Is USD/JPY Building a Base?

US Dollar, Japanese Yen, USD/JPY – Technical Outlook:

- USD/JPY has rebounded from crucial support held in recent weeks.

- Still, it is too early to say if USD/JPY’s multi-week downtrend is over.

- What are the key signposts to watch?

Recommended by Manish Jaradi

How to Trade USD/JPY

USD/JPY SHORT-TERM TECHNICAL FORECAST – NEUTRAL

The Japanese yen’s slide against the US dollar in recent days confirms that the upward pressure has faded for now, but it doesn’t alter the broader uptrend trend established in recent months.

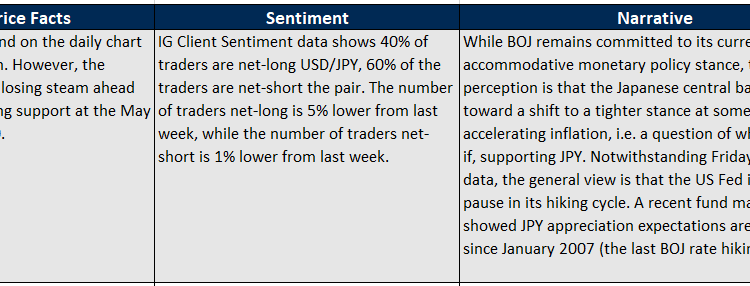

Price Facts, Sentiment, Narrative

USD/JPY is up after US Fed last week hiked interest rates by 25 basis points and Chair Powell said the central bank could conduct a few more rate hikes to bring down inflation to its target.

US jobs and services data beat expectations, triggering a repricing higher in US rate expectations. In addition, reports that Bank of Japan Deputy Governor Masayoshi Amamiya could succeed incumbent Haruhiko Kuroda as central bank governor have provided some support to USD/JPY as BOJ’s ultra-easy policy is expected to continue.

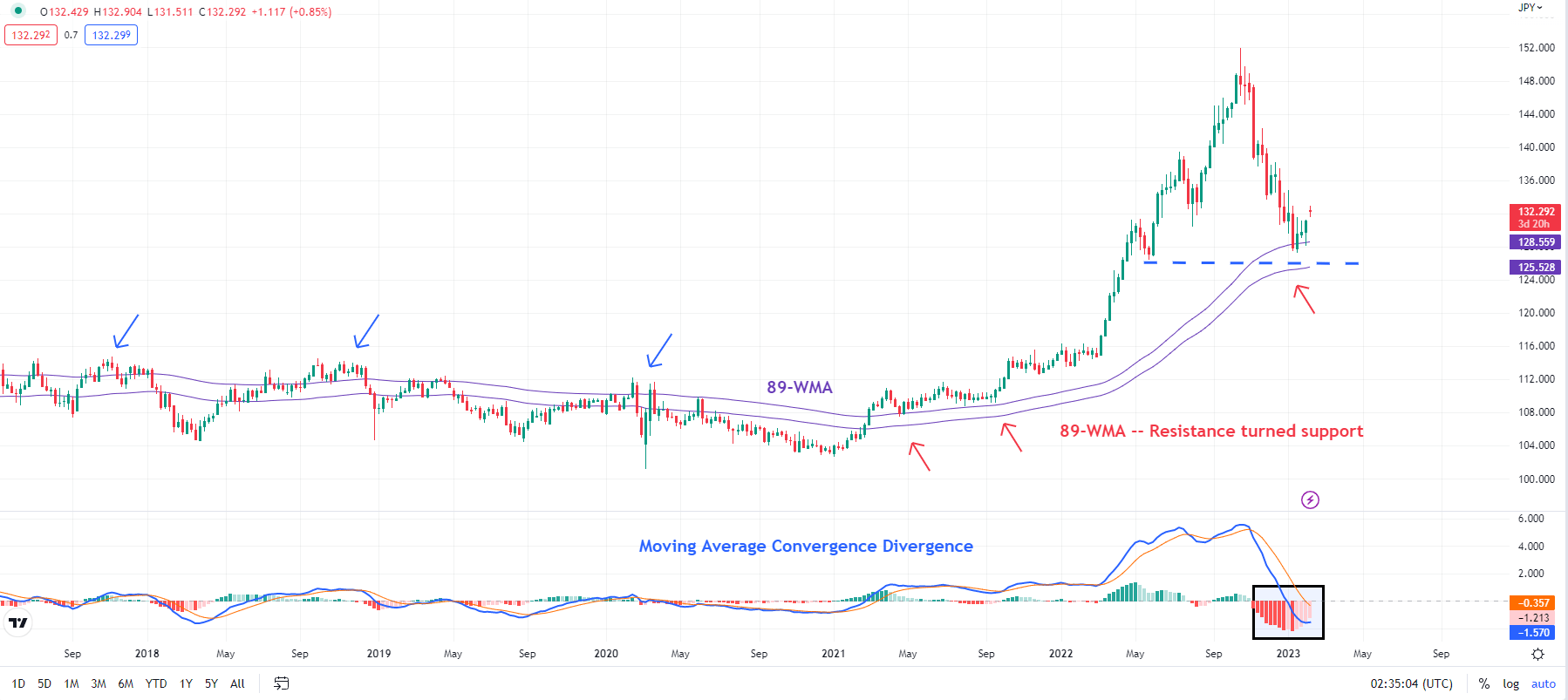

USD/JPY Weekly Chart

Chart Created Using TradingView

On technical charts, USD/JPY’s slide has been losing steam in recent weeks,as highlighted in the previous update. The subsequent break above the 89-period moving average on the 240-minute chart, near the upper edge of a declining channel since November, confirms that the three-month-long downward pressure has faded somewhat in the short term (see mid-January updatehighlighting the scenario).

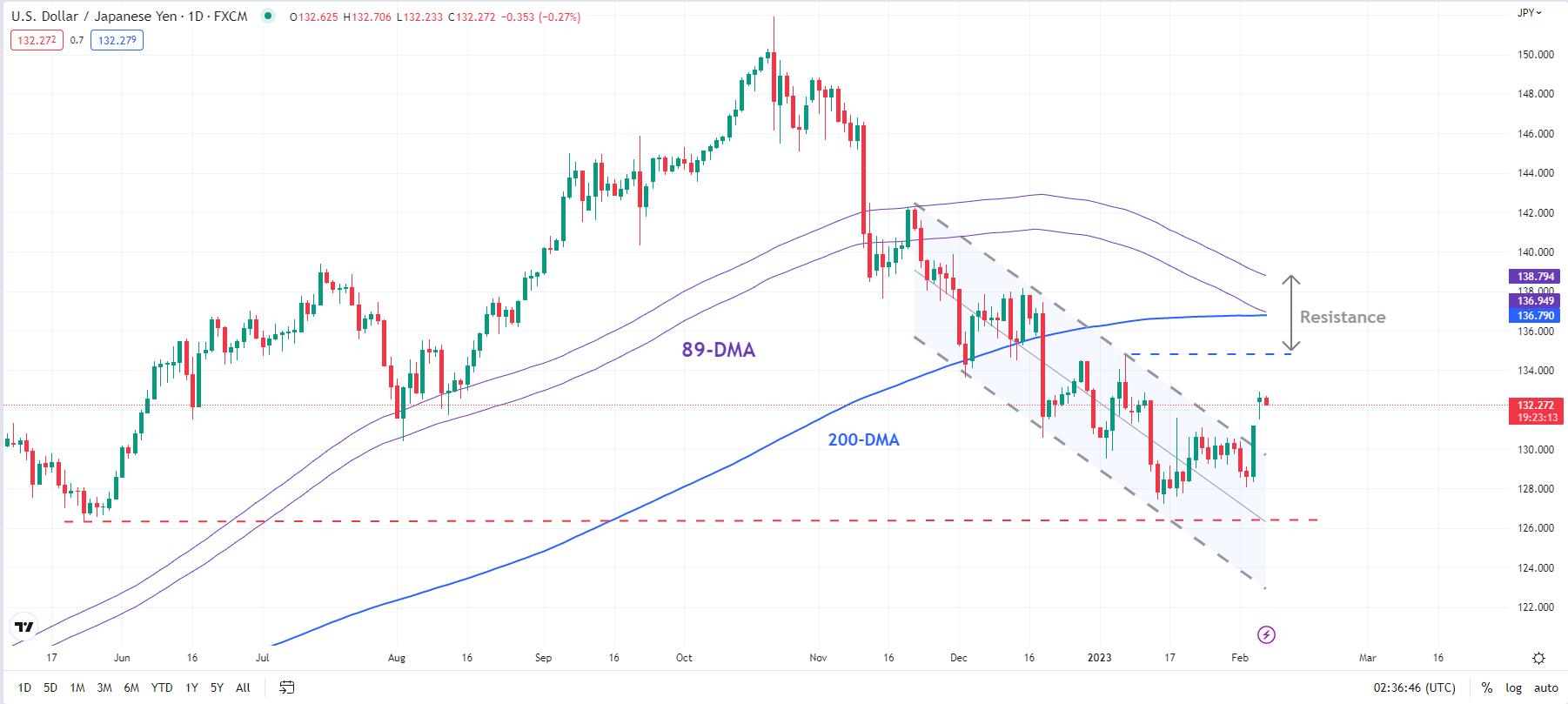

USD/JPY Daily Chart

Chart Created Using TradingView

However, zooming out a bit, on the daily chart, the recent bounce looks corrective. Unless USD/JPY is able to clear a stiff barrier at 134.00-137.00, including the 89-day moving average, the 200-day moving average, around the early-January high, the broader trend remains down (see the daily chart).

— Written by Manish Jaradi, Strategist for DailyFX.com

Comments are closed.