Japan’s PM Reveals Prerequisite for New BoJ Head

USD/JPY News and Analysis

Recommended by Richard Snow

Get Your Free JPY Forecast

PM Kishida to Present New BoJ Nominations to Parliament Next Week

Japanese Prime Minister Fumio Kishida provided the first prerequisite for the new Bank of Japan (BoJ) candidate who will replace outgoing BoJ Governor Harukiko Kuroda. Speaking in parliament earlier today, Kishida stated, “Since the Lehman crisis, close coordination among major central bank leaders, as well as the ability to receive and deliver high-quality communication to and from domestic and overseas markets, have become extremely important”.

Many believe this places former BoJ Deputy Governor Hiroshi Nakaso who has international experience, speaks fluent English and has strong contacts with overseas central bankers. The fact that Kishida specifically mentioned the collapse of Lehman Brothers and the crisis that ensued, certainly suggests Nakaso may be considered given that he was integral to coordination efforts of global central banks at that very time. However, many believed Nakaso pulled out of the running for the top position when it was revealed last week that he had take up a post heading up an Asia-Pacific Economic Cooperation advisory council.

Persistent Inflation and Wage Growth Raises Questions about BoJ Ultra-Dovish Policy Future

Most of Japan’s measures of inflation suggest that rising prices show little sign of abating despite the BoJ standing firm on its forecast that inflation will be back at the 2% target in the first half of this year. In addition, rising wage growth (4.8%) has also raised concerns of a wage-price spiral for the island nation.

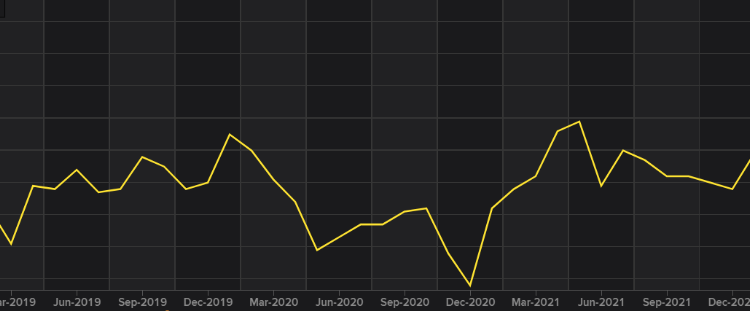

Average Earnings (Japan)

Source: refinitiv

Such inflationary pressures have raised speculation that the BoJ may be forced into one of the largest global central banking pivots in recent history as normalization of the Bank’s ultra-dovish policy has entered the public discourse.

USD/JPY Technical Analysis

USD/JPY revealed the potential for a massive bullish reversal last week with the emergence of a morning star pattern – typically a bullish reversal pattern – which saw the pair break above the descending trendline acting as resistance.

If that wasn’t enough, Monday’s gap to the upside appeared to reinforce the bullish momentum into the start of the week as it is fairly rare to see gaps in the FX market, although, they are most likely to appear after the weekend than during the week. But yesterday’s price action erased a large portion of prior gains with a minor continuation of that bearish move today.

Moves to the downside now see 129.40 come back into focus and thereafter, a test of the descending trendline which acted as prior resistance, around 128.50. If the initial bullish impulse is to continue, there would have to be a rather significant rise from here resulting in a move above Monday’s high, towards 134.50.

As things stand, it appears the market is struggling to assess the way forward as strong US data brings with it continued warnings of more hikes which tend to support USD valuations. While at the same time, Japan is considering nominees for the top job at the BoJ for April as the probability of policy normalization at the ultra-dovish BoJ by the new incumbent cannot be ruled out. Hints of an historic policy reversal will likely bid up the yen, making this a rather tricky trading environment for trend traders.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

Comments are closed.