How to build a Renko chart. Renko chart examples. – Analytics & Forecasts – 15 February 2023

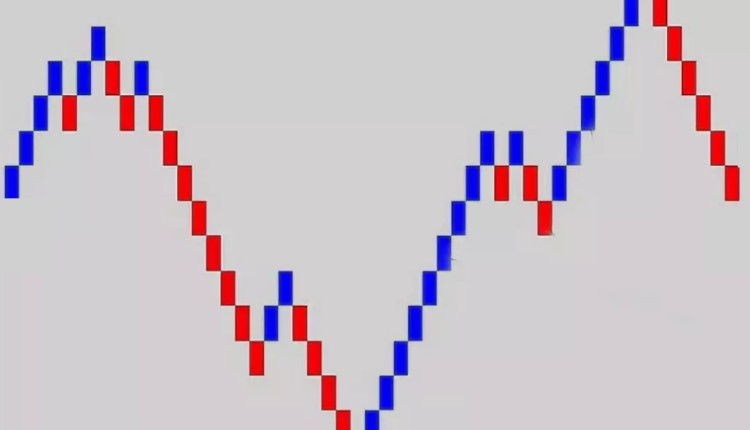

A type of chart, developed by the Japanese, that is only concerned with price movement; time and volume are not included. It is thought to be named for the Japanese word for bricks, “renga”. A renko chart is constructed by placing a brick in the next column once the price surpasses the top or bottom of the previous brick by a predefined amount. White bricks are used when the direction of the trend is up, while black bricks are used when the trend is down. This type of chart is very effective for traders to identify key support/resistance levels. Transaction signals are generated when the direction of the trend changes and the bricks alternate colors.

In this chart, time and volume has no role. Renko candles look like small bricks or boxes. They have no upper or lower shadows. We can change the box size in the Renko charts.

The smaller the size, the higher number of boxes and so more details of the price changes.

It's important to note that prices may exceed the top (or bottom) of the current brick. Again, new bricks are only added when prices completely “fill” the brick.

For example, for a 5-point chart, if prices rise from 98 to 102, the hollow brick that goes from 95 to 100 is added to the chart BUT the hollow brick that goes from 100 to 105 is NOT DRAWN. The Renko chart will give the impression that prices stopped at 100. This is the Renko chart in figure.

In the picture Renko chart forex system in action.

A renko chart is constructed by placing a brick in the next column once the price surpasses the top or bottom of the previous brick by a pre-defined amount. White bricks are used when the direction of the trend is up, while black bricks are used when the trend is down. This type of chart is very effective for traders to identify key support/resistance levels. Transaction signals are generated when the direction of the trend changes and the bricks alternate colors.

Basic trend reversals are signaled with the emergence of a red or green box/brick. A new green brick indicates the beginning of a new uptrend. A new red brick indicates the beginning of a new downtrend. Since the Renko chart is a trend following technique, there are times when Renko charts produce whipsaws, giving signals near the end of short-lived trends. However, the expectation with a trend following technique is that it allows you to ride the major portion of significant trends.

Renko charts can also be very helpful when determining support and resistance levels since they isolates the underlying price trend by filtering out minor price changes. Renko charts are also very effective at identifying key support or resistance levels.

Comments are closed.