Markets Peel Back Hopes for BoJ Policy Change

USD/JPY ANALYSIS & TALKING POINTS

- Weak Japanese economic data dampens optimism around BoJ policy shift.

- Fed to keep rates at current levels but will inflation add to NFP and bolster hawkish bets?

- Key support zone under threat.

Supercharge your trading prowess with an in-depth analysis of the JAPANESE YEN outlook, offering insights from both fundamental and technical viewpoints. Claim your free Q4 trading guide now!

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen ended the week on a volatile note after being pushed and prodded from the Asian session all the way through to the much awaited Non-Farm Payroll (NFP) report. Japanese GDP significantly missed estimates and the QoQ print fell into negative territory thus heightening recessionary fears moving forward. This may keep the Bank of Japan’s (BOJ) more cautious to tighten monetary policy despite high levels of inflation.

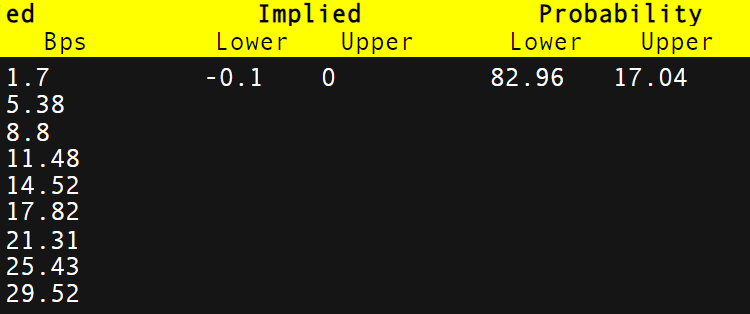

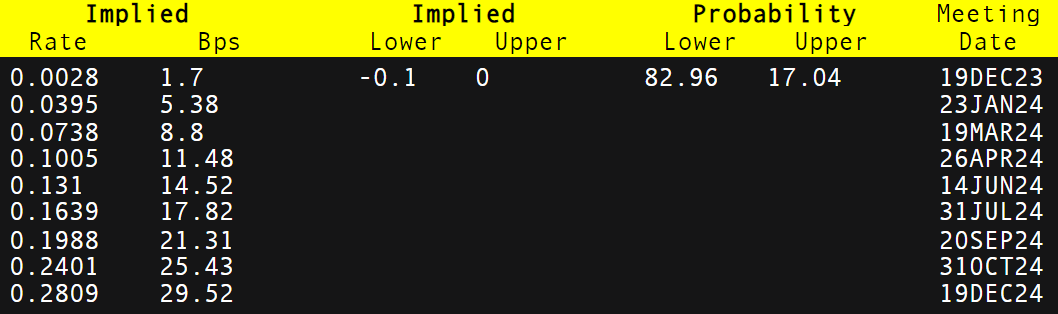

Although we have seen the BoJ Governor Ueda hint at a policy shift, I do not expect anything major from the December meeting without easing the market into it. Data dependency is more crucial than ever for the Japanese central bank as solid additional support for inflation and labor data is required to push the BoJ into changing their current stance. Money markets price in an interest rate hike around September/October 2024 (refer to table below) which supplements my expectation for no drastic changes just yet.

BANK OF JAPAN INTEREST RATE PROBABILITIES

Source: Refinitiv

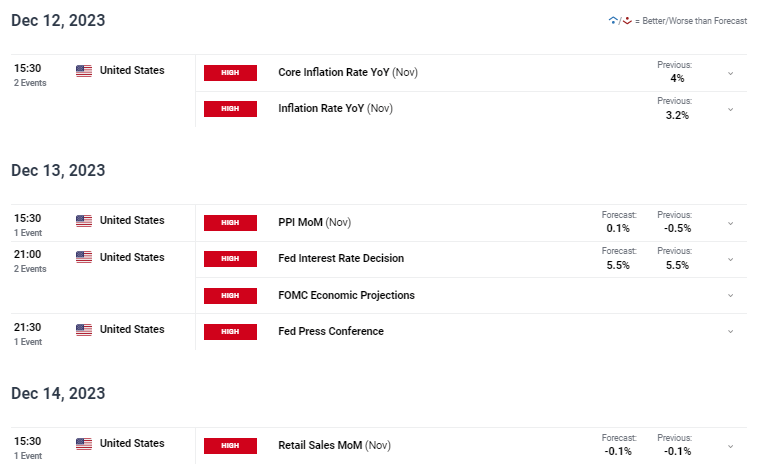

With no Japanese specific data scheduled next week (see economic calendar below), the US will come into focus. After an upside surprise via the NFP report on all metrics, the greenback may further its ascendency should inflation beat forecasts. That being said, the Federal Reserve is likely to keep rates on hold but could pair with a hawkish narrative from Fed Chair Jerome Powell to maintain a restrictive monetary policy environment. US PPI and retail sales will round off the high impact data for the week ahead of the following week’s BoJ rate announcement.

USD/JPY ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

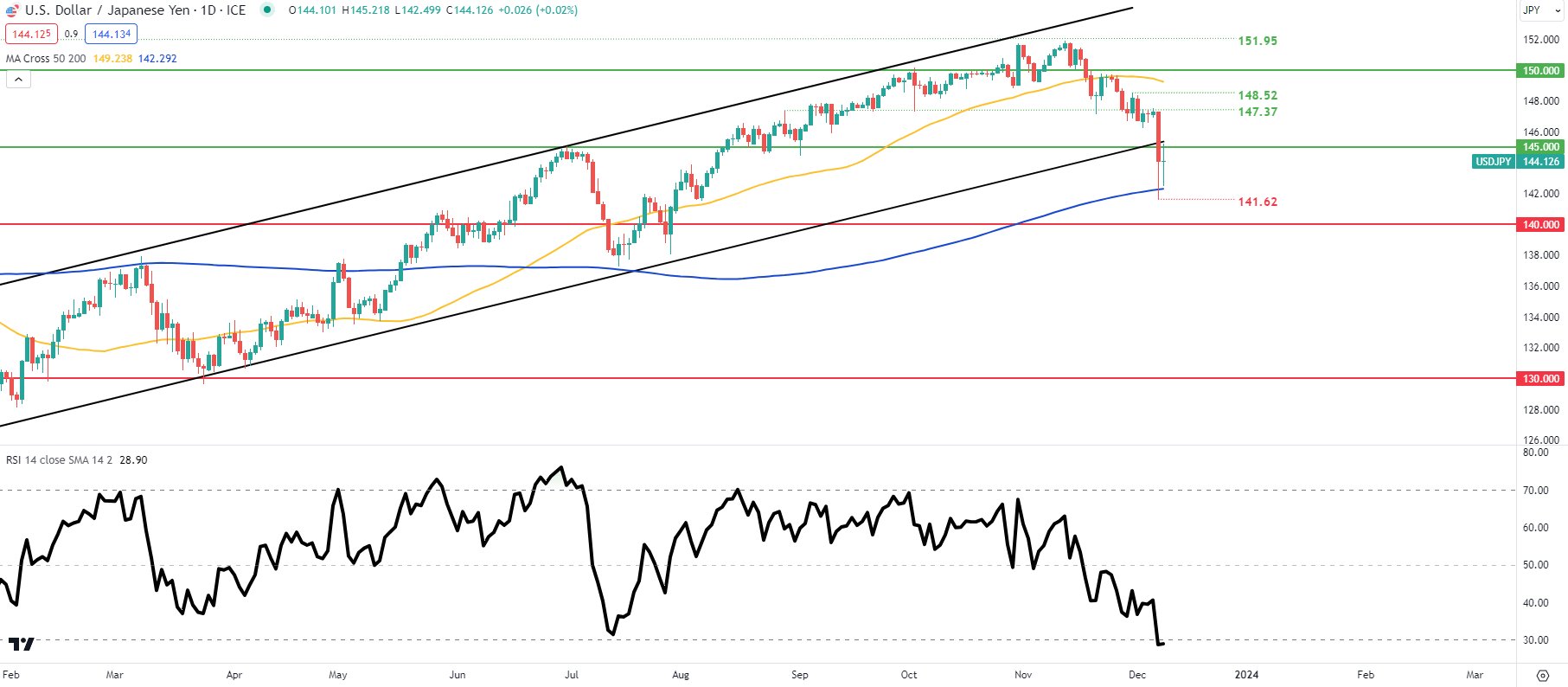

USD/JPY TECHNICAL ANALYSIS

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

Daily USD/JPY price action above shows bears looking to breach the longer-term channel support zone. Support was found around the 200-day moving average (blue) as the pair moves into oversold territory on the Relative Strength Index (RSI). A weekly close in an around channel support/145.00 psychological handle will not confirm a downside bias and could spark a pullback for the USD.

Key resistance levels:

- 148.52

- 147.37

- Channel support

- 145.00

Key support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently net SHORT on USD/JPY, with 68% of traders currently holding short positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

| Change in | Longs | Shorts | OI |

| Daily | -5% | 9% | 4% |

| Weekly | 10% | -17% | -10% |

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.