Open Interest Surge to Ignite a Fresh Bout of Volatility?

BITCOIN, CRYPTO KEY POINTS:

- Bitcoin Remains Rangebound as Open Interest Suggests Volatility May be on its Way.

- Whales Continue to Accumulate Bitcoin at an Impressive Rate as the $30k Mark is Seen as Key.

- Technicals are Starting to Point Toward a Retracement but a Weaker US Dollar Could Help Underpin the World's Largest Cryptocurrency.

- To Learn More AboutPrice Action,Chart Patterns and Moving Averages,Check out the DailyFX Education Series.

READ MORE: Oil Price Forecast: WTI Remains Vulnerable Below the 100-Day MA

Bitcoin prices continue to range in and around the $35k mark as market participants await a fresh jolt of volatility. There has been a sharp increase in open interest (OI) on derivatives markets which many crypto enthusiasts believe hints at a renewed round of volatility for the world’s largest crypto.

Supercharge your trading prowess with an in-depth analysis of Bitcoins outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Zain Vawda

Get Your Free Bitcoin Forecast

OPEN INTEREST SURGE TO REIGNITE VOLATILITY?

According to reports and having a look at the data itself there does appear to be a correlation between increases in (OI) and spikes in volatility. In recent months when Open Interest has reached elevated levels, we have had increased levels of volatility, with the current level close to $15.5 billion. The CME exchange has also achieved a new record in Open Interest, valued around 3.68 billion which is interesting given that the CME exchange is preferred by institutional investors. This might further strengthen the conviction of crypto enthusiasts that a spot ETF approval may be around the corner as institutional investors prepare.

Bitcoin miners are smiling however, as Bitcoin transaction fees hit 5- month peak. According to data from statistics resource BitinfoCharts, the average BTC transaction fee is approaching $6 as of November 7. The increased has been laid at the feet of Bitcoin Ordinals which is making its presence felt in what is somewhat reminiscent of the second quarter of 2023. Ordinals are nonfungible tokens (NFTs) that store data directly on the blockchain and add a significant number of transactions for miners to process. The effect usually results in an increase in fees with approximately 1 million ordinal “mints” having taken place in the last 7 days. This is also creating a backlog in transactions with the current number of 120k in stark contrast to the beginning of October when the number was around 30k.

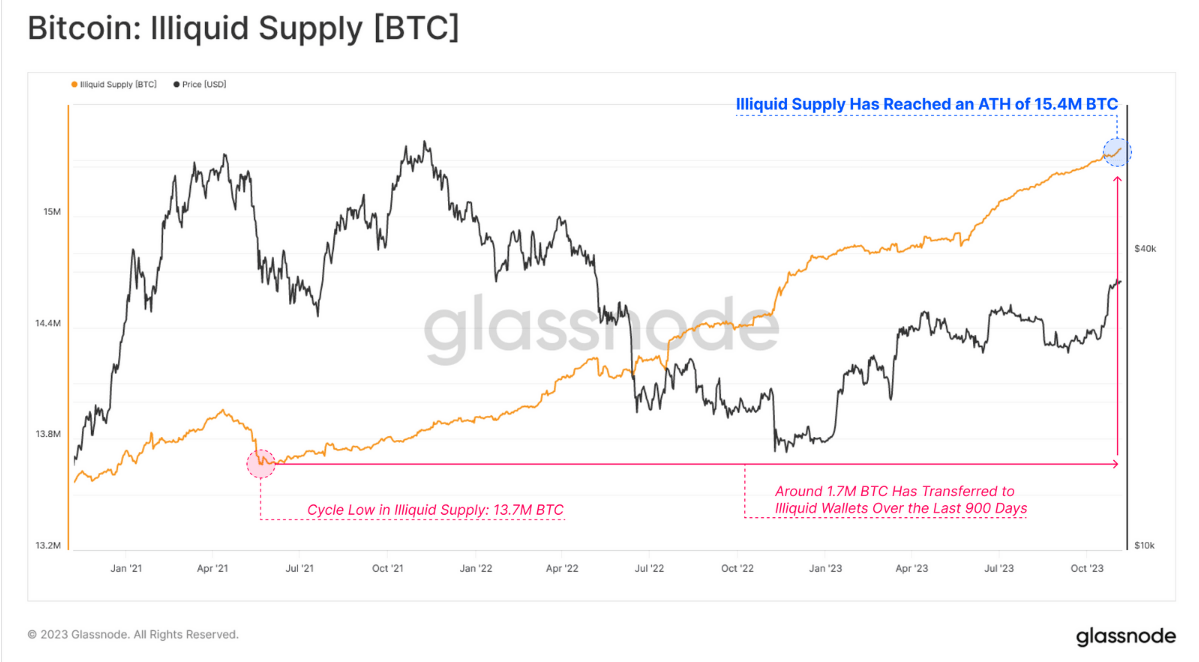

Bitcoin supply meanwhile remains tight with long-term holders continuing to accumulate bitcoin at an impressive rate. According to Glassnode, spending behavior of short-term holders suggest a shift in market character has taken place now that prices are above the $30k mark. Not surprising really as this was earmarked as a key level in my quarterly outlook as well.

The chart below measures the amount of supply held in wallets with minimal history of spending is also at an ATH of 15.4M BTC.

Source: Glassnode

LOOKING AHEAD

We do have some US data ahead this week as the US Dollar has faced a bit of selling pressure on hopes the Fed rate hike cycle is done. The DXY has not had a material impact on Bitcoin prices of late, but will that change? If Dollar weakness does continue Bitcoin bulls will hope for a better reaction and potentially further upside.

As time goes by it is important to pay attention to any new announcements around the Spot Bitcoin ETF by the SEC as this could be the much-needed push to break Bitcoin out of this recent lull.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: HOW TO USE TWITTER FOR TRADERS

TECHNICAL OUTLOOK AND FINAL THOUGHTS

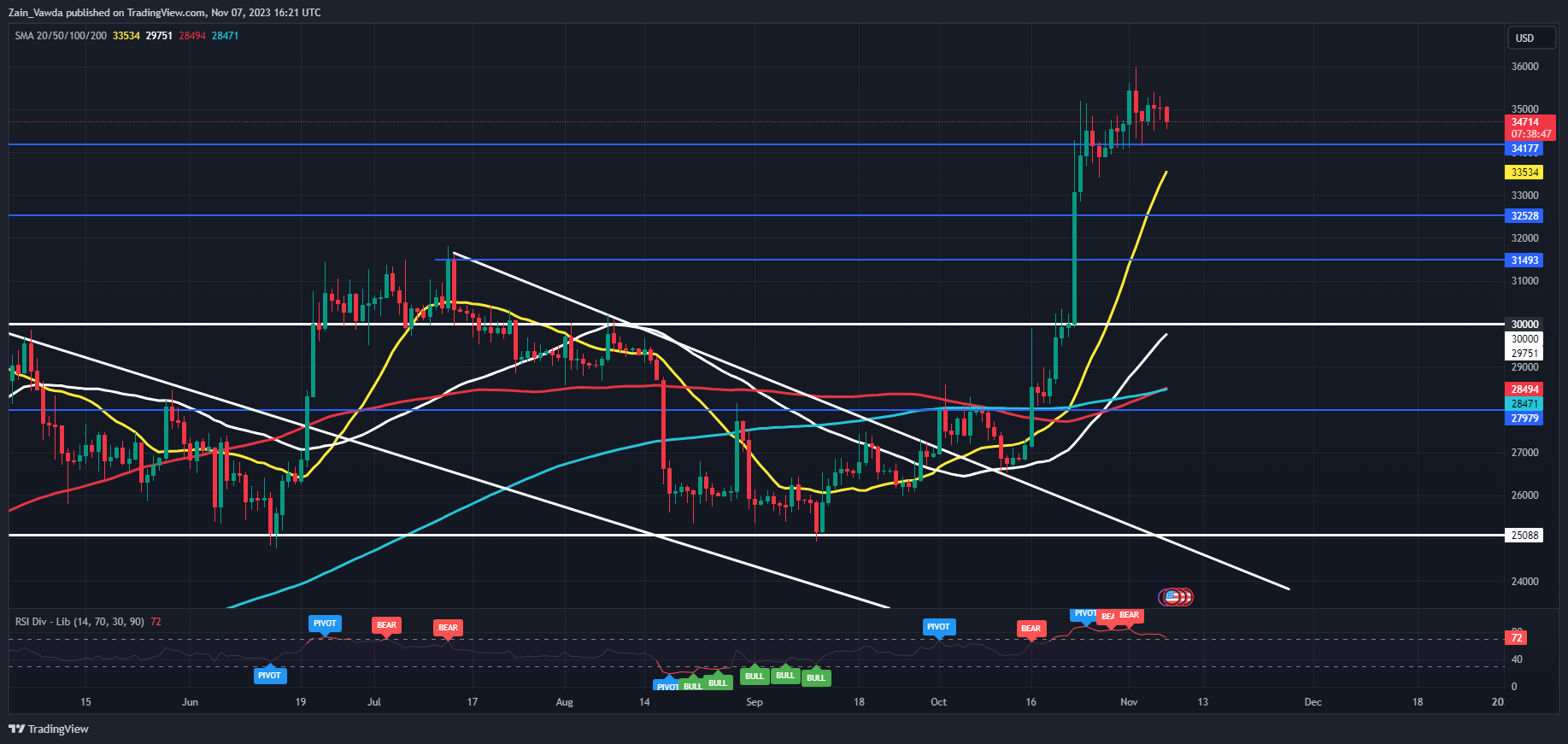

From a technical standpoint BTCUSD is currently stuck in a period of consolidation which is understandable given the recent rally. The longer we do consolidate the more likely we are to see a volatile breakout as this is how it historically unfolds. At present the $35k is proving particularly stubborn with immediate support provided at the $34k handle.

If we are to see a retracement here the most intriguing level for me in terms of bullish continuation would be the swing high in the middle of July around the $31.5k mark. A pullback toward this area may provide would be bulls with an appealing risk to reward opportunity.

BTCUSD Daily Chart, November 7, 2023.

Source: TradingView, chart prepared by Zain Vawda

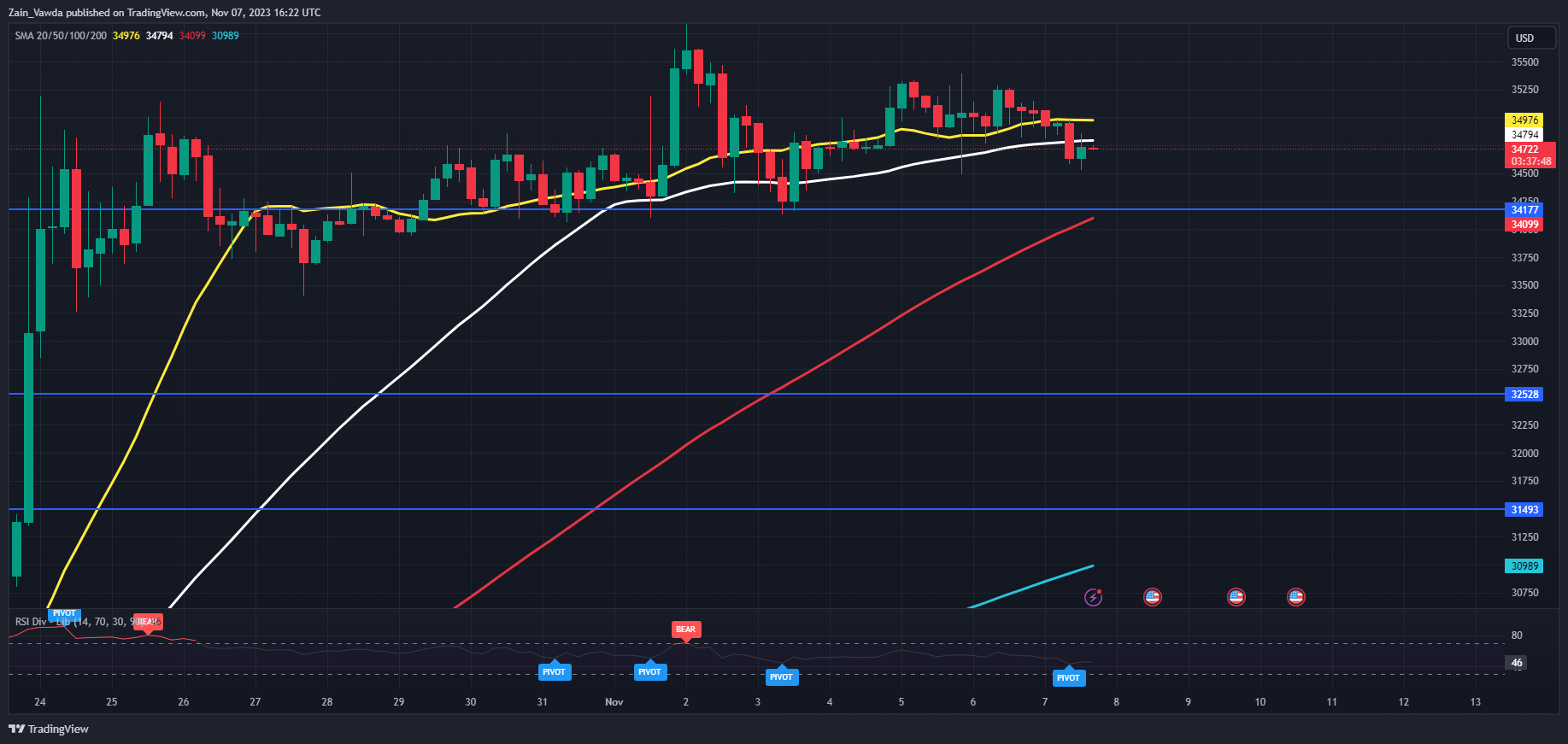

Looking at the H4 timeframe and there are some signs that bears may be gathering. We have printed a lower high and lower low since the November 5 high. A daily candle close below the $34.1K mark may be needed to convince bears that a deeper retracement is on the table.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

BTCUSD Four-Hour Chart, November 7, 2023.

Source: TradingView, chart prepared by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

Comments are closed.