INTRO TO BASIC DAX TRADING – CRASH COURSE – Trading Strategies – 18 December 2023

The German DAX index is traded at an institutional level via the Frankfurt Stock Exchange (XETRA) and consists of 40 major blue chip companies in Germany. Important! The entire article will refer only to the DAX chart (symbol DE40 on Trading View) and all time references are only CE(S)T times. So wherever you live, make sure to have your chart time set to Central European Time or equivalent UTC time. Or, even better, just use Berlin time in Trading View.

DAX can be traded as futures contracts via FDAX (€25/p), FDXM (mini-DAX, €5/p) or FDXS (micro-DAX, €1/p), or as a CFD on most brokers (symbol DE30, DE40 or GER40).

THE INSTITUTIONAL DAILY ROUTINE

What very few people talk about in trading is TIME from an institutional standpoint. We hear all kinds of fancy words about time and related major price levels, but almost no one tells you about the ‘why’ behind properly timing the market as a day trader. First and foremost, you need to learn WHEN to hunt for trades and WHEN NOT to. Some time intervals are way more likely to provide trade setups and real moves than others. Of course, time is not the only factor to consider but it comes first. Moreover, there are certain days of the month when the chances of clean setups and smooth price action are usually way lower. But this is outside the scope of this basic course. Based on the trading schedule of institutions in the DAX index, as well as based on experience you develop over the years focusing on this instrument alone, you can derive a roadmap of when to look for trades and when to expect lower probability of movement. Let’s dissect the day-to-day routine of the institutions trading the DAX index. And this is public data from XETRA’s website btw, not out of my head. But few people know where to look and what to look for.

WHAT ARE AUCTIONS?

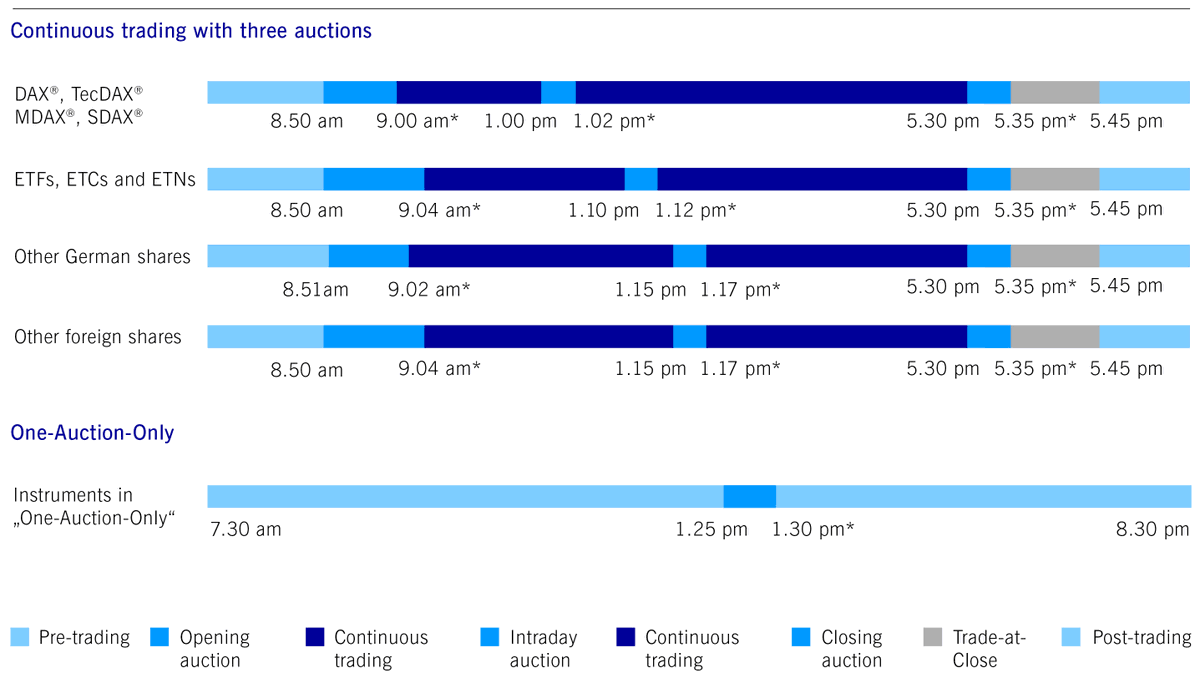

Officially, the trading methodology that takes place on XETRA each and every day is called “Continuous trading with auctions”. Auctions are small, well-defined windows of time during which institutional traders and investors place/match their orders for buying or selling DAX in the T7 trading platform. These orders might be of type market, limit, stop, as well as other more advanced types that are not too relevant to our brief discussion here.

These auctions are performed electronically/algorithmically, and their main purpose is to concentrate liquidity and allow for the submission of high-volume institutional orders. This is when investment funds, pension funds, banks or other large traders are focused on placing their orders. And this is important for us, too.

The rest of the day, outside these small windows of time, it’s called continuous trading or regular trading hours. Now let’s talk briefly about the 3 daily auctions.

If you want to try use my automated DAX SPECIALIST PRO EA you can find it HERE

WHAT ARE THE AUCTION TIMES?

8:50 – 9:00 CE(S)T – Opening auction – This auction determines the opening price of the day via an algorithmic procedure. London open is 9:00 CE(S)T.

13:00 – 13:02 CE(S)T – Intra-Day Auction (IDA for short) – Midday auction introduced in recent years to allow a new time window for institutions to inject liquidity into the market. This auction also ends with an algorithmic procedure that lasts between 13:02:00 and 13:02:30 CE(S)T.

17:30 – 17:35 CE(S)T – Closing auction – This auction determines the closing/settlement price of the day via an algorithmic procedure. The daily Settlement Price is derived from the VWAP of the prices of all trades executed during the last minute before 17:30 CET and it is a reference price for institutions to calculate their short-to-medium-term portfolio returns / unrealized profits / losses.

17:35 – 17:45 CE(S)T – Trade-at-Close phase – Immediately follows the Closing auction and allows institutional traders to place their last orders of the day based on the closing price.

Credits to

Before 9:00, the Pre-trading phase can also be traded, but I prefer not to. After 17:45, DAX is still traded in the Post-trading phase until 22:00 CE(S)T, but that is irrelevant for me.

Important! In my own analysis, I treat the Closing auction and Trade-at-Close phases as a singular phase between 17:30 – 17:45 CE(S)T.

Important! You can get the daily Settlement Price for the previous day from here (pick the correct date and see D. Settle on the 1st row):

So, this is how you can correctly mark truly relevant levels/zones on your chart based on INSTITUTIONAL TIME and INSTITUTIONAL PRICE values.

Bottom line is your have to incorporate both PRICE and TIME into your trading strategy. One is irrelevant without the other.

Also, please trust me when I say that day trading is NOT everyday trading. Be very selective with your setups. You don’t need more than 4-6 trades per month to be consistently profitable.

Now…

Of course, I didn’t manage to cover all the details about DAX’s auctions, auction types, institutional order types, particular scenarios or corner-cases and so on. It’s hard to cover such a wide range of information in a single post.

However, if you enjoyed this mini-course and would like me to dive deeper into the DAX trading world and create more educational threads 100% free, post some DAX analysis or some of my trades, please LIKE and comment this post so I’ll know I have your support going forward.

If you want to try use my automated DAX SPECIALIST PRO EA you can find it HERE

Comments are closed.