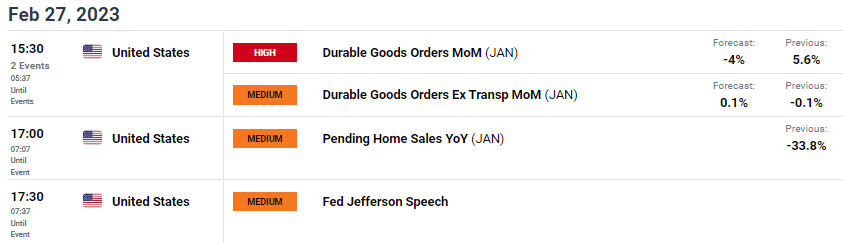

The economic calendar today contains one standout data print in the form of US durable goods orders for January (see economic calendar below). While the headline read is expected to fall after a flurry of airplane orders in December, the ‘ex transport’ figure is projected marginally higher.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

From a political standpoint, European Commission President Ursula von der Leyen is set to travel to the UK today to meet with Prime Minister Rishi Sunak regarding a new Brexit deal. This could spark renewed trading between Northern Ireland and the UK but has not really translated through to GBP just yet.

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

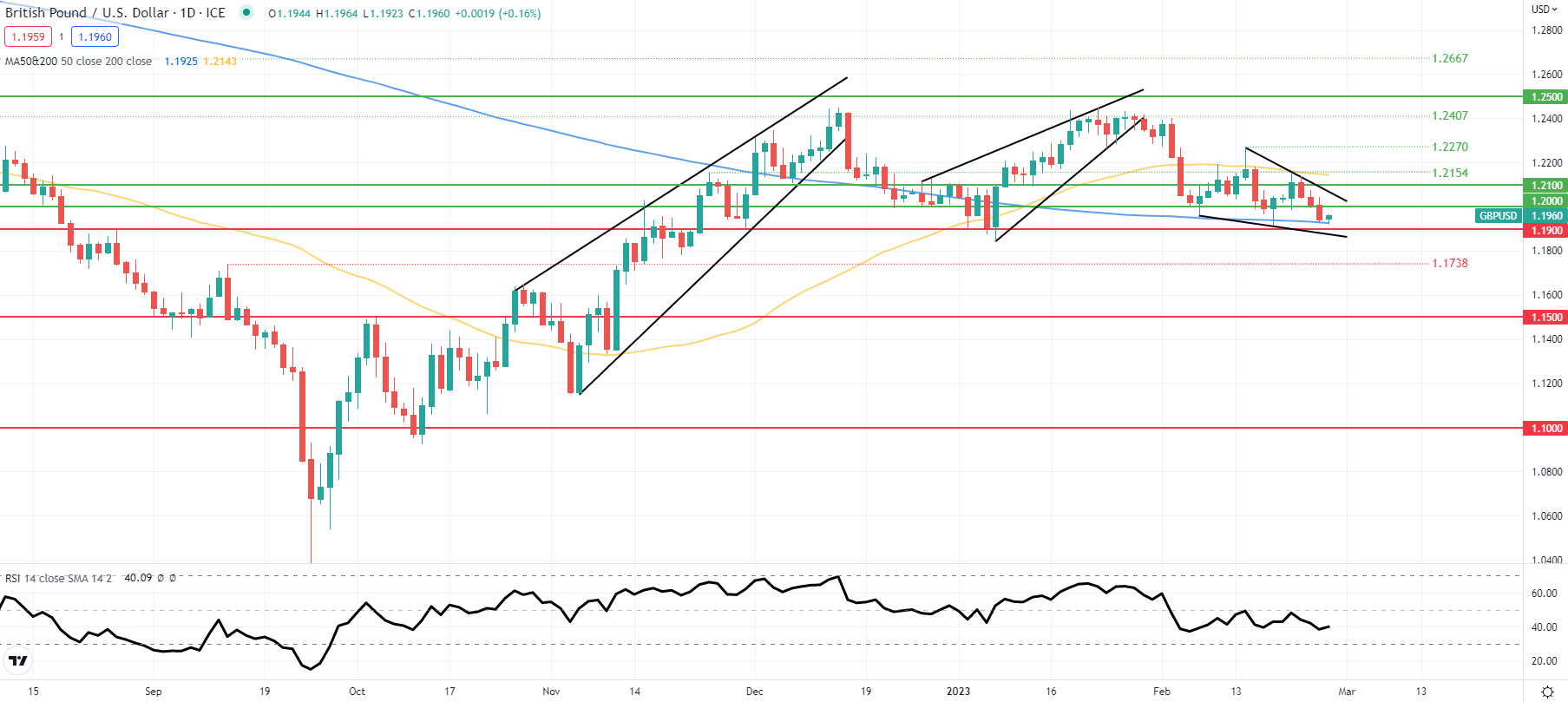

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action remains below the 1.2000 psychological handle now testing the key 200-day SMA (blue). A breach below this level could spark a downfall for the pound, coinciding with the 1.1900 support level and falling wedge support (black). It is difficult to ignore the short-term bullish trend seen through the USD but with a host of US economic data scheduled this week, any slight miss on expectations could see the dollar pullback.

Key resistance levels:

- 1.2100

- Wedge resistance

- 1.2000

Key support levels:

- 200-day SMA

- 1.1900

- Wedge support

HESITANT IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 64% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term mixed bias.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.