Internal netting in Forex – Other – 2 July 2023

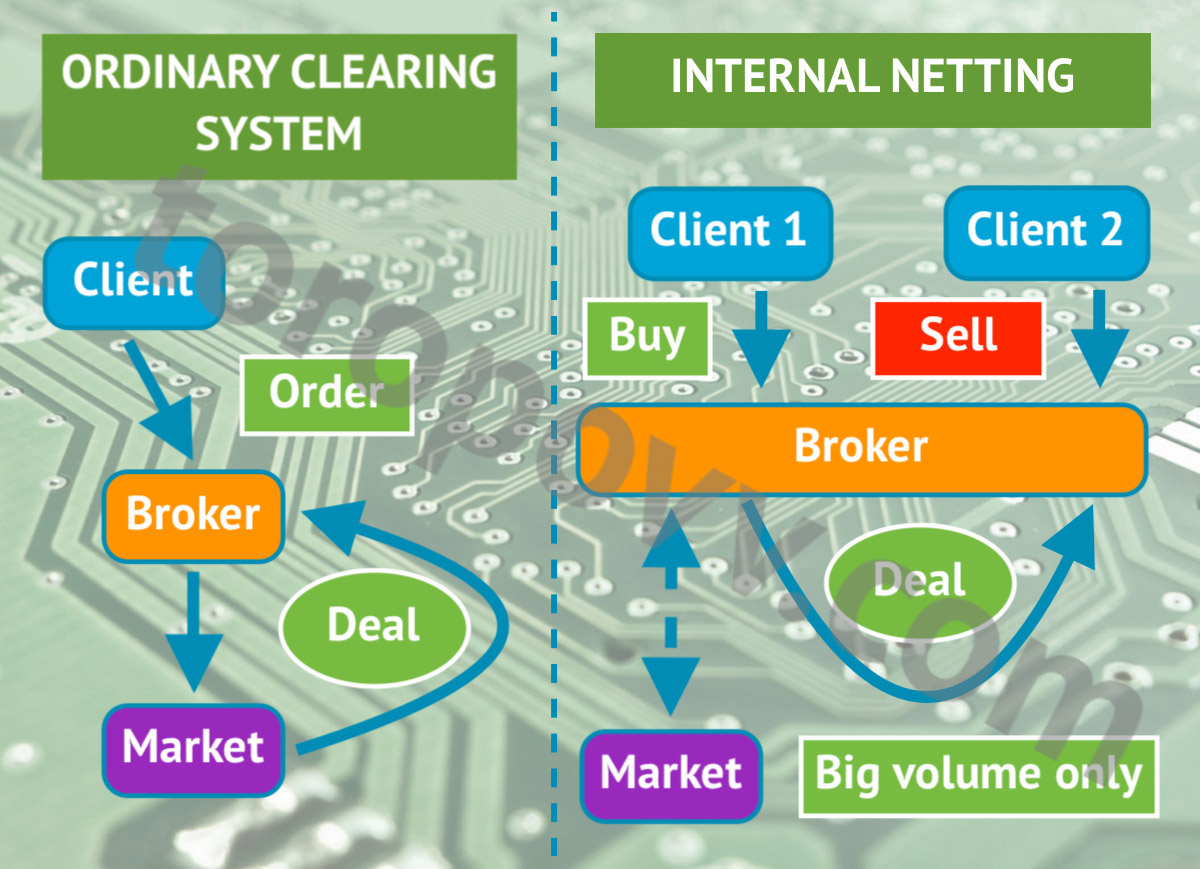

Internal netting in Forex is the process by which a brokerage firm or financial institution matches and settles trades internally, without routing them to an external market or exchange. It is also known as “internal matching” or “internal clearing.” Here are its features.

When traders place forex orders, they can be either market orders or limit orders. Market orders are executed at the prevailing market price, while limit orders are executed only when the market price reaches a specified level. In the case of internal clearing, the brokerage firm or financial institution attempts to match these orders internally instead of sending them to an external market.

Internal netting: How does it work

The internal matching process typically works as follows:

- Order Submission: Traders submit their buy or sell orders to the brokerage firm or financial institution through their trading platform.

- Order Matching: The internal netting system of the institution matches buy orders with sell orders based on price, quantity, and other criteria. The goal is to find matching orders within the system.

- Trade Execution: Once a match is found, the brokerage firm executes the trade internally by matching the buyer with the seller. And vice versa. This internal trade execution eliminates the need to interact with external market liquidity.

- Netting: After the trade execution, the internal clearing system calculates the net positions for each currency pair. Netting involves offsetting the buy and sell positions of each trader within the institution, resulting in a consolidated net position for the institution.

- Settlement: The internal netting system then updates the traders’ account balances based on the executed trades and net positions. The system transfers the appropriate amounts of currencies between the traders’ accounts internally, reflecting the outcome of the trades.

My solutions on MQL5 Market: Vladimir Toropov's products for traders

Internal netting: Benefits

Benefits of internal matching in Forex:

Faster Execution

Internal matching allows for quicker order matching and trade execution, as it avoids the delays that can occur when routing orders to external markets.

Reduced Costs of internal netting

By matching trades internally, brokerage firms can minimize transaction costs associated with trading on external exchanges, such as exchange fees or commissions.

Improved Liquidity

Internal matching can enhance liquidity within the institution’s trading system. Especially in situations where there may be limited liquidity in the external market.

Increased Privacy of internal netting

Internal matching keeps trades and trading strategies within the institution, which can be advantageous for traders who prefer to keep their activities private.

Nuances

However, internal clearing is specific to each brokerage firm or financial institution. Not all firms utilize internal netting. Some firms may opt to route orders to external markets for execution. The decision to use internal matching depends on various factors, including the firm’s infrastructure, liquidity sources, regulatory requirements, and client preferences.

My solutions on MQL5 Market: Vladimir Toropov's products for traders

Comments are closed.