Oil Prices in Freefall, On Cusp of Breakdown, USD/CAD Buoyed by Market Mayhem

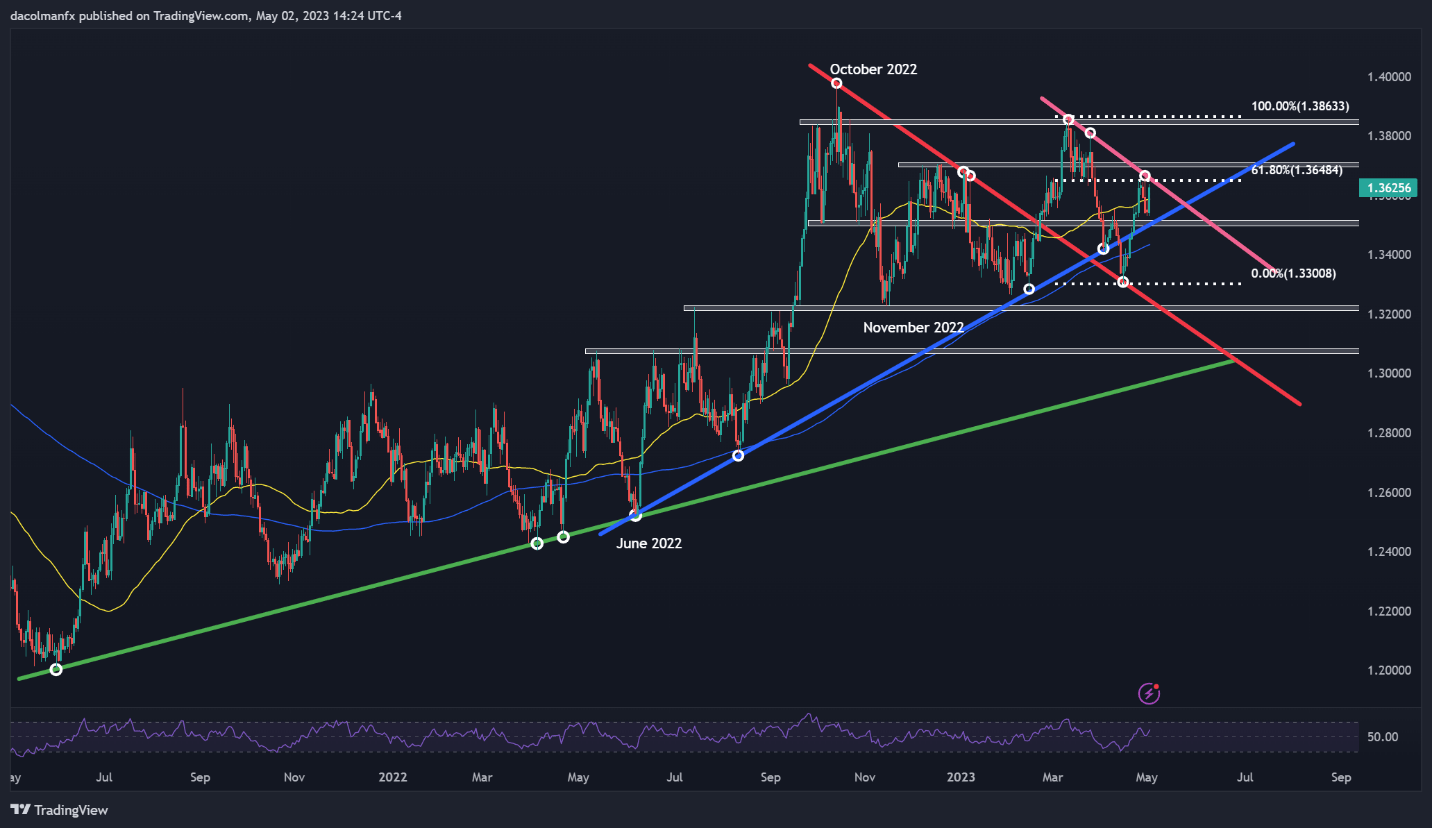

CRUDE OIL TECHNICAL ANALYSIS

Crude oil surged in early April following OPEC+’s unexpected announcement to cut production to stabilize energy markets. The decision briefly carried WTI futures to their best levels since November 2022, but the bullish impetus faded quickly when prices were unable to clear cluster resistance in the $83.50 area.

The chart below shows how oil has pulled back aggressively in recent weeks after its failed attempt to recapture its 200-day simple moving average. In fact, the sell-off accelerated today when the $74.00 barrier was taken out, a move that pushed the commodity to its lowest point since late March.

After Tuesday’s slump, oil appears to be sitting above trendline resistance turned support at $71.50 – a key technical region to watch in the near term. Bulls do not want to see prices slip below this floor as a breakdown could pave the way for a retest of $70.25 ahead of a move toward $66.40.

On the flip side, if traders manage to defend dynamic support at $71.50 and spark a bullish turnaround, initial resistance appears at $74.00. On further strength, attention shifts higher to the 50-day simple moving average located near $76.60.

Recommended by Diego Colman

Improve your trading with IG Client Sentiment Data

CRUDE OIL FUTURES TECHNICAL CHART

Crude Oil Futures Chart Prepared Using TradingView

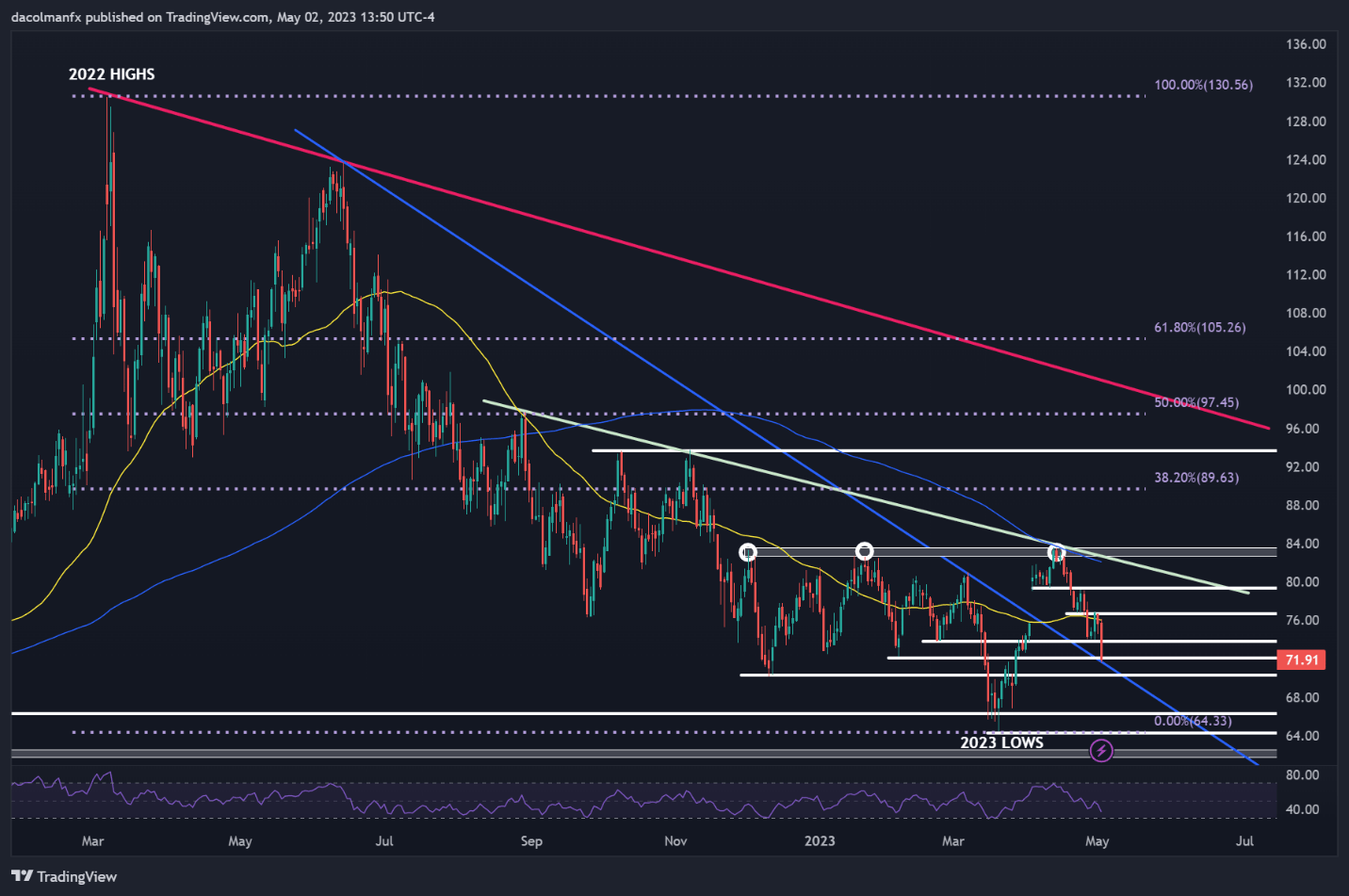

USD/CAD TECHNICAL ANALYSIS

The sell-off in oil, in concert with the subdued sentiment, has been a headwind for the Canadian dollar – a high-beta currency sensitive to global growth scares and energy market developments. As crude prices headed lower in recent days, USD/CAD regained its footing, rising from 1.3300 to 1.3625 in less than three weeks, with the exchange rate now above its 50-day simple moving average.

Overall, the outlook for USD/CAD has turned more constructive, but to be confident in the bullish thesis, we need to see the pair break above cluster resistance at 1.3650/1.3670, an area where a short-term descending trendline converges with the 61.8% Fibonacci retracement of the March-April pullback. A move above this ceiling would plead in favor of a retest of the psychological 1.3700 level, followed by 1.3865.

On the other hand, if sellers regain decisive control of the market and spark a bearish reversal, initial support is located near the 50-day simple moving average. If this floor is breached, however, bears could become emboldened to challenge trendline support crossing the 1.3500 handle. On further weakness, the 200-day simple moving average could become the next downside target.

Recommended by Diego Colman

Get Your Free USD Forecast

USD/CAD TECHNICAL CHART

USD/CAD Technical Chart Prepared Using TradingView

Comments are closed.