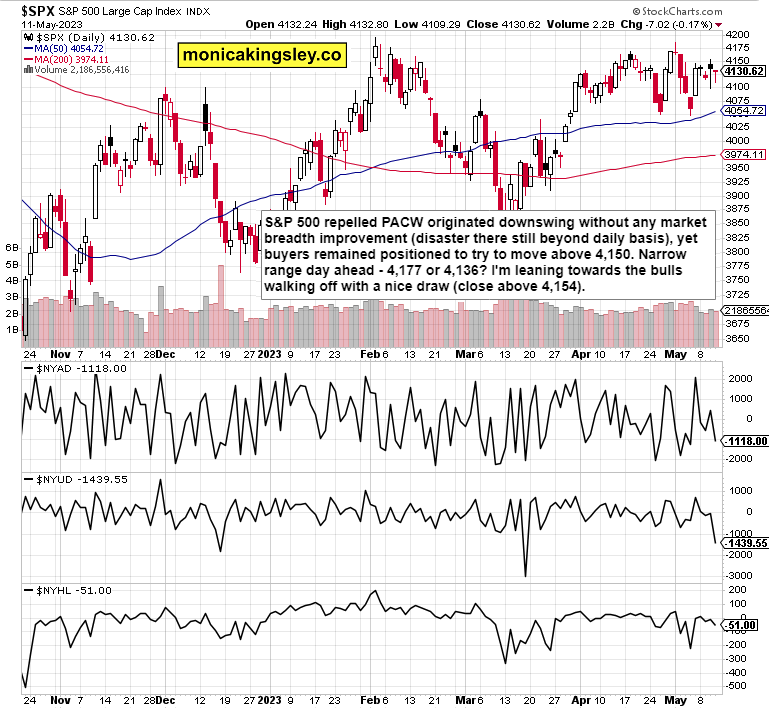

More S&P 500 reprieve

S&P 500 clear bearish progress didn‘t last in spite of PACW woes being as indicative of unsolved banking situation as the increased Fed loans to banks (over $90bn now, which is an increase of $10bn this week). That‘s what happens when the original incentive to withdraw deposits in search of better yields in T-Bills and money market funds, is still there – 3m yield after the two-day plunge is at 5.20% while the 6m is at 5.14%. This has a profound effect on commercial banks‘ ability to extend credit, the real economy‘s lifeblood, as commercial real estate remains in the wings.

While we haven‘t seen a genuine earnings recession yet (the data thus far aren‘t wildly underperforming the downgraded Q1 expectation), we‘re in as a minimum for P/E contraction as LEIs keep pointing down, the Fed remains restrictive, and market leaders prefer to squeeze value sales while volume sales aren‘t exactly rising (i.e. the pie is not growing much) while doing share buybacks to boost profitability (EPS).

Thus far any weakness outside of Big Tech was unable to force S&P 500 lower much – so, the question is what would make tech shake a little. As I wrote earlier, any straw can break the camel‘s back – it may or may not be a big one.

Similarly the USD is in a vulnerable position, propped up by the debt ceiling drama slowly moving to center stage (next week some more). Holding above 101 key support breaking which can usher significant downside, the dollar is likely to rise solidly above 102, which would of course keep exerting pressure on real assets the way it did in precious metals and copper yesterday. Note that crypto had been indicatively weakening for quite a while already, so that sums up the intermarket case of what to expect in stocks in the weeks ahead.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts – today‘s full scale article contains 6 of them.

S&P 500 and Nasdaq outlook

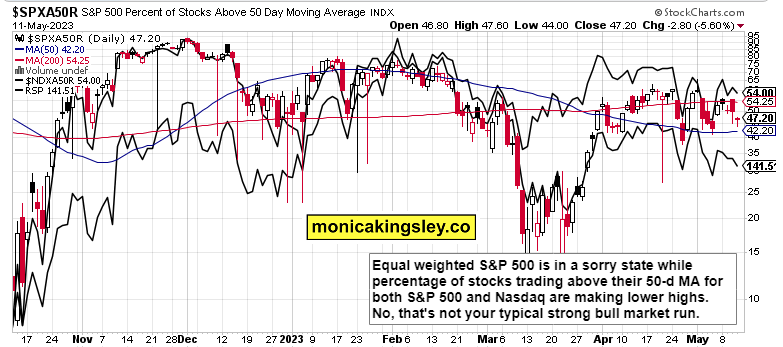

This is not even a miserable „improvement“ in market breadth – that statement awaits for after the close today. Just how much upside can the buyers still squeeze (4,188 or higher), that‘s the key question.

Pretty humbling chart showing the waning power of this bear market rally. As a minimum, a serious drop for all the technical and fundamental reasons awaits before we move into a good Q4 2023 performance time.

Comments are closed.