How I found and then profited from a super simple price action pattern for Gold (XAUUSD) – Trading Strategies – 30 April 2023

The internet is awash with thousands of threads and guru videos espousing profitable trading strategies and patterns. However, what most of them have in common is that they look great in the presentation but tend to cause a steady decline in the account balance once implemented. This was my experience for many years as a trader.

One day, though, I had an epiphany: certain price action patterns for reversals generate trigger signals that are similar to classical technical analysis indicators like MACD, at least in some cases. This realization completely changed my perspective on trading strategies forever!

The Hunt

If you look at the trading game from the perspective of a hunter, its not about to predict every move of the big fat Mammut. It is essential to be aware of the environment where the Mammut is running so you see the boundaries, where it can and cant run to.

The Mammut cant climb on a rocks. It needs water to drink and sometimes it has to walk through narrow paths in order to get to the water. So a smart hunter will wait at that narrow path for the Mammut and prepare its weapons. Then wait. When the time comes and the Mammut walks through the path, the hunter is ready to strike.

The Market

Similar to Mammuts, the price needs to move. In order to catch big gains, we need big moves.

I am usually a fan of hunting reversals. And after a trend, a new trend starts.

So if the price moves up for quite some time, when do we know that the reversal is about to start?

The Key

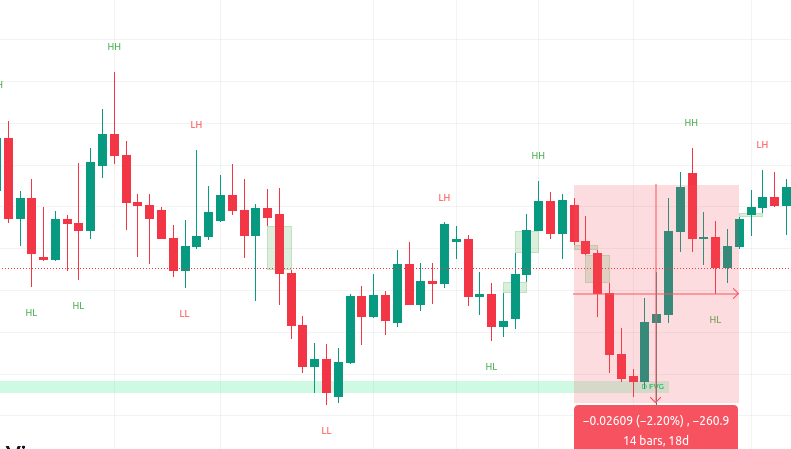

After parsing the price data to fractals and labelling them as higher-high (HH), lower-high (LH), lower-low (LL) and higher-low (HL), I felt down from my chair. Why the f*** didn't I see it earlier?

When the trend reverts from bullish to bearish, the price has to go pass some recent LL after one or multiple HLs.

It can't be other than that. So this pattern will exist all times. It will never disappear.

We can also describe the entry hunting over time with that simple video:

How to profit from this pattern

Now, after finding the nice pattern, the non-creative work started to combine it with position sizing strategies, risk and trade management. In order to bring all these components together, I use and used in all my EAs optimization. Since each component depends on the others. Like the position size depends on the distances between LL and HH. The Take Profit and Stop-Loss Levels also depend on these but also on the historical profits and loss of the EA (some aspects of MinVar portfolio optimization theory).

And finally, a strategy comes out, which can work and eventually remain profitable for years.

False Breakouts

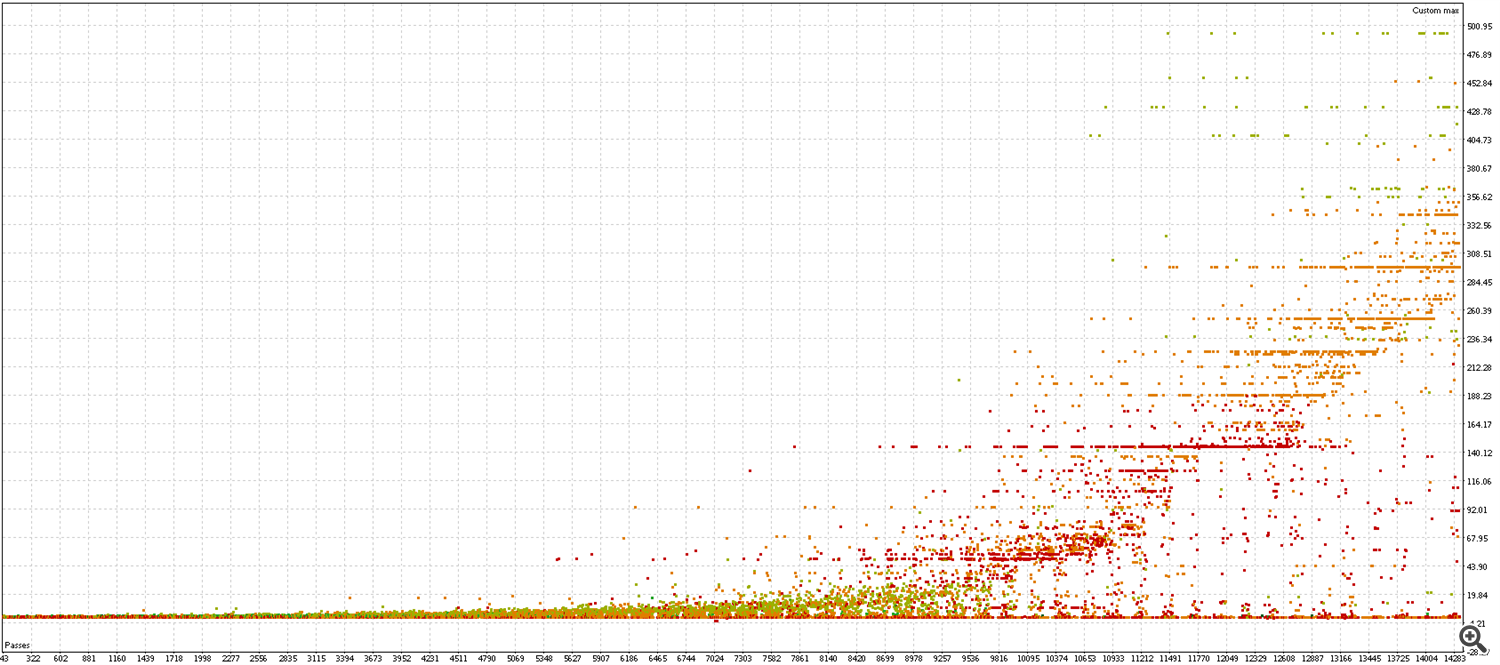

But wait, how do we handle false breakouts? Yes, we try this and that but at the end of the day, we cant 100% predict if this will be a false breakout or not. If it does not break out immediately, we need to wait for many days. Personally, I can wait but a Drawdown of 2% like shown in the image below feels often too large for day-traders.

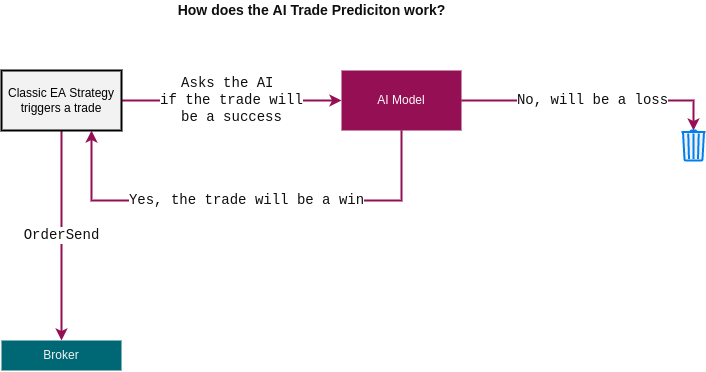

AI predicting the trade results

In order to avoid running after false breakout, I added a new tool. AI-based prediction of the trade outcome. The AI module is trained with the original EA. After integration, the original EA asks the AI-module about the trade outcome prediction. If the prepared trade is likely to be a win, the order is sent to the broker.

x

You can find more details in this blog post: https://www.mql5.com/en/blogs/post/752461

Results

Mixing all the tricks and experience together, I am very proud to present you the new system: AI for GOLD.

It performes great in the backtest. And during the first 7 weeks it performed even better than expected!

Check out the product page and see the current state of the live-monitoring signals.

Download the demo now and check its performance with your broker. Don't hesitate. Every day you wait, you are loosing potential profits!

Comments are closed.