How to use GPT Suggestions – Analytics & Forecasts – 25 May 2023

GPT Suggestions: A 2-Day Forward Test Case Study

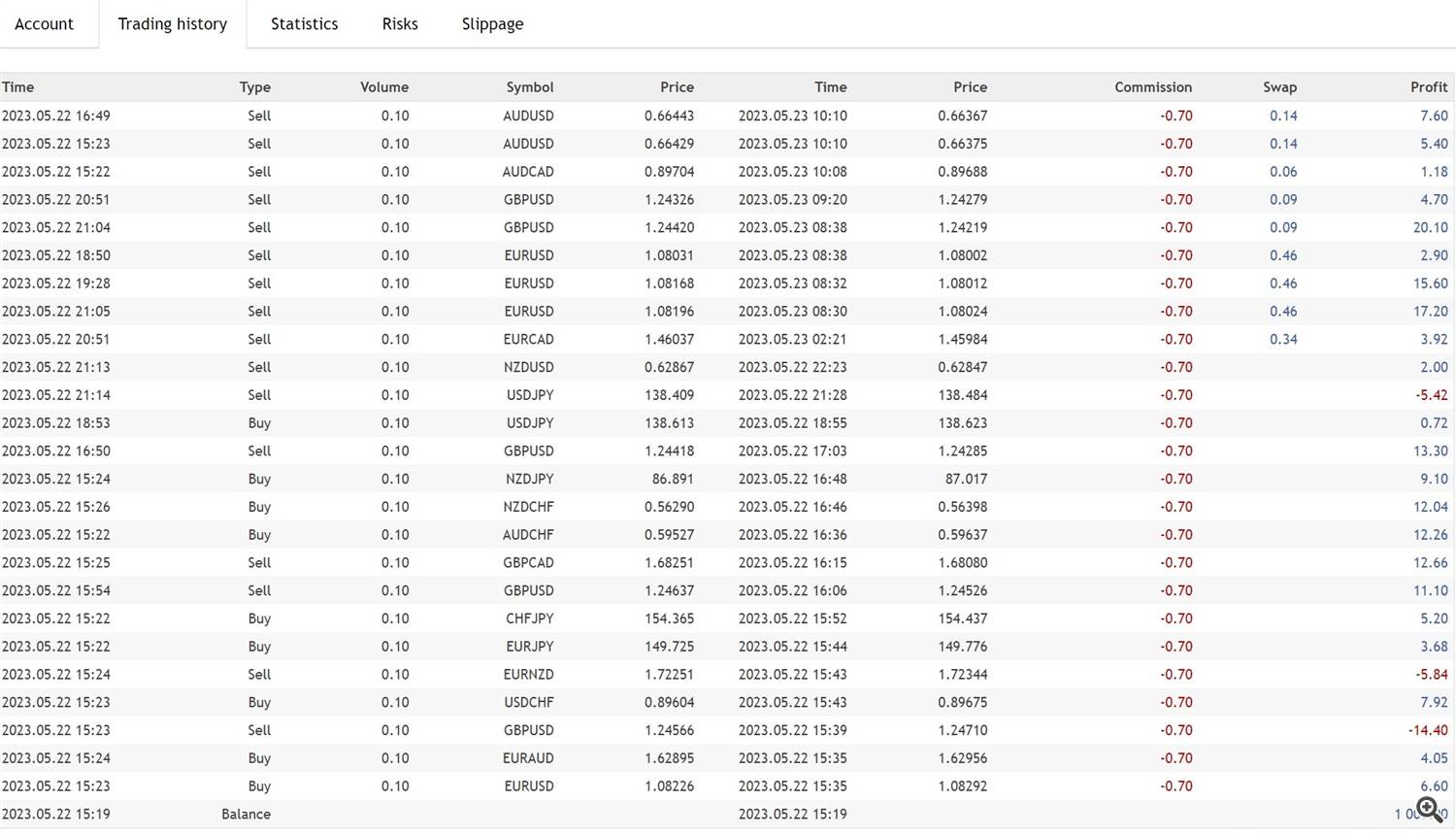

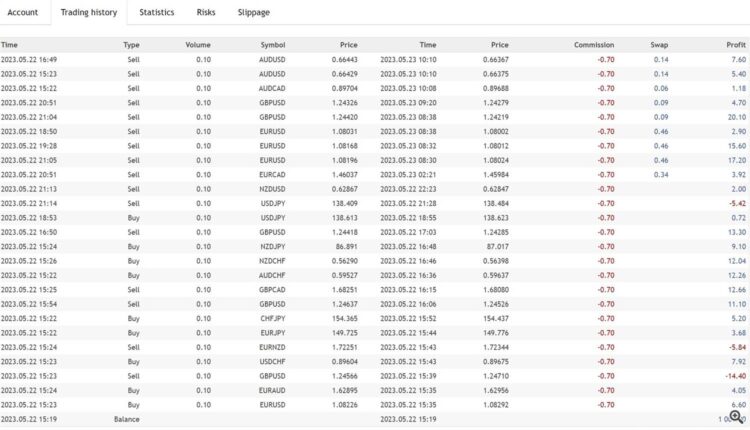

The objective of this test was to demonstrate the remarkable potential of the GPT Suggestions feature. On Day 1, I initiated a series of trades. My selection of symbols was entirely arbitrary. I incorporated almost all major and minor symbols into the market watch to include them in the GPT Assistant’s list. Beginning with a balance of $1000, I executed the following trades using a fixed lot of 0.1, thereby foregoing the risk lot sizing method.

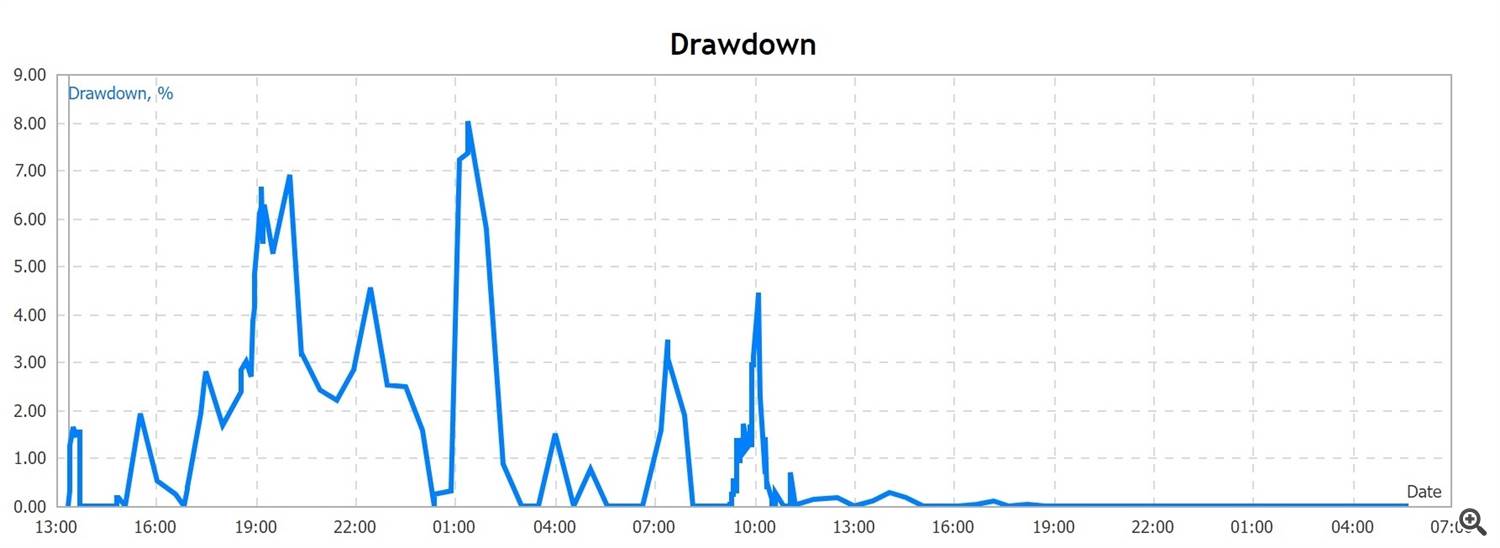

To provide a contrasting scenario, I engaged in a few martingale trades. The results? The account’s drawdown (DD) catapulted from a minimal 1.8% (keeping in mind that at one point about 18 trades were live and the DD remained under 2%) to almost 8%. This dramatic shift underscores why martingale strategies or altering the Risk-Reward Ratio (RRR) is not recommended. These suggestions are specifically designed for intraday trading. In the ideal world, Stop-Loss (SL) and Take-Profit (TP) should be in the range of 100 and 150 points. Quite often there will be different so my advice is to skip these suggestions and move on to the next symbol. There will be plenty more trade opportunities later on, tomorrow or later on in the week. Do not rush! Forex trading is not a sprint, it’s a marathon. As evidenced by the screenshots above, except for the martingale trades, trades closed almost immediately. While even chatGPT with its advanced predictive capabilities can’t foretell the future, it can provide highly accurate speculative moves based on an extensive analysis of hundreds of variables. Unlike human traders, chatGPT can evaluate charts in mere seconds and provide decisive trading directions. Whether it is to buy or sell, it will provide you with corresponding SL and TP values. Then all you need to do is click on the right button. How easy is that?

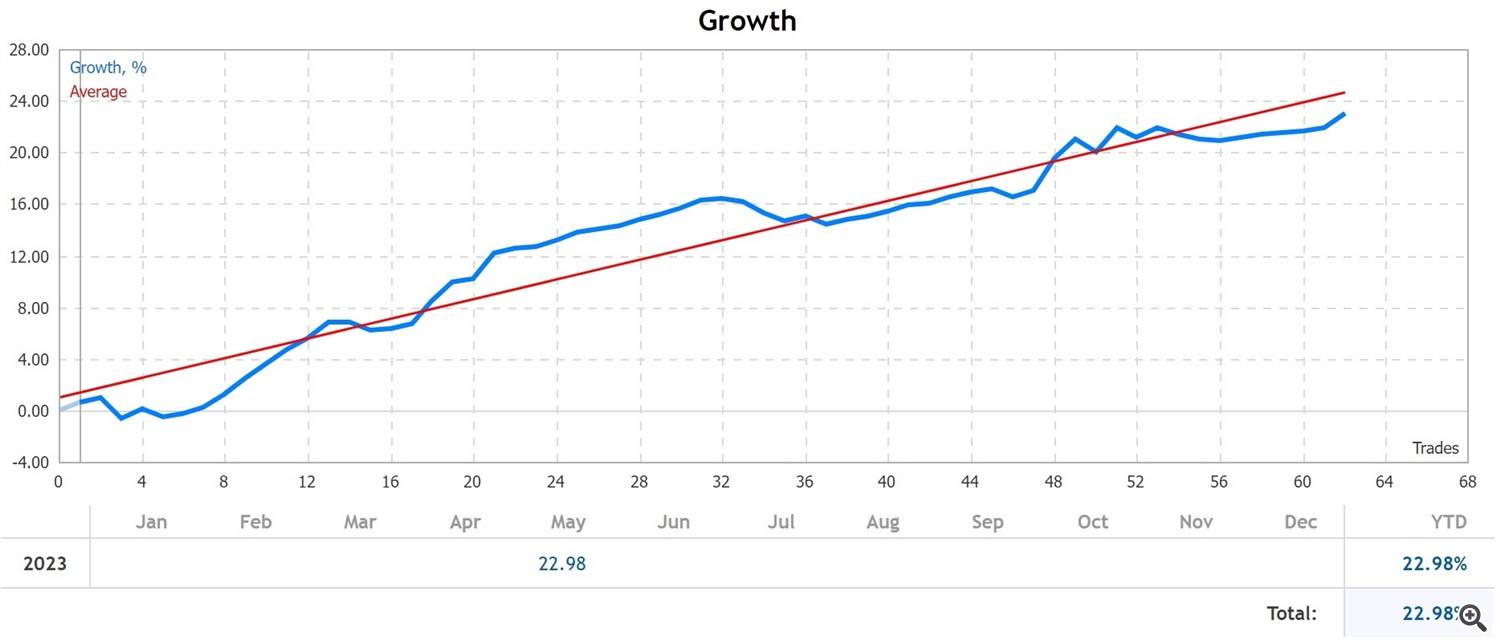

About the optimal timing to use GPT Suggestions, I would suggest executing your trades around 2 hours after the start of the Asian and London sessions and 1.5 hours post the New York session’s opening. Do not trade around high impact news, unless you are using NEWS analysis and placing orders manually. My initial run was conducted after the start of New York session, followed by the London opening on Day 2. On the second day, I reduced the risk. Upon receiving a GPT Suggestion, I selected “use the risk value” and it came up with 0.06 lot. Then the lot size varied every time and it was in the range of 0.02 and 0.13 lot. The second day of forward testing increased the profit from 14% to 23%, all the while maintaining the DD well under 8%.

If you’re employing GPT Assistant for proprietary trading, I recommend a 0.25% risk when opening a maximum of 5 trades simultaneously, as higher frequency trading could potentially jeopardize the challenge. Please note, some firms restrict high-frequency trading, so ensure you’re well-versed with your account’s Terms & Conditions. And do not use martingale or RRR.

I personally think that it’s an amazing feature because it gives you all the control. It is you and only you who is in charge of your account’s growth. As you can see below, all it takes is just a few clicks of the mouse to see your balance going up. It took me less than 24h to achieve these results with GPT Assistant:

If you have any questions, please contact me at any time.

Comments are closed.