Loonie Struggles as Crude Oil Tumbles

USD/CAD ANLAYSIS & TALKING POINTS

- Debt ceiling passing through Congress the focal point for markets.

- Crude oil prices hampered by OPEC+ tension.

- Can the BOC avoid another rate hike?

- Death cross looms but upside momentum endures.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

The Canadian dollar has not had a happy few weeks and this looks set to continue today with both USD and crude oil factors weighing on the loonie. As has been the theme of late, US debt ceiling uncertainty around the deal being passed through Congress is lingering with some Republicans stating that they will reject the deal. The greenback’s safe haven appeal has thus been fed with risk aversion, pushing USD/CAD higher.

Crude oil prices have similarly slipped on the back of a stronger USD; however, friction amongst OPEC+’s largest contributors (Russia and Saudi Arabia) has grown due to Russia failing to meet its production cut agreements and possibly extending this trend once they meet on June 4th to decide on an output deal. There has been a unilateral agreement to cut production but considering Russia’s history, analysts are doubtful leaving crude oil capped. Chinese manufacturing PMI exacerbated the issue from the demand-side with actual numbers reaching 48.8 (the lowest level for 2023) and highlighting the contractionary state of China’s manufacturing economy.

Recommended by Warren Venketas

Get Your Free Oil Forecast

Later today, Canadian GDP will come into focus and will be crucial for the Bank of Canada’s (BOC) upcoming interest rate decision on June 7th. If GDP comes in higher than forecasted, the BOC may need to rethink their prior GDP projections and possibly look to hike in the July meeting. Currently, money markets are pricing in a 72% chance of another pause.

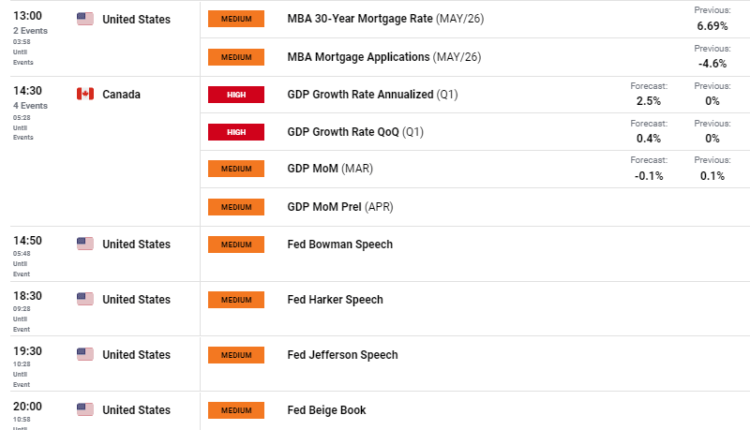

From a US perspective, Fed speakers will dominate headlines while rising 30-year mortgage rates may continue today highlighting the tight monetary policy environment set by the Fed.

USD/CAD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

USD/CAD DAILY CHART

Chart prepared by Warren Venketas, IG

Introduction to Technical Analysis

Moving Averages

Recommended by Warren Venketas

Daily USD/CAD price action shows bulls maintain the price above the 1.3600 psychological handle while the 50-day (yellow) and 200-day (blue) moving average may look to crossover in what is known as a death cross. Although there is room for further upside short-term, the medium-term could lead to a weaker dollar should the US debt ceiling pass through Congress and OPEC+ go ahead with their intended production cuts.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently SHORT on USD/CAD , with 59% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

Comments are closed.