Key Data and Events Next Week Will Steer the Greenback

US Dollar (DXY) Price, Chart, and Analysis

- FOMC rate decision is key for the dollar.

- US Treasury yields remain elevated as supply looms.

Recommended by Nick Cawley

Traits of Successful Traders

The US dollar is stuck in a short-term sideways pattern with the fundamental and technical outlooks sending a variety of mixed signals. Next week’s economic calendar has a cluster of high-importance data releases and events that may add some volatility into the mix and breathe some life back into the market.

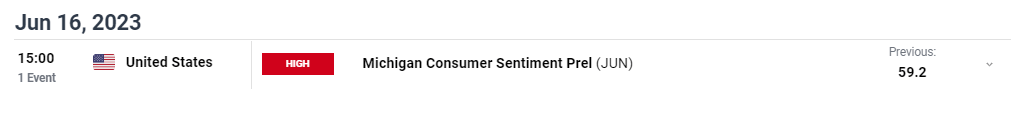

For all market-moving data releases and economic events see the real-time DailyFX calendar

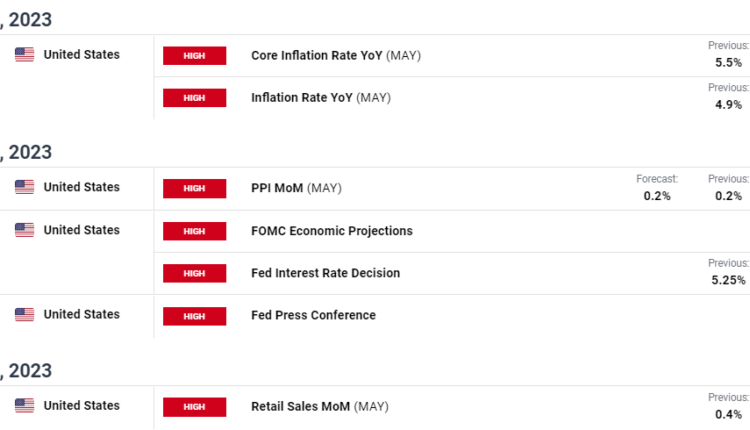

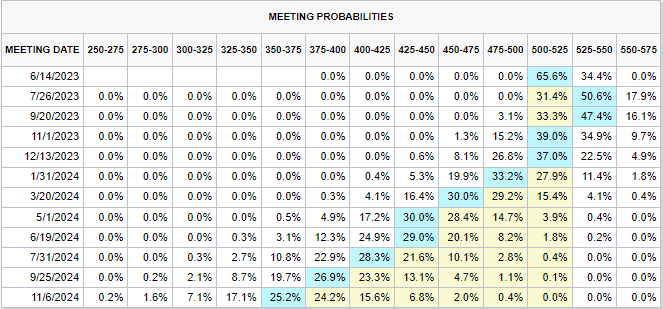

The main event next week in the US is the latest Fed policy decision with markets currently expecting chair Powell to keep rates on hold. Fed Fund's expectations assign a 66% probability of the Fed staying put at 500-525 but in recent days the probability of a rate hike at the July meeting has increased noticeably. Future probabilities also show the Fed then holding rates at this higher level at the September meeting before Fed Funds are trimmed back to 500-525 for the rest of the year.

US Treasury bond yields pushed sharply higher yesterday aided in part by interest rate hikes this week by the Reserve Bank of Australia (RBA) and the Bank of Canada (BoC). Neither central bank was expected to push borrowing costs higher but both cited higher-than-forecast inflation as a factor in their decisions. In addition to this hawkish global backdrop, the US government is preparing to sell huge amounts of US Treasuries, starting soon, to help refill their Treasury General Account (TGA), a government account that pays the bills. The TGA coffers were nearly empty at the end of last month due to the debt ceiling talks. With a deluge of supply along the curve hitting the market in the coming weeks and months, investors will demand higher yields to help fund the government, especially if they believe that rates are going higher in July.

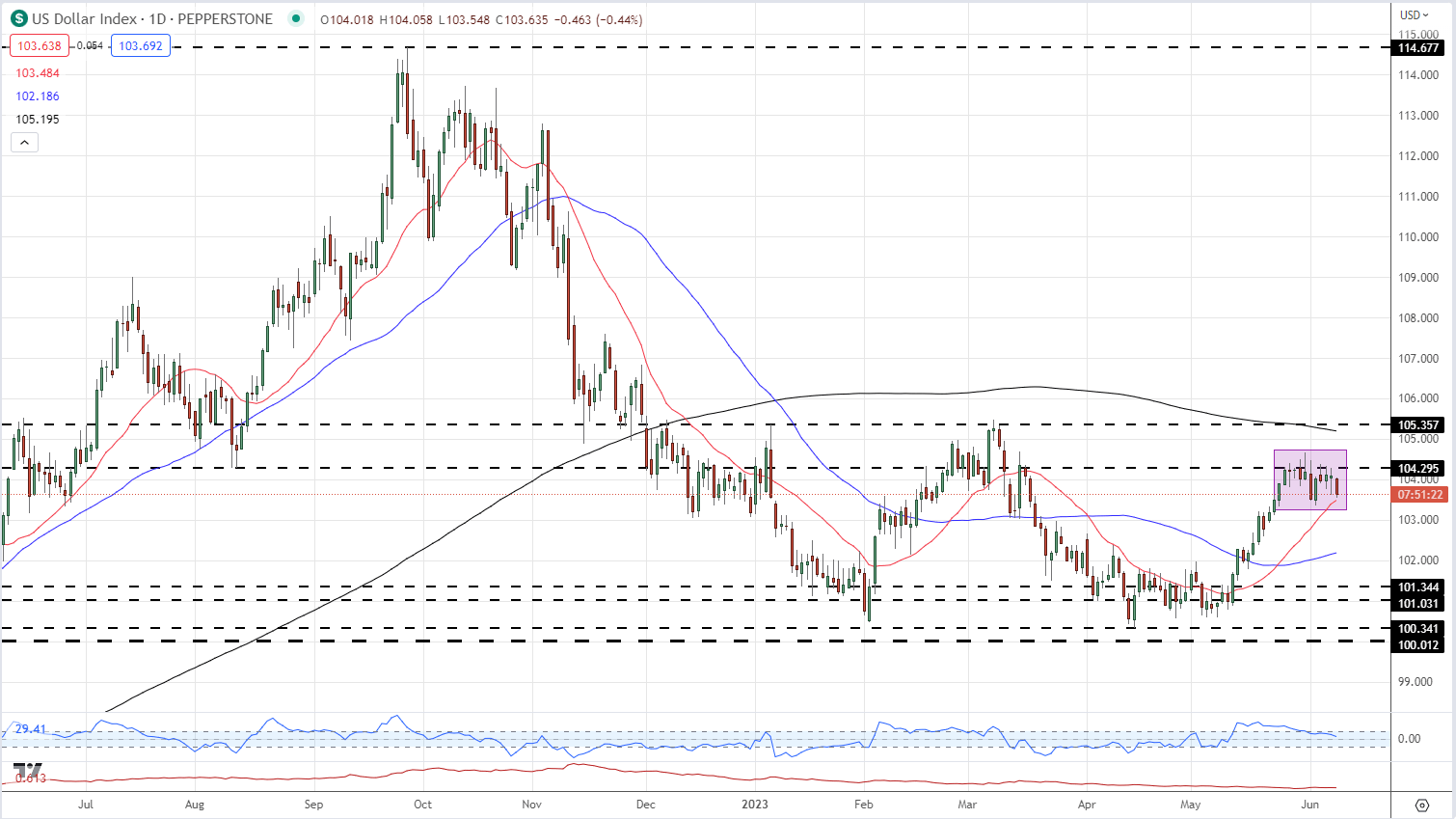

The US dollar is currently struggling with this mixed background and remains stuck in a sideways trend. The rally over the last six weeks has stalled and the greenback is now waiting for next week’s data and events to unfold. Volatility remains low and the three moving averages are mixed with the 20-dsma (red line) pushing higher while the longer-dated 200-dsma (black line) is moving slowly lower. Short-term support is seen around 103.35 with resistance around 104.30.

US Dollar (DXY) Daily Price Chart – June 8, 2023

Chart via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Comments are closed.